What 16 Analyst Ratings Have To Say About Dick's Sporting Goods

Providing a diverse range of perspectives from bullish to bearish, 16 analysts have published ratings on Dick's Sporting Goods (NYSE:DKS) in the last three months.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 6 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 3 | 6 | 4 | 0 | 0 |

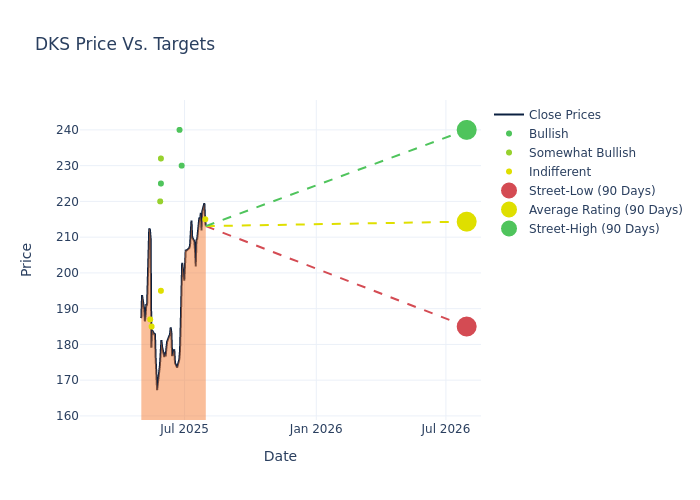

In the assessment of 12-month price targets, analysts unveil insights for Dick's Sporting Goods, presenting an average target of $220.12, a high estimate of $273.00, and a low estimate of $180.00. This current average has decreased by 4.81% from the previous average price target of $231.25.

Analyzing Analyst Ratings: A Detailed Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Dick's Sporting Goods. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Anthony Chukumba | Loop Capital | Raises | Hold | $215.00 | $180.00 |

| Michael Baker | DA Davidson | Maintains | Buy | $230.00 | $230.00 |

| Robert Ohmes | B of A Securities | Lowers | Buy | $240.00 | $250.00 |

| Michael Lasser | UBS | Lowers | Buy | $225.00 | $260.00 |

| Adrienne Yih | Barclays | Raises | Overweight | $232.00 | $217.00 |

| Christopher Horvers | JP Morgan | Lowers | Neutral | $195.00 | $224.00 |

| Michael Baker | DA Davidson | Lowers | Buy | $230.00 | $273.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $220.00 | $220.00 |

| Michael Baker | DA Davidson | Maintains | Buy | $273.00 | $273.00 |

| Anthony Chukumba | Loop Capital | Lowers | Hold | $180.00 | $195.00 |

| Peter Benedict | Baird | Lowers | Neutral | $185.00 | $230.00 |

| Adrienne Yih | Barclays | Lowers | Overweight | $217.00 | $223.00 |

| Joseph Feldman | Telsey Advisory Group | Lowers | Outperform | $220.00 | $250.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $250.00 | $250.00 |

| Ike Boruchow | Wells Fargo | Raises | Equal-Weight | $187.00 | $171.00 |

| Adrienne Yih | Barclays | Lowers | Overweight | $223.00 | $254.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Dick's Sporting Goods. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Dick's Sporting Goods compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Dick's Sporting Goods's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Dick's Sporting Goods's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Dick's Sporting Goods analyst ratings.

Discovering Dick's Sporting Goods: A Closer Look

Dick's Sporting Goods offers sports and outdoor apparel, footwear, and equipment online and in about 900 US stores. It operates stores under its own name, as well as outlets, golf specialty stores under the Golf Galaxy name, and outlets. Dick's carries private-label merchandise and national brands such as Nike, Adidas, and many others. In 2025, the company agreed to purchase international athletic footwear and apparel retailer Foot Locker for $2.4 billion in equity value. Based in the Pittsburgh area, Dick's was founded in 1948 by the father of current executive chair and controlling shareholder Edward Stack.

Dick's Sporting Goods's Financial Performance

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Dick's Sporting Goods's revenue growth over a period of 3M has been noteworthy. As of 30 April, 2025, the company achieved a revenue growth rate of approximately 5.18%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Dick's Sporting Goods's net margin is impressive, surpassing industry averages. With a net margin of 8.32%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Dick's Sporting Goods's ROE excels beyond industry benchmarks, reaching 8.46%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Dick's Sporting Goods's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.53%, the company showcases efficient use of assets and strong financial health.

Debt Management: Dick's Sporting Goods's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.5, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for DKS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Truist Securities | Maintains | Buy | |

| Mar 2022 | Cowen & Co. | Maintains | Outperform | |

| Mar 2022 | Stephens & Co. | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings