Expert Outlook: Host Hotels & Resorts Through The Eyes Of 4 Analysts

In the last three months, 4 analysts have published ratings on Host Hotels & Resorts (NASDAQ:HST), offering a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

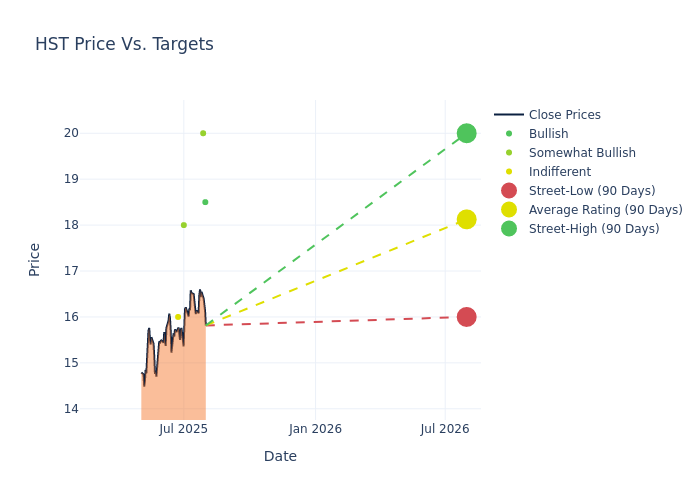

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $18.12, a high estimate of $20.00, and a low estimate of $16.00. This current average has increased by 4.56% from the previous average price target of $17.33.

Decoding Analyst Ratings: A Detailed Look

A comprehensive examination of how financial experts perceive Host Hotels & Resorts is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Simon Yarmak | Stifel | Raises | Buy | $18.50 | $17.00 |

| Duane Pfennigwerth | Evercore ISI Group | Raises | Outperform | $20.00 | $19.00 |

| James Feldman | Wells Fargo | Raises | Overweight | $18.00 | $16.00 |

| Daniel Politzer | JP Morgan | Announces | Neutral | $16.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Host Hotels & Resorts. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Host Hotels & Resorts compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Host Hotels & Resorts's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into Host Hotels & Resorts's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Host Hotels & Resorts analyst ratings.

Delving into Host Hotels & Resorts's Background

Host Hotels & Resorts owns 81 predominantly urban and resort upper-upscale and luxury hotel properties representing over 43,000 rooms, mainly in the United States. Host recently sold off the company's interests in a joint venture owning a portfolio of hotels throughout Europe and also sold other joint ventures that owned properties in Asia and the United States. The majority of Host's portfolio operates under the Marriott and Starwood brands.

Financial Milestones: Host Hotels & Resorts's Journey

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Positive Revenue Trend: Examining Host Hotels & Resorts's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 8.36% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Real Estate sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Host Hotels & Resorts's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 15.56% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 3.74%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Host Hotels & Resorts's ROA stands out, surpassing industry averages. With an impressive ROA of 1.91%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Host Hotels & Resorts's debt-to-equity ratio is below the industry average. With a ratio of 0.85, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for HST

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Wells Fargo | Maintains | Equal-Weight | |

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Dec 2021 | Goldman Sachs | Upgrades | Sell | Neutral |

Posted-In: BZI-AARAnalyst Ratings