Deep Dive Into BorgWarner Stock: Analyst Perspectives (11 Ratings)

Providing a diverse range of perspectives from bullish to bearish, 11 analysts have published ratings on BorgWarner (NYSE:BWA) in the last three months.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 6 | 4 | 0 | 0 |

| Last 30D | 0 | 2 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 2 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 2 | 0 | 0 |

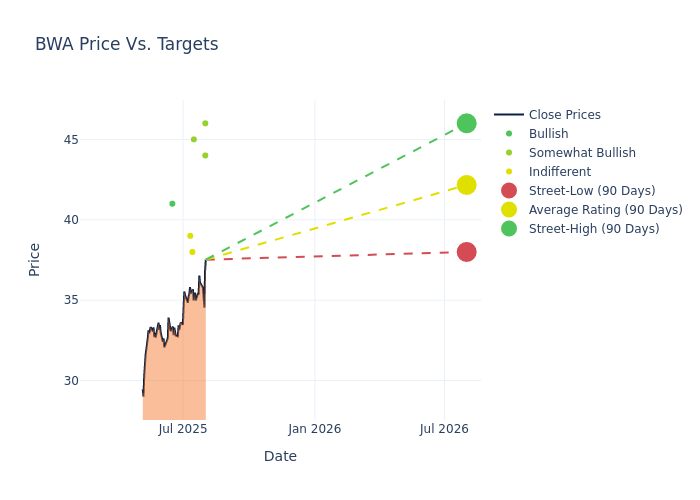

Analysts have set 12-month price targets for BorgWarner, revealing an average target of $40.55, a high estimate of $46.00, and a low estimate of $32.00. This upward trend is evident, with the current average reflecting a 9.86% increase from the previous average price target of $36.91.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of BorgWarner among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Colin Langan | Wells Fargo | Raises | Overweight | $46.00 | $45.00 |

| Alexander Potter | Piper Sandler | Raises | Overweight | $44.00 | $37.00 |

| Dan Levy | Barclays | Raises | Overweight | $45.00 | $42.00 |

| Joseph Spak | UBS | Raises | Neutral | $38.00 | $35.00 |

| David Leiker | Baird | Raises | Neutral | $39.00 | $32.00 |

| Colin Langan | Wells Fargo | Raises | Overweight | $45.00 | $44.00 |

| John Murphy | B of A Securities | Raises | Buy | $41.00 | $35.00 |

| Alexander Potter | Piper Sandler | Raises | Overweight | $37.00 | $36.00 |

| Colin Langan | Wells Fargo | Raises | Overweight | $44.00 | $40.00 |

| Joseph Spak | UBS | Raises | Neutral | $35.00 | $31.00 |

| David Leiker | Baird | Raises | Neutral | $32.00 | $29.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to BorgWarner. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of BorgWarner compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of BorgWarner's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on BorgWarner analyst ratings.

Delving into BorgWarner's Background

BorgWarner is a tier one supplier of turbo and thermal management technologies, drivetrain systems, powerdrive systems, and battery and charging systems mostly to automotive original equipment manufacturers. Its products aim to move a vehicle with as few electrons as possible, resulting in cleaner, cost-optimized, and more-efficient vehicles. Foundational products, the combustion vehicle business, contributes more than 80% to group revenue while BorgWarner transitions to becoming an electric vehicle-centric parts supplier (e-business). In 2023, 25% of the company's revenue was sourced from Volkswagen and Ford. Revenue is well diversified geographically, with approximately a third each generated in North America, Europe, and Asia.

BorgWarner: A Financial Overview

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: BorgWarner's revenue growth over a period of 3M has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -2.23%. This indicates a decrease in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: BorgWarner's net margin is impressive, surpassing industry averages. With a net margin of 4.47%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): BorgWarner's ROE stands out, surpassing industry averages. With an impressive ROE of 2.79%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): BorgWarner's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.13%, the company showcases efficient use of assets and strong financial health.

Debt Management: BorgWarner's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.71.

The Core of Analyst Ratings: What Every Investor Should Know

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for BWA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Underweight | |

| Feb 2022 | Deutsche Bank | Maintains | Hold | |

| Dec 2021 | Barclays | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings