What 5 Analyst Ratings Have To Say About Affiliated Managers Group

Providing a diverse range of perspectives from bullish to bearish, 5 analysts have published ratings on Affiliated Managers Group (NYSE:AMG) in the last three months.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 2 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

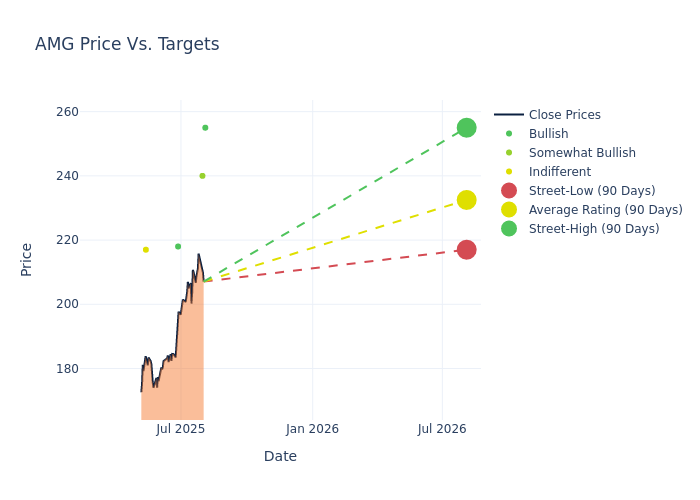

In the assessment of 12-month price targets, analysts unveil insights for Affiliated Managers Group, presenting an average target of $226.0, a high estimate of $255.00, and a low estimate of $200.00. Surpassing the previous average price target of $201.20, the current average has increased by 12.33%.

Decoding Analyst Ratings: A Detailed Look

The perception of Affiliated Managers Group by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Bill Katz | TD Cowen | Raises | Buy | $255.00 | $214.00 |

| Alexander Paris | Barrington Research | Raises | Outperform | $240.00 | $200.00 |

| Alexander Paris | Barrington Research | Maintains | Outperform | $200.00 | $200.00 |

| Alexander Blostein | Goldman Sachs | Raises | Buy | $218.00 | $197.00 |

| Craig Siegenthaler | B of A Securities | Raises | Neutral | $217.00 | $195.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Affiliated Managers Group. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Affiliated Managers Group compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Affiliated Managers Group's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Affiliated Managers Group's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Affiliated Managers Group analyst ratings.

Delving into Affiliated Managers Group's Background

Affiliated Managers Group offers investment strategies to investors through its network of affiliates. The firm typically buys a majority interest in small to mid-size boutique asset managers, receiving a fixed percentage of revenue from these firms in return. Affiliates operate independently, with AMG providing strategic, operational, and technology support, as well as global distribution. At the end of March 2025, AMG's affiliate network—which includes firms like Abacus Capital and Pantheon dedicated to private markets (which accounted for 20% of AUM), AQR Capital and Capula Investment Management in liquid alternatives (22%), and Harding Loevner, Tweedy Browne, Parnassus, and Yacktman in equities, multi-asset, and bond strategies (58%)—had $712 billion in managed assets.

Financial Milestones: Affiliated Managers Group's Journey

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3M period, Affiliated Managers Group faced challenges, resulting in a decline of approximately -0.68% in revenue growth as of 30 June, 2025. This signifies a reduction in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: Affiliated Managers Group's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 17.09%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Affiliated Managers Group's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.62%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Affiliated Managers Group's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.96%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Affiliated Managers Group's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.81.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for AMG

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Deutsche Bank | Maintains | Buy | |

| Feb 2022 | Deutsche Bank | Maintains | Buy | |

| Nov 2021 | Deutsche Bank | Maintains | Buy |

Posted-In: BZI-AARAnalyst Ratings