A Preview Of Abbott Laboratories's Earnings

Abbott Laboratories (NYSE:ABT) is preparing to release its quarterly earnings on Thursday, 2025-07-17. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Abbott Laboratories to report an earnings per share (EPS) of $1.25.

Investors in Abbott Laboratories are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

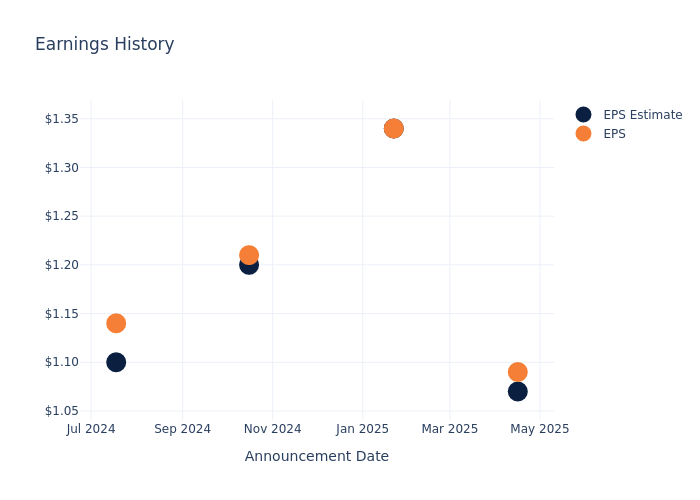

Earnings Track Record

The company's EPS beat by $0.02 in the last quarter, leading to a 0.99% increase in the share price on the following day.

Here's a look at Abbott Laboratories's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.07 | 1.34 | 1.20 | 1.10 |

| EPS Actual | 1.09 | 1.34 | 1.21 | 1.14 |

| Price Change % | 1.0% | 5.0% | 0.0% | 2.0% |

Tracking Abbott Laboratories's Stock Performance

Shares of Abbott Laboratories were trading at $131.49 as of July 15. Over the last 52-week period, shares are up 31.7%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Observations about Abbott Laboratories

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Abbott Laboratories.

The consensus rating for Abbott Laboratories is Outperform, derived from 12 analyst ratings. An average one-year price target of $143.0 implies a potential 8.75% upside.

Comparing Ratings Among Industry Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Intuitive Surgical, Boston Scientific and Stryker, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Intuitive Surgical, with an average 1-year price target of $565.56, suggesting a potential 330.12% upside.

- Analysts currently favor an Outperform trajectory for Boston Scientific, with an average 1-year price target of $119.36, suggesting a potential 9.23% downside.

- Analysts currently favor an Buy trajectory for Stryker, with an average 1-year price target of $423.2, suggesting a potential 221.85% upside.

Key Findings: Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for Intuitive Surgical, Boston Scientific and Stryker, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Abbott Laboratories | Outperform | 3.95% | $5.89B | 2.75% |

| Intuitive Surgical | Outperform | 19.19% | $1.46B | 4.16% |

| Boston Scientific | Outperform | 20.93% | $3.21B | 3.06% |

| Stryker | Buy | 11.88% | $3.74B | 3.15% |

Key Takeaway:

Abbott Laboratories ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

About Abbott Laboratories

Abbott manufactures and markets cardiovascular and diabetes devices, adult and pediatric nutritional products, diagnostic equipment and testing kits, and branded generic drugs. Products include pacemakers, implantable cardioverter defibrillators, neuromodulation devices, coronary stents, catheters, infant formula, nutritional liquids for adults, continuous glucose monitors, and immunoassays and point-of-care diagnostic equipment. Abbott derives approximately 60% of sales outside the United States.

Abbott Laboratories's Financial Performance

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Abbott Laboratories displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 3.95%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Abbott Laboratories's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 12.79% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Abbott Laboratories's ROE stands out, surpassing industry averages. With an impressive ROE of 2.75%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.63%, the company showcases effective utilization of assets.

Debt Management: Abbott Laboratories's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.27.

To track all earnings releases for Abbott Laboratories visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.