UnitedHealth Group Unusual Options Activity

Financial giants have made a conspicuous bearish move on UnitedHealth Group. Our analysis of options history for UnitedHealth Group (NYSE:UNH) revealed 50 unusual trades.

Delving into the details, we found 36% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 15 were puts, with a value of $950,832, and 35 were calls, valued at $3,177,036.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $150.0 to $460.0 for UnitedHealth Group during the past quarter.

Analyzing Volume & Open Interest

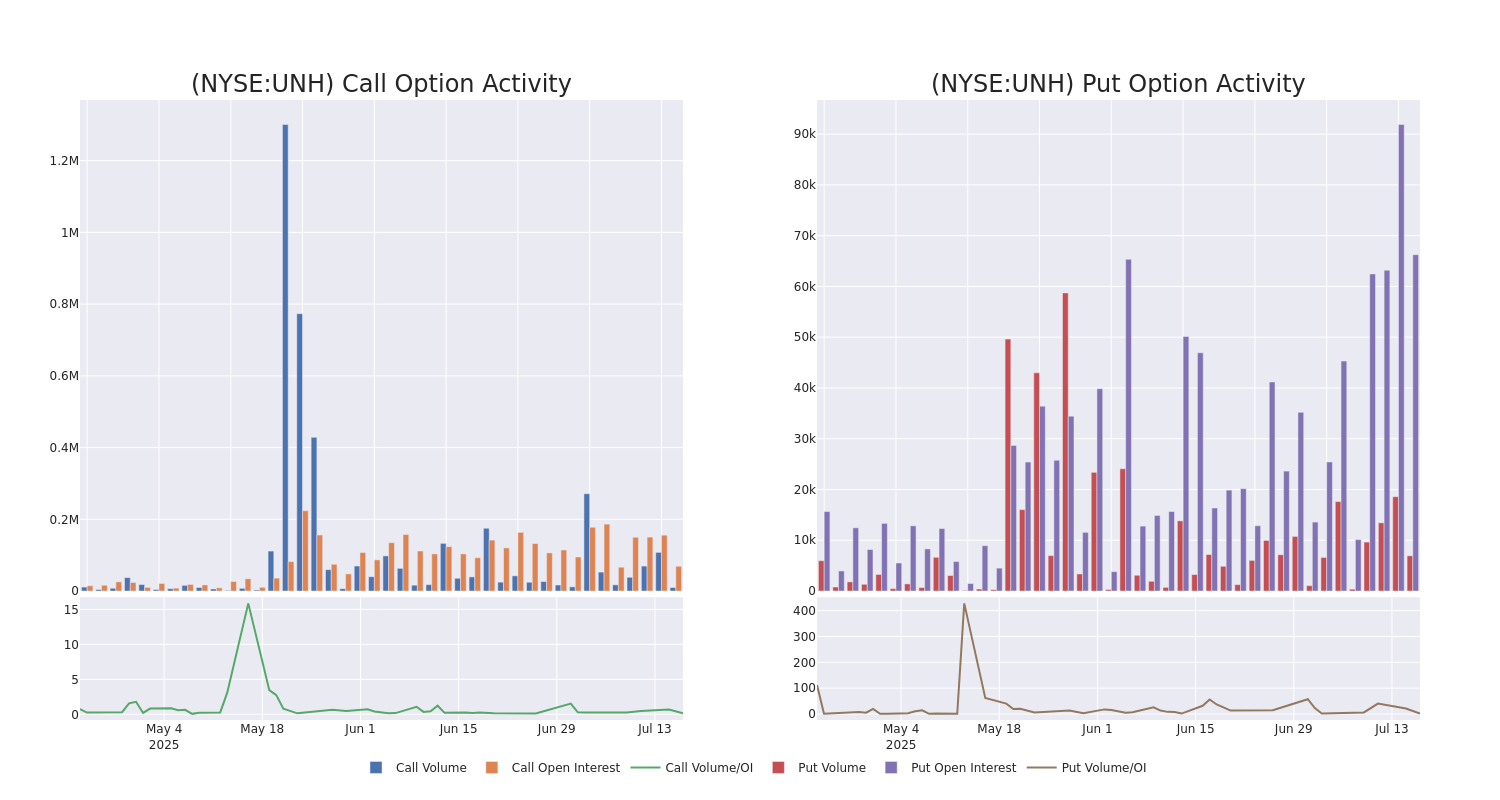

In today's trading context, the average open interest for options of UnitedHealth Group stands at 3299.68, with a total volume reaching 15,535.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in UnitedHealth Group, situated within the strike price corridor from $150.0 to $460.0, throughout the last 30 days.

UnitedHealth Group Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | CALL | SWEEP | BULLISH | 12/17/27 | $113.6 | $109.7 | $113.6 | $210.00 | $851.9K | 59 | 135 |

| UNH | CALL | TRADE | BEARISH | 01/16/26 | $8.7 | $8.6 | $8.6 | $400.00 | $559.0K | 13.8K | 1.0K |

| UNH | CALL | SWEEP | BEARISH | 12/17/27 | $108.65 | $108.6 | $108.6 | $210.00 | $543.0K | 59 | 60 |

| UNH | PUT | TRADE | NEUTRAL | 01/15/27 | $34.35 | $31.15 | $32.8 | $250.00 | $459.2K | 807 | 141 |

| UNH | CALL | SWEEP | BULLISH | 09/19/25 | $16.8 | $16.7 | $16.8 | $300.00 | $92.4K | 6.9K | 388 |

About UnitedHealth Group

UnitedHealth Group is one of the largest private health insurers and provides medical benefits to about 51 million members globally, including 1 million outside the US as of December 2024. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in medical insurance. Along with its insurance assets, UnitedHealth's Optum franchises help create a healthcare services colossus that spans everything from pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

After a thorough review of the options trading surrounding UnitedHealth Group, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

UnitedHealth Group's Current Market Status

- Trading volume stands at 7,244,700, with UNH's price down by -1.04%, positioned at $289.44.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 12 days.

Expert Opinions on UnitedHealth Group

In the last month, 4 experts released ratings on this stock with an average target price of $371.25.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on UnitedHealth Group with a target price of $337.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on UnitedHealth Group with a target price of $385.

* An analyst from JP Morgan persists with their Overweight rating on UnitedHealth Group, maintaining a target price of $418.

* An analyst from Truist Securities persists with their Buy rating on UnitedHealth Group, maintaining a target price of $345.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for UnitedHealth Group with Benzinga Pro for real-time alerts.