Earnings Preview: Fiserv

Fiserv (NYSE:FI) is preparing to release its quarterly earnings on Wednesday, 2025-07-23. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Fiserv to report an earnings per share (EPS) of $2.43.

The market awaits Fiserv's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

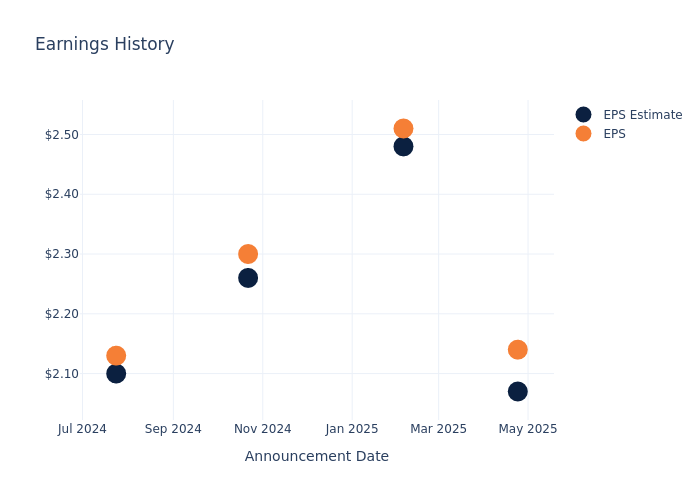

Earnings History Snapshot

During the last quarter, the company reported an EPS beat by $0.07, leading to a 0.36% increase in the share price on the subsequent day.

Here's a look at Fiserv's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 2.07 | 2.48 | 2.26 | 2.10 |

| EPS Actual | 2.14 | 2.51 | 2.30 | 2.13 |

| Price Change % | 0.0% | 1.0% | 1.0% | -3.0% |

Fiserv Share Price Analysis

Shares of Fiserv were trading at $165.46 as of July 21. Over the last 52-week period, shares are up 3.71%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Observations about Fiserv

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Fiserv.

With 20 analyst ratings, Fiserv has a consensus rating of Outperform. The average one-year price target is $221.15, indicating a potential 33.66% upside.

Understanding Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of PayPal Holdings, Block and Fidelity National Info, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for PayPal Holdings, with an average 1-year price target of $80.57, suggesting a potential 51.31% downside.

- Analysts currently favor an Outperform trajectory for Block, with an average 1-year price target of $69.68, suggesting a potential 57.89% downside.

- Analysts currently favor an Neutral trajectory for Fidelity National Info, with an average 1-year price target of $88.67, suggesting a potential 46.41% downside.

Analysis Summary for Peers

The peer analysis summary provides a snapshot of key metrics for PayPal Holdings, Block and Fidelity National Info, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Fiserv | Outperform | 5.06% | $3.06B | 3.21% |

| PayPal Holdings | Neutral | 1.20% | $3.72B | 6.33% |

| Block | Outperform | -3.11% | $2.29B | 0.89% |

| Fidelity National Info | Neutral | 2.59% | $879M | 0.50% |

Key Takeaway:

Fiserv ranks first in revenue growth among its peers. It also leads in gross profit margin. However, it has the lowest return on equity.

About Fiserv

Fiserv is a leading provider of core processing and complementary services, such as electronic funds transfer, payment processing, and loan processing, for US banks and credit unions, with a focus on small and midsize banks. Through the merger with First Data in 2019, Fiserv also provides payment processing services for merchants. About 10% of the company's revenue is generated internationally.

Financial Insights: Fiserv

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Fiserv displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 5.06%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Fiserv's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 16.59% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Fiserv's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 3.21%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Fiserv's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 1.08%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Fiserv's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.1.

To track all earnings releases for Fiserv visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.