Tigo Energy Skyrockets 50% After Hours — Strong Q2 Results Fuel Investor Optimism

Tigo Energy Inc (NASDAQ:TYGO) saw a 50.41% surge in its stock value during after-hours trading on Tuesday, following the release of second-quarter financial results.

Check out the current price of TYGO stock here.

What Happened: The stock of the California-based power optimizer company closed at $1.23 after gaining 0.82% for the day, and soared to $1.85 in after-hours trading, representing a 50.41% increase, according to Benzinga Pro data.

The second-quarter financial results, released on Tuesday, revealed a significant increase in revenue, which surged by 89.4% compared to the second quarter of 2024. This surpassed the market’s expectations and led to the stock’s remarkable after-hours performance.

See Also: This Is What Whales Are Betting On BigBear.ai Hldgs

The quarter-three sales guidance, which was higher than expected, also contributed to the stock’s surge. The company projected quarter-three sales to be between $29 million and $31million, compared to the estimated $23.88M.

Zvi Alon, Chairman and CEO of Tigo stated, "This performance underscores our ability to gain market share in this challenging environment, driven by strong demand for our innovative MLPE products.”

Why It Matters: Tigo Energy’s second quarter financial results were impressive, with the company reporting a revenue of $24.1 million, a 89.4% year-over-year increase. The company also reduced the net loss by 60.9% compared to previous year totaled at $4.4 million, a 60.9% decrease compared to a net loss of $11.3 million.

These impressive results, along with the revenue expectation between the range of $29 million to $31 million for the third quarter sales guidance, have contributed to the increase in Tigo Energy’s stock value.

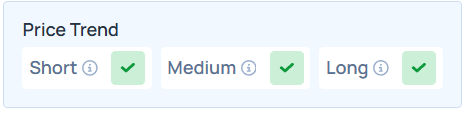

Benzinga's Edge Stock Rankings indicates TYGO stock has a positive trend across all time frames. Know the stock value of other solar energy sector players.

Photo Courtesy: Mizkit on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: why it's movingEquities Markets