Insights into Huntington Ingalls Indus's Upcoming Earnings

Huntington Ingalls Indus (NYSE:HII) is preparing to release its quarterly earnings on Thursday, 2025-07-31. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Huntington Ingalls Indus to report an earnings per share (EPS) of $3.33.

The announcement from Huntington Ingalls Indus is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

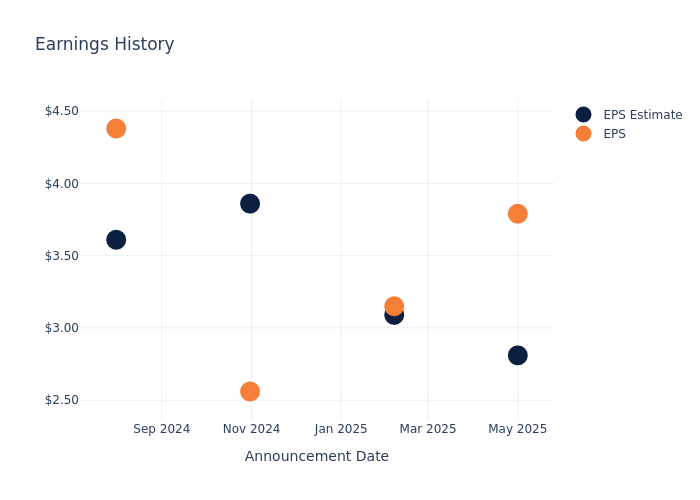

Performance in Previous Earnings

During the last quarter, the company reported an EPS beat by $0.98, leading to a 1.12% increase in the share price on the subsequent day.

Here's a look at Huntington Ingalls Indus's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 2.81 | 3.09 | 3.86 | 3.61 |

| EPS Actual | 3.79 | 3.15 | 2.56 | 4.38 |

| Price Change % | 1.0% | 5.0% | 2.0% | -1.0% |

Stock Performance

Shares of Huntington Ingalls Indus were trading at $260.84 as of July 29. Over the last 52-week period, shares are down 2.28%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analyst Observations about Huntington Ingalls Indus

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Huntington Ingalls Indus.

The consensus rating for Huntington Ingalls Indus is Buy, derived from 3 analyst ratings. An average one-year price target of $266.67 implies a potential 2.24% upside.

Peer Ratings Overview

The below comparison of the analyst ratings and average 1-year price targets of Kratos Defense & Security, Leonardo DRS and ATI, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Kratos Defense & Security, with an average 1-year price target of $51.43, suggesting a potential 80.28% downside.

- Analysts currently favor an Buy trajectory for Leonardo DRS, with an average 1-year price target of $48.0, suggesting a potential 81.6% downside.

- Analysts currently favor an Outperform trajectory for ATI, with an average 1-year price target of $105.0, suggesting a potential 59.75% downside.

Peers Comparative Analysis Summary

The peer analysis summary outlines pivotal metrics for Kratos Defense & Security, Leonardo DRS and ATI, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Huntington Ingalls Indus | Buy | -2.53% | $394M | 3.16% |

| Kratos Defense & Security | Buy | 9.16% | $73.60M | 0.33% |

| Leonardo DRS | Buy | 16.13% | $181M | 1.95% |

| ATI | Outperform | 9.73% | $235.80M | 5.21% |

Key Takeaway:

Huntington Ingalls Indus ranks at the bottom for Revenue Growth among its peers. It is in the middle for Gross Profit. The company is at the bottom for Return on Equity.

Unveiling the Story Behind Huntington Ingalls Indus

Huntington Ingalls Industries is the largest independent military shipbuilder in the US, spun out of Northrop Grumman in 2011. It operates three segments, two of which are storied shipyards: Ingalls produces non-nuclear-powered ships including amphibious landing ships and Arleigh Burke-class destroyers while Newport News produces nuclear-powered ships as the only producer of Gerald Ford-class aircraft carriers and a major subcontractor on Virginia and Columbia-class nuclear submarines. Huntington Ingalls shares production of destroyers and nuclear submarines with General Dynamics' Bath Iron Works and Electric Boat shipyards, respectively. The company's Mission Technologies segment produces uncrewed sea vessels and provides a range of IT and other services to US government agencies.

Huntington Ingalls Indus: A Financial Overview

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Challenges: Huntington Ingalls Indus's revenue growth over 3 months faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -2.53%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Huntington Ingalls Indus's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 5.45%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Huntington Ingalls Indus's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.16%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Huntington Ingalls Indus's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.23%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.71.

This article was generated by Benzinga's automated content engine and reviewed by an editor.