What to Expect from Lincoln Electric Holdings's Earnings

Lincoln Electric Holdings (NASDAQ:LECO) is gearing up to announce its quarterly earnings on Thursday, 2025-07-31. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Lincoln Electric Holdings will report an earnings per share (EPS) of $2.32.

Investors in Lincoln Electric Holdings are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

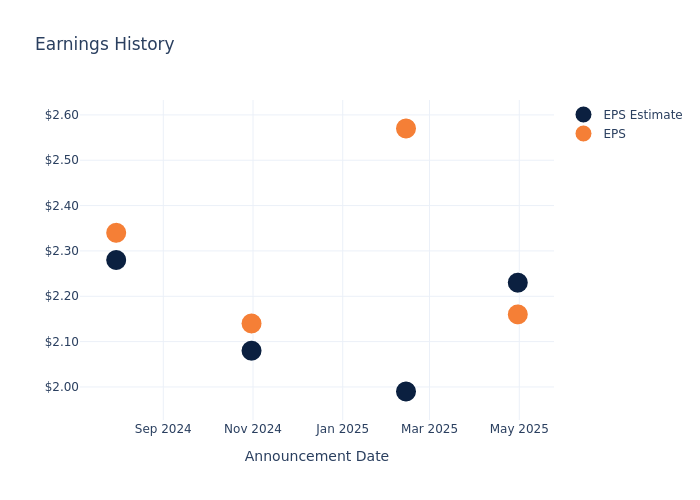

Earnings Track Record

Last quarter the company missed EPS by $0.07, which was followed by a 0.82% increase in the share price the next day.

Here's a look at Lincoln Electric Holdings's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 2.23 | 1.99 | 2.08 | 2.28 |

| EPS Actual | 2.16 | 2.57 | 2.14 | 2.34 |

| Price Change % | 1.0% | 0.0% | 5.0% | -3.0% |

Performance of Lincoln Electric Holdings Shares

Shares of Lincoln Electric Holdings were trading at $224.08 as of July 29. Over the last 52-week period, shares are up 11.75%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Observations about Lincoln Electric Holdings

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Lincoln Electric Holdings.

With 6 analyst ratings, Lincoln Electric Holdings has a consensus rating of Outperform. The average one-year price target is $213.83, indicating a potential 4.57% downside.

Comparing Ratings with Competitors

The below comparison of the analyst ratings and average 1-year price targets of Nordson, RBC Bearings and ITT, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Nordson, with an average 1-year price target of $251.67, suggesting a potential 12.31% upside.

- Analysts currently favor an Buy trajectory for RBC Bearings, with an average 1-year price target of $423.4, suggesting a potential 88.95% upside.

- Analysts currently favor an Buy trajectory for ITT, with an average 1-year price target of $174.57, suggesting a potential 22.09% downside.

Summary of Peers Analysis

In the peer analysis summary, key metrics for Nordson, RBC Bearings and ITT are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Lincoln Electric Holdings | Outperform | 2.36% | $365.45M | 8.88% |

| Nordson | Outperform | 4.96% | $373.90M | 3.85% |

| RBC Bearings | Buy | 5.80% | $193.40M | 2.44% |

| ITT | Buy | 0.26% | $316.30M | 3.91% |

Key Takeaway:

Lincoln Electric Holdings ranks at the top for Revenue Growth among its peers. It is in the middle for Gross Profit. For Return on Equity, it is also in the middle.

Discovering Lincoln Electric Holdings: A Closer Look

Lincoln Electric is a leading manufacturer of welding, cutting, and brazing products. The firm's portfolio of products includes arc-welding solutions, plasma and oxy-fuel cutting systems, and brazing and soldering alloys, as well as automation solutions. Lincoln Electric serves clients in the general fabrication, heavy industries, automotive, construction, shipbuilding, energy and process industries, among other end markets. Based in Cleveland, Ohio, Lincoln Electric has operations in 19 countries and has 11,000 employees worldwide. The company generated roughly $4 billion in sales in 2024.

Key Indicators: Lincoln Electric Holdings's Financial Health

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Lincoln Electric Holdings's remarkable performance in 3 months is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 2.36%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Lincoln Electric Holdings's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 11.8% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Lincoln Electric Holdings's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 8.88%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Lincoln Electric Holdings's ROA excels beyond industry benchmarks, reaching 3.32%. This signifies efficient management of assets and strong financial health.

Debt Management: Lincoln Electric Holdings's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.94, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

This article was generated by Benzinga's automated content engine and reviewed by an editor.