What to Expect from AptarGroup's Earnings

AptarGroup (NYSE:ATR) is preparing to release its quarterly earnings on Thursday, 2025-07-31. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect AptarGroup to report an earnings per share (EPS) of $1.58.

The announcement from AptarGroup is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

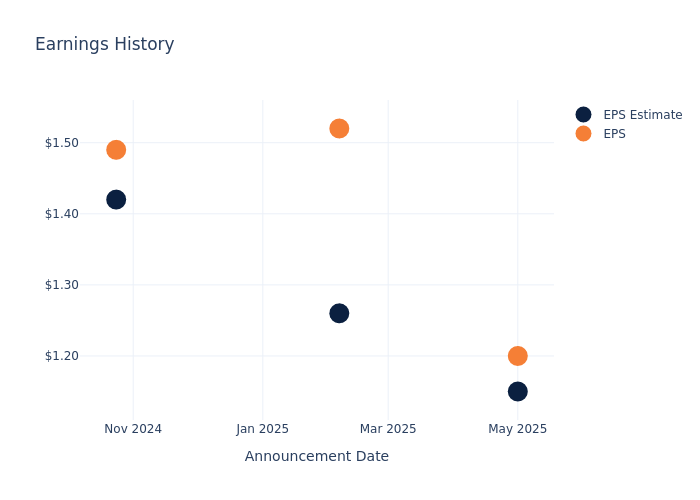

Past Earnings Performance

The company's EPS beat by $0.05 in the last quarter, leading to a 2.51% increase in the share price on the following day.

Here's a look at AptarGroup's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.15 | 1.26 | 1.42 | 1.36 |

| EPS Actual | 1.20 | 1.52 | 1.49 | 1.37 |

| Price Change % | 3.0% | -8.0% | 1.0% | 4.0% |

Market Performance of AptarGroup's Stock

Shares of AptarGroup were trading at $158.82 as of July 29. Over the last 52-week period, shares are up 6.71%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Take on AptarGroup

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on AptarGroup.

A total of 3 analyst ratings have been received for AptarGroup, with the consensus rating being Outperform. The average one-year price target stands at $175.0, suggesting a potential 10.19% upside.

Peer Ratings Overview

In this comparison, we explore the analyst ratings and average 1-year price targets of Crown Holdings, Silgan Hldgs and Ball, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Crown Holdings, with an average 1-year price target of $119.4, suggesting a potential 24.82% downside.

- Analysts currently favor an Buy trajectory for Silgan Hldgs, with an average 1-year price target of $62.0, suggesting a potential 60.96% downside.

- Analysts currently favor an Neutral trajectory for Ball, with an average 1-year price target of $62.8, suggesting a potential 60.46% downside.

Analysis Summary for Peers

In the peer analysis summary, key metrics for Crown Holdings, Silgan Hldgs and Ball are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| AptarGroup | Outperform | -3.07% | $336.41M | 3.15% |

| Crown Holdings | Neutral | 9.08% | $625M | 6.48% |

| Silgan Hldgs | Buy | 11.36% | $270.40M | 3.34% |

| Ball | Neutral | 7.76% | $604M | 3.15% |

Key Takeaway:

AptarGroup ranks at the bottom for Revenue Growth among its peers. It is in the middle for Gross Profit. AptarGroup is at the bottom for Return on Equity.

All You Need to Know About AptarGroup

Headquartered in Crystal Lake, Illinois, AptarGroup is a leading global supplier of dispensing systems such as aerosol valves, pumps, closures, and elastomer packaging components to the consumer goods and pharmaceutical markets. With the bulk of its annual net sales coming from Europe (49% of sales) and the United States (32%), Aptar aims to increase its presence in Asia (11%) and Latin America (8%). It operates three business segments, Pharma, Beauty, and Closures. Pharma generates over two thirds of group profits.

Financial Milestones: AptarGroup's Journey

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Negative Revenue Trend: Examining AptarGroup's financials over 3 months reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -3.07% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 8.88%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): AptarGroup's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.15%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): AptarGroup's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.76% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: AptarGroup's debt-to-equity ratio is below the industry average at 0.42, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for AptarGroup visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.