Unpacking the Latest Options Trading Trends in Atlassian

Deep-pocketed investors have adopted a bullish approach towards Atlassian (NASDAQ:TEAM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in TEAM usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 28 extraordinary options activities for Atlassian. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 57% leaning bullish and 28% bearish. Among these notable options, 21 are puts, totaling $1,794,958, and 7 are calls, amounting to $427,293.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $160.0 and $250.0 for Atlassian, spanning the last three months.

Insights into Volume & Open Interest

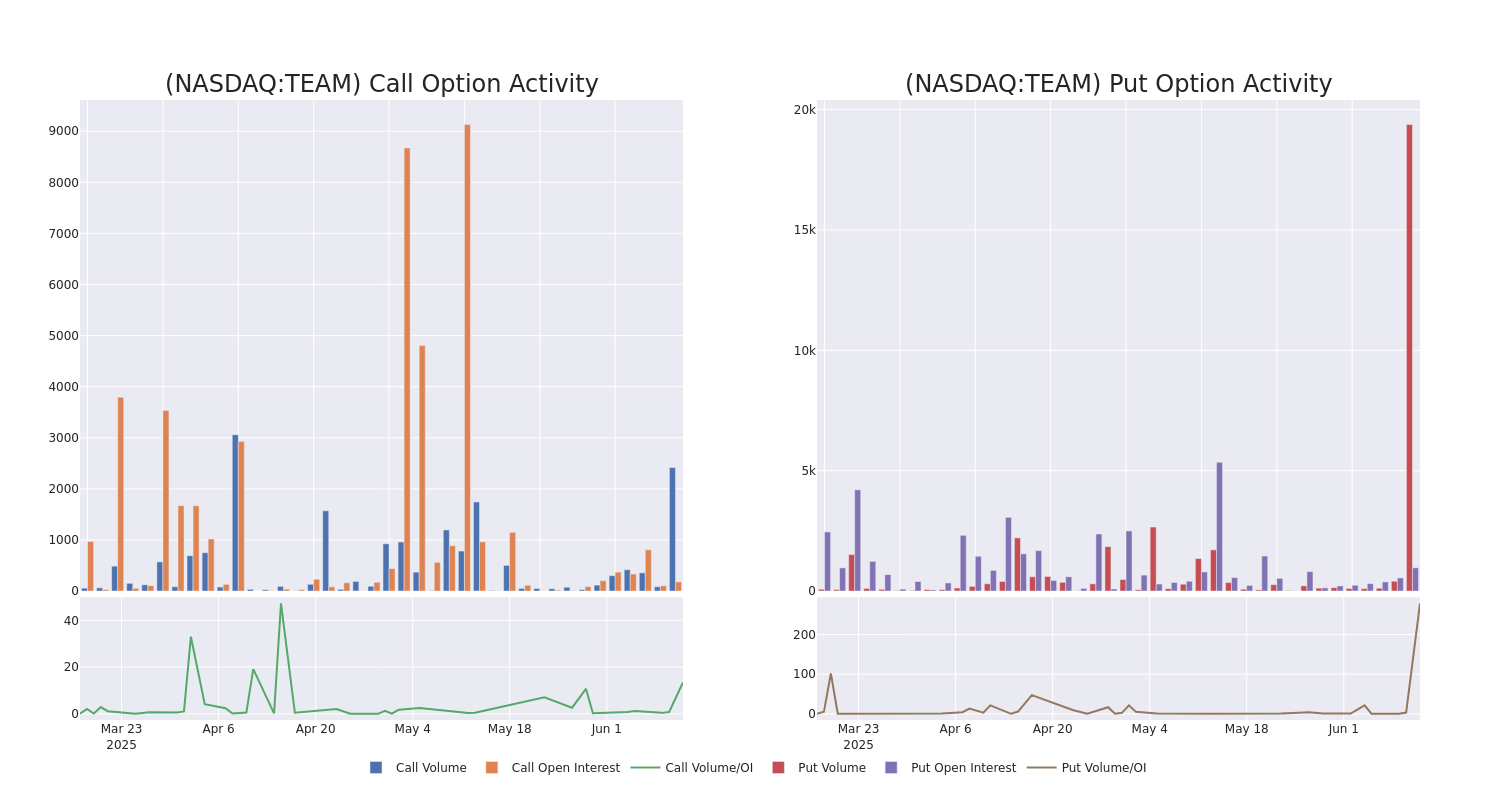

In today's trading context, the average open interest for options of Atlassian stands at 114.5, with a total volume reaching 21,798.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Atlassian, situated within the strike price corridor from $160.0 to $250.0, throughout the last 30 days.

Atlassian Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TEAM | PUT | SWEEP | BEARISH | 06/27/25 | $8.1 | $7.5 | $7.9 | $200.00 | $286.7K | 70 | 480 |

| TEAM | PUT | SWEEP | BEARISH | 06/27/25 | $8.6 | $8.1 | $8.1 | $200.00 | $216.2K | 70 | 747 |

| TEAM | PUT | TRADE | BULLISH | 06/13/25 | $11.4 | $10.5 | $10.6 | $210.00 | $137.8K | 408 | 155 |

| TEAM | CALL | TRADE | BULLISH | 08/15/25 | $4.5 | $3.6 | $4.4 | $250.00 | $122.7K | 18 | 280 |

| TEAM | PUT | SWEEP | BULLISH | 06/27/25 | $8.5 | $6.6 | $8.1 | $200.00 | $107.7K | 70 | 1.7K |

About Atlassian

Atlassian produces software that helps teams work together more efficiently and effectively. The company provides project planning and management software, collaboration tools, and IT help desk solutions. The company operates in four segments: subscriptions (term licenses and cloud agreements), maintenance (annual maintenance contracts that provide support and periodic updates and are generally attached to perpetual license sales), perpetual license (upfront sale for indefinite usage of the software), and other (training, strategic consulting, and revenue from the Atlassian Marketplace app store). Atlassian was founded in 2002 and is headquartered in Sydney.

Current Position of Atlassian

- With a volume of 779,105, the price of TEAM is down -0.74% at $200.0.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 49 days.

What Analysts Are Saying About Atlassian

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $290.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on Atlassian with a target price of $290.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Atlassian with Benzinga Pro for real-time alerts.