Regeneron Pharmaceuticals Unusual Options Activity For July 01

Whales with a lot of money to spend have taken a noticeably bullish stance on Regeneron Pharmaceuticals.

Looking at options history for Regeneron Pharmaceuticals (NASDAQ:REGN) we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 0% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $777,330 and 7, calls, for a total amount of $257,536.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $300.0 to $680.0 for Regeneron Pharmaceuticals over the recent three months.

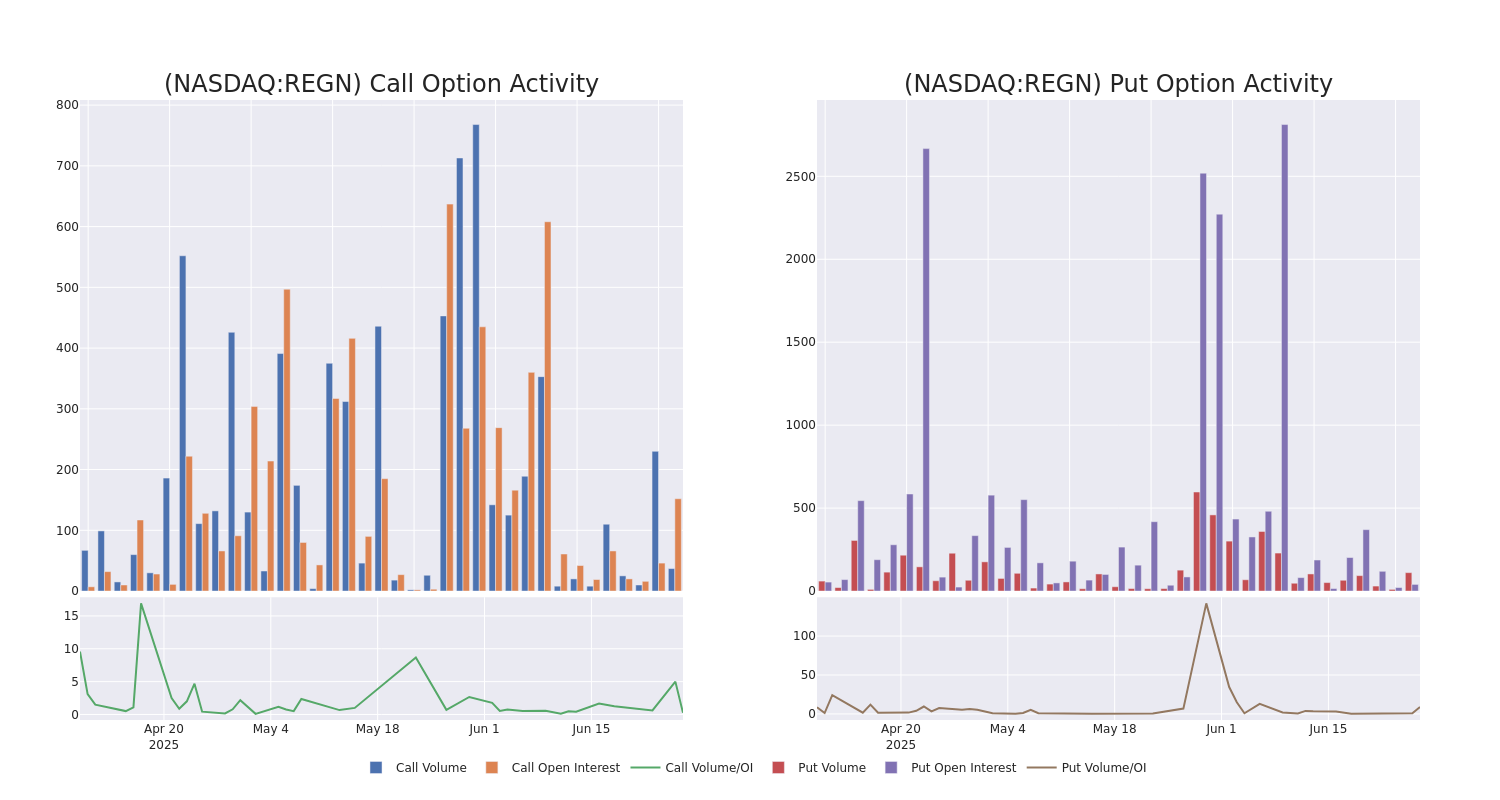

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Regeneron Pharmaceuticals's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Regeneron Pharmaceuticals's substantial trades, within a strike price spectrum from $300.0 to $680.0 over the preceding 30 days.

Regeneron Pharmaceuticals Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| REGN | PUT | TRADE | NEUTRAL | 02/20/26 | $71.0 | $65.1 | $68.1 | $560.00 | $340.4K | 0 | 50 |

| REGN | PUT | TRADE | NEUTRAL | 01/16/26 | $155.4 | $149.3 | $152.6 | $680.00 | $183.1K | 25 | 12 |

| REGN | PUT | TRADE | BULLISH | 01/16/26 | $132.3 | $125.5 | $128.0 | $650.00 | $64.0K | 64 | 5 |

| REGN | PUT | TRADE | NEUTRAL | 03/20/26 | $61.8 | $54.9 | $58.76 | $530.00 | $58.7K | 12 | 20 |

| REGN | PUT | TRADE | NEUTRAL | 03/20/26 | $62.1 | $54.8 | $58.45 | $530.00 | $58.4K | 12 | 20 |

About Regeneron Pharmaceuticals

Regeneron Pharmaceuticals discovers, develops, and commercializes products that fight eye disease, cardiovascular disease, cancer, and inflammation. The company has several marketed products, including low-dose Eylea and Eylea HD, approved for wet age-related macular degeneration and other eye diseases; Dupixent in immunology; Praluent for LDL cholesterol lowering; Libtayo in oncology; and Kevzara in rheumatoid arthritis. Regeneron is also developing monoclonal and bispecific antibodies with Sanofi, other collaborators, and independently, and has earlier-stage partnerships that bring new technology to the pipeline, including RNAi (Alnylam) and Crispr-based gene editing (Intellia).

Having examined the options trading patterns of Regeneron Pharmaceuticals, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Regeneron Pharmaceuticals's Current Market Status

- With a trading volume of 767,808, the price of REGN is up by 2.65%, reaching $538.89.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 31 days from now.

Professional Analyst Ratings for Regeneron Pharmaceuticals

5 market experts have recently issued ratings for this stock, with a consensus target price of $673.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for Regeneron Pharmaceuticals, targeting a price of $650.

* Maintaining their stance, an analyst from UBS continues to hold a Neutral rating for Regeneron Pharmaceuticals, targeting a price of $560.

* An analyst from JP Morgan has decided to maintain their Overweight rating on Regeneron Pharmaceuticals, which currently sits at a price target of $800.

* An analyst from Morgan Stanley persists with their Overweight rating on Regeneron Pharmaceuticals, maintaining a target price of $755.

* An analyst from BMO Capital persists with their Outperform rating on Regeneron Pharmaceuticals, maintaining a target price of $600.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Regeneron Pharmaceuticals, Benzinga Pro gives you real-time options trades alerts.