Humana's Options: A Look at What the Big Money is Thinking

Deep-pocketed investors have adopted a bearish approach towards Humana (NYSE:HUM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in HUM usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for Humana. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 41% leaning bullish and 58% bearish. Among these notable options, 6 are puts, totaling $210,195, and 6 are calls, amounting to $257,020.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $180.0 and $255.0 for Humana, spanning the last three months.

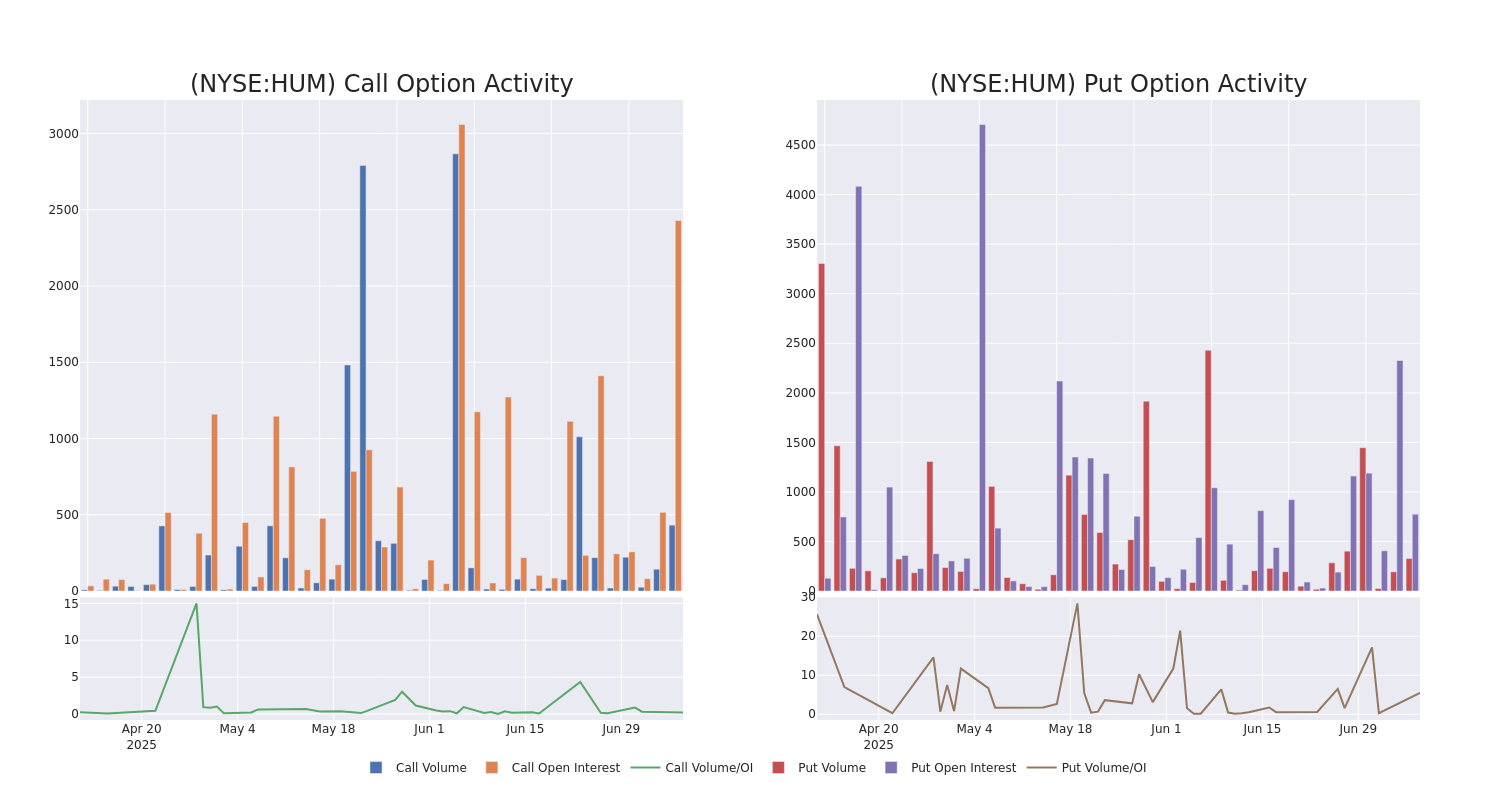

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Humana's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Humana's whale trades within a strike price range from $180.0 to $255.0 in the last 30 days.

Humana Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HUM | CALL | TRADE | BULLISH | 09/19/25 | $19.4 | $18.9 | $19.3 | $240.00 | $106.1K | 690 | 79 |

| HUM | PUT | SWEEP | BEARISH | 07/11/25 | $4.5 | $4.2 | $4.5 | $237.50 | $45.0K | 223 | 217 |

| HUM | PUT | TRADE | BEARISH | 08/15/25 | $22.6 | $22.5 | $22.6 | $250.00 | $40.6K | 204 | 19 |

| HUM | CALL | SWEEP | BEARISH | 07/11/25 | $3.6 | $3.5 | $3.5 | $237.50 | $35.0K | 161 | 109 |

| HUM | PUT | TRADE | BULLISH | 10/17/25 | $23.3 | $23.1 | $23.1 | $240.00 | $34.6K | 4 | 16 |

About Humana

Humana is one of the largest private health insurers in the US, and the firm has built a niche specializing in government-sponsored programs, with nearly all its medical membership stemming from Medicare, Medicaid, and the military's Tricare program. Beyond medical insurance, the company provides other healthcare services, including primary-care services, at-home services, and pharmacy benefit management.

After a thorough review of the options trading surrounding Humana, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Humana

- Trading volume stands at 417,881, with HUM's price down by 0.0%, positioned at $237.21.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 22 days.

Expert Opinions on Humana

3 market experts have recently issued ratings for this stock, with a consensus target price of $269.33.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from B of A Securities has decided to maintain their Neutral rating on Humana, which currently sits at a price target of $260.

* Maintaining their stance, an analyst from Truist Securities continues to hold a Hold rating for Humana, targeting a price of $280.

* Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Humana with a target price of $268.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Humana with Benzinga Pro for real-time alerts.