These Analysts Cut Their Forecasts On Charter Communications Following Q2 Earnings

Charter Communications, Inc. (NASDAQ:CHTR) reported a second-quarter EPS miss on Friday.

The company reported quarterly revenue growth of 0.6% year-on-year to $13.77 billion, beating the analyst consensus estimate of $13.76 billion.

Earnings per share of $9.18 missed the analyst consensus estimate of $9.80.

Charter lost 117,000 internet customers, compared to a decline of 149,000 during the second-quarter of 2024 which included the impact of approximately 50,000 disconnects related to the end of the FCC's Affordable Connectivity Program subsidies.

“Our converged connectivity revenue grew by over 5% in the second quarter, with a long runway for growth,” said Chris Winfrey, President and CEO of Charter. “Our seamless connectivity products offer the fastest speeds at the best price. And our strategic investments in network evolution and convergence, rural build, U.S.-based service and seamless entertainment innovation, will accelerate future customer and revenue growth.”

Charter Communications shares fell 2.8% to trade at $301.04 on Monday.

These analysts made changes to their price targets on Charter Communications following earnings announcement.

- Barclays analyst Kannan Venkateshwar maintained Charter Communications with an Underweight rating and lowered the price target from $341 to $275.

- RBC Capital analyst Jonathan Atkin maintained Charter Communications with a Sector Perform and lowered the price target from $430 to $370.

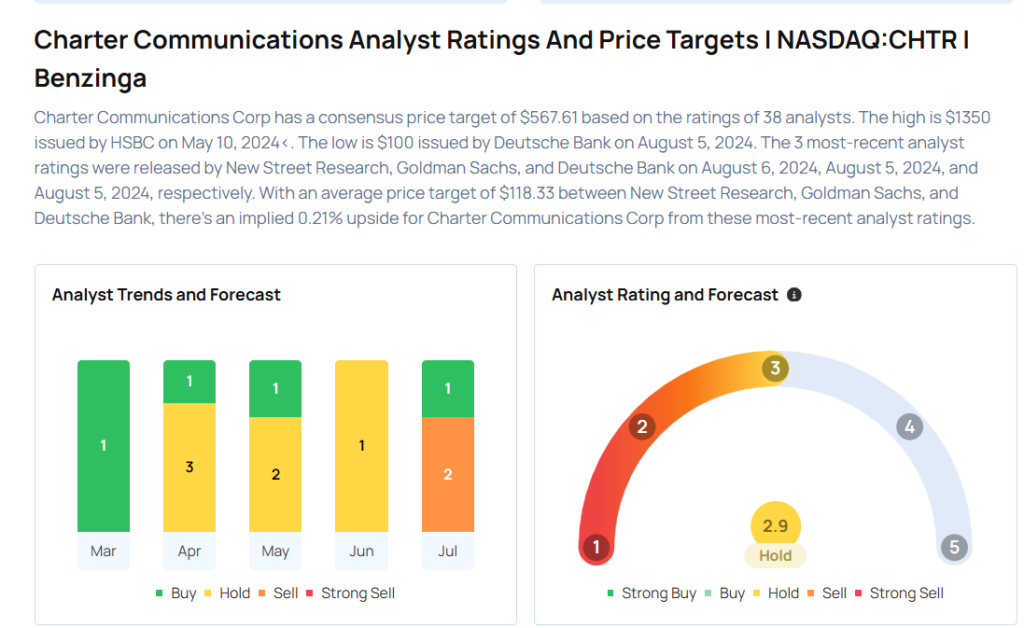

Considering buying CHTR stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for CHTR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Truist Securities | Downgrades | Buy | Hold |

| Jan 2022 | Deutsche Bank | Maintains | Hold | |

| Jan 2022 | Barclays | Maintains | Equal-Weight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas