Meta Platforms Unusual Options Activity For July 16

Whales with a lot of money to spend have taken a noticeably bullish stance on Meta Platforms.

Looking at options history for Meta Platforms (NASDAQ:META) we detected 65 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 40% with bearish.

From the overall spotted trades, 35 are puts, for a total amount of $3,950,776 and 30, calls, for a total amount of $2,177,901.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $5.0 and $1100.0 for Meta Platforms, spanning the last three months.

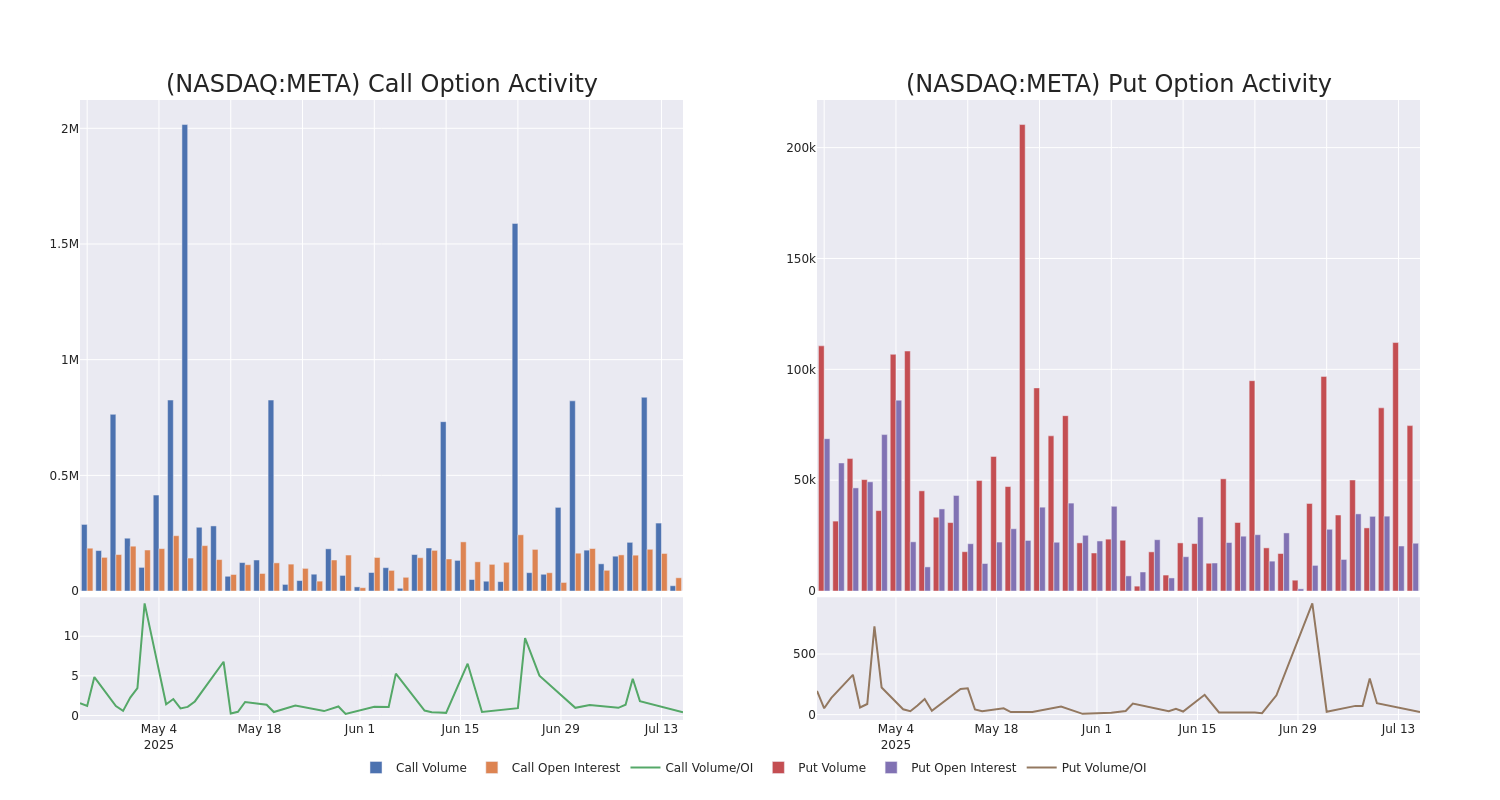

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Meta Platforms's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Meta Platforms's whale trades within a strike price range from $5.0 to $1100.0 in the last 30 days.

Meta Platforms Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| META | PUT | SWEEP | BULLISH | 08/01/25 | $23.65 | $23.6 | $23.6 | $700.00 | $1.0M | 1.6K | 839 |

| META | PUT | TRADE | BULLISH | 08/01/25 | $24.1 | $23.85 | $23.85 | $700.00 | $655.8K | 1.6K | 289 |

| META | CALL | SWEEP | BEARISH | 07/25/25 | $8.8 | $8.6 | $8.6 | $720.00 | $653.6K | 4.0K | 802 |

| META | PUT | SWEEP | BEARISH | 07/18/25 | $5.35 | $5.2 | $5.2 | $700.00 | $555.6K | 6.9K | 5.4K |

| META | PUT | SWEEP | BULLISH | 08/01/25 | $23.9 | $23.7 | $23.7 | $700.00 | $180.2K | 1.6K | 292 |

About Meta Platforms

Meta is the largest social media company in the world, boasting close to 4 billion monthly active users worldwide. The firm's "Family of Apps," its core business, consists of Facebook, Instagram, Messenger, and WhatsApp. End users can leverage these applications for a variety of different purposes, from keeping in touch with friends to following celebrities and running digital businesses for free. Meta packages customer data, gleaned from its application ecosystem and sells ads to digital advertisers. While the firm has been investing heavily in its Reality Labs business, it remains a very small part of Meta's overall sales.

In light of the recent options history for Meta Platforms, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Meta Platforms's Current Market Status

- With a trading volume of 3,355,718, the price of META is down by -0.44%, reaching $707.26.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 14 days from now.

What The Experts Say On Meta Platforms

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $784.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for Meta Platforms, targeting a price of $850.

* An analyst from Piper Sandler downgraded its action to Overweight with a price target of $808.

* An analyst from Citigroup persists with their Buy rating on Meta Platforms, maintaining a target price of $803.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on Meta Platforms, which currently sits at a price target of $664.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Meta Platforms with a target price of $795.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Meta Platforms options trades with real-time alerts from Benzinga Pro.