Gary Black Slams Tesla Over 'Disaster' Second Quarter Earnings, Says He Would Pass On TSLA Stock, Calls Robotaxi Launch 'Kabuki Theater'

Future Fund LLC's managing director, Gary Black, has criticized Tesla Inc. (NASDAQ:TSLA) over the company's "disaster" second-quarter earnings call.

Check out the current price of TSLA stock here.

What Happened: The investor shared his thoughts via a post on social media platform X on Thursday, slamming bullish Tesla investors and analysts as well as criticizing the automaker's decision to release a scaled-down, affordable Model Y.

"Too bad any new volume will cannibalize higher-priced Model Y trims rather than add incremental volume," Black said, before adding that Tesla experienced a 15-20% decline in average unit price when the company previously announced price cuts.

Black also slammed the company's Austin robotaxi launch, calling it "Kabuki theater," and criticizing the presence of safety drivers as well as "influencers" becoming testimonial first riders.

"Austin has not been ‘selling fully autonomous rides’ as promised on TSLA's 1Q conference call – certainly not that can be leveraged to new markets at the flip of a switch, as was alluded," the investor said.

Black also criticized Tesla valuations by bullish analysts, saying that stocks like Nvidia Corp. (NASDAQ:NVDA), Amazon.com Inc. (NASDAQ:AMZN), Meta Platforms Inc. (NYSE:META), etc, trade at "1.8x-2.2x forward" Price to Earnings Growth (PEG).

He slammed TSLA stock for trading at "5x PEG," with a Price/Earnings ratio of 160x vs a 5-year growth rate of 30%. "I'd rather pass on TSLA until it finds its growth path again," the investor said in his post.

Why It Matters: The news comes as Tesla reported a 12% YoY decline, registering $22.5 billion in revenue and delivering over 384,212 units in the second quarter during Wednesday's earnings call. Despite the revenue being in line with Wall Street estimates, the deliveries were better than expected by analysts.

Black has been criticizing Elon Musk's electric vehicle giant for releasing a scaled-down version of the Model Y, which, without a new form factor, would cannibalize sales. His opinion has been shared by other experts like Deepwater Management's co-founder Gene Munster.

Interestingly, Musk doubled down on Robotaxis, targeting an ambitious goal of serving over half of the U.S. population with Tesla's autonomous ride-hailing service and also targeting 100,000 units of Optimus robots produced annually.

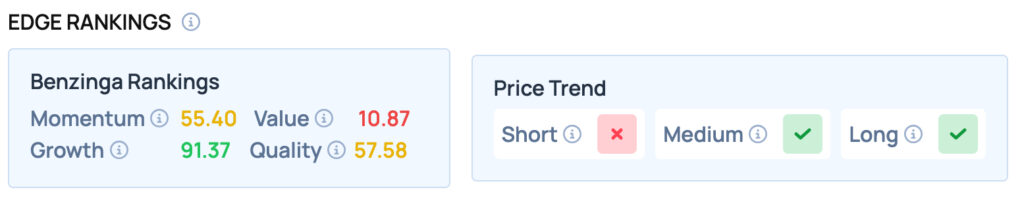

Tesla offers Satisfactory Momentum and Quality, while scoring well on the Growth metric, but offering poor Value. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: VTT Studio / Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Tech