Albemarle Unusual Options Activity For July 25

Investors with a lot of money to spend have taken a bullish stance on Albemarle (NYSE:ALB).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ALB, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 14 uncommon options trades for Albemarle.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 42%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $251,812, and 9 are calls, for a total amount of $600,223.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $140.0 for Albemarle over the recent three months.

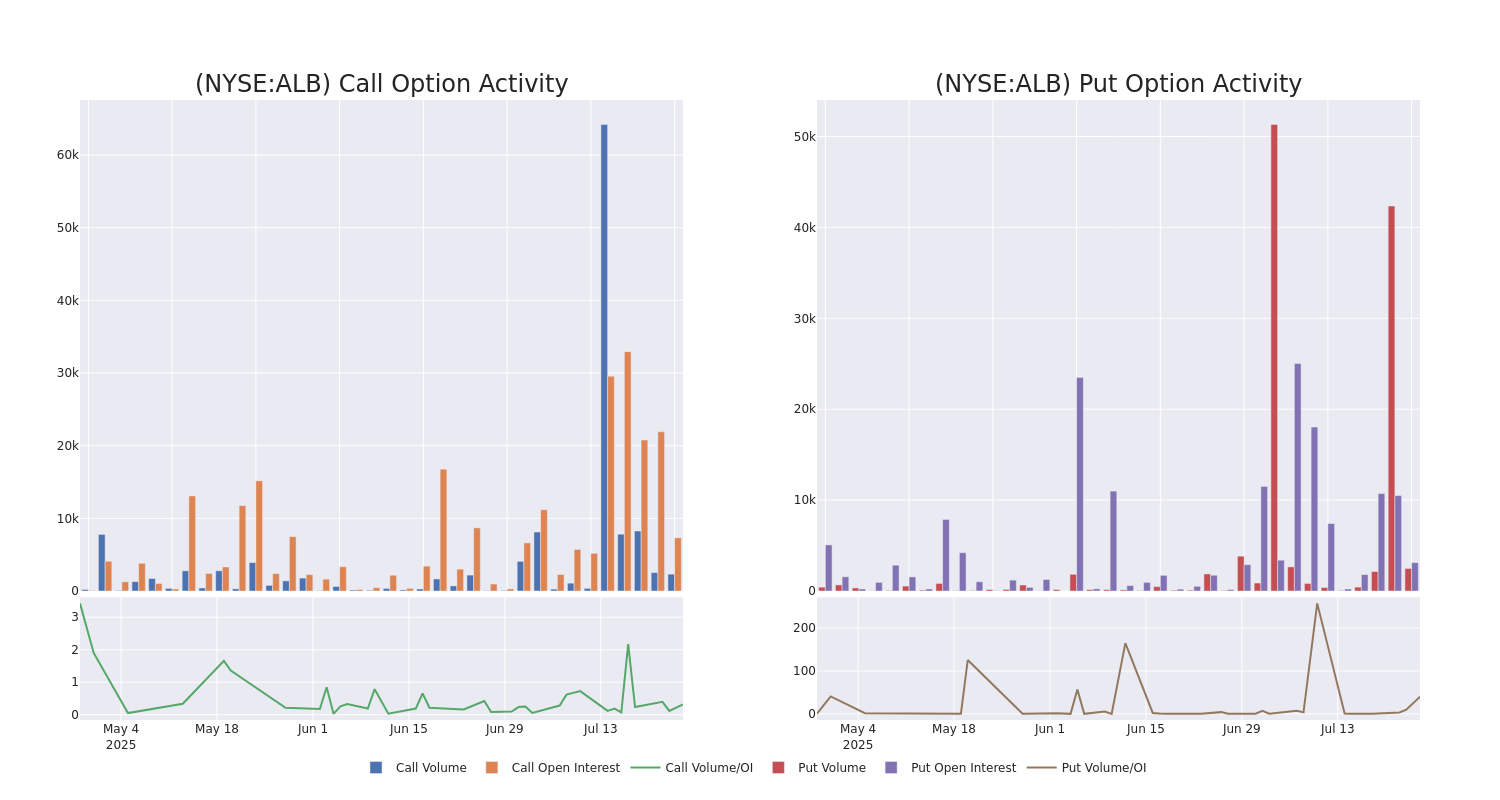

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Albemarle's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Albemarle's whale trades within a strike price range from $60.0 to $140.0 in the last 30 days.

Albemarle 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ALB | CALL | TRADE | NEUTRAL | 01/16/26 | $1.96 | $1.62 | $1.82 | $140.00 | $127.4K | 446 | 700 |

| ALB | CALL | SWEEP | BEARISH | 06/18/26 | $15.9 | $15.6 | $15.6 | $85.00 | $124.8K | 54 | 100 |

| ALB | PUT | TRADE | BEARISH | 09/19/25 | $5.6 | $5.45 | $5.6 | $80.00 | $112.0K | 2.7K | 227 |

| ALB | CALL | TRADE | BULLISH | 08/15/25 | $0.91 | $0.75 | $0.91 | $100.00 | $91.0K | 1.3K | 1.0K |

| ALB | CALL | TRADE | BULLISH | 06/18/26 | $12.2 | $12.15 | $12.2 | $95.00 | $89.0K | 121 | 99 |

About Albemarle

Albemarle is one of the world's largest lithium producers. In the lithium industry, the majority of demand comes from batteries, where lithium is used as the energy storage material, particularly in electric vehicles. Albemarle is a fully integrated lithium producer. Its upstream resources include salt brine deposits in Chile and the US and two hard rock mines in Australia, both of which are joint ventures. The company operates lithium refining plants in Chile, the US, Australia, and China. Albemarle is a global leader in the production of bromine, used in flame retardants. It is also a major producer of oil refining catalysts.

Following our analysis of the options activities associated with Albemarle, we pivot to a closer look at the company's own performance.

Where Is Albemarle Standing Right Now?

- Trading volume stands at 3,839,208, with ALB's price up by 0.58%, positioned at $84.67.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 5 days.

Expert Opinions on Albemarle

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $73.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from UBS downgraded its action to Sell with a price target of $57.

* An analyst from Wells Fargo has decided to maintain their Equal-Weight rating on Albemarle, which currently sits at a price target of $75.

* Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Albemarle with a target price of $87.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Albemarle, Benzinga Pro gives you real-time options trades alerts.