Decoding Lowe's Companies's Options Activity: What's the Big Picture?

Deep-pocketed investors have adopted a bearish approach towards Lowe's Companies (NYSE:LOW), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in LOW usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for Lowe's Companies. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 33% leaning bullish and 41% bearish. Among these notable options, 4 are puts, totaling $482,441, and 8 are calls, amounting to $332,144.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $200.0 and $280.0 for Lowe's Companies, spanning the last three months.

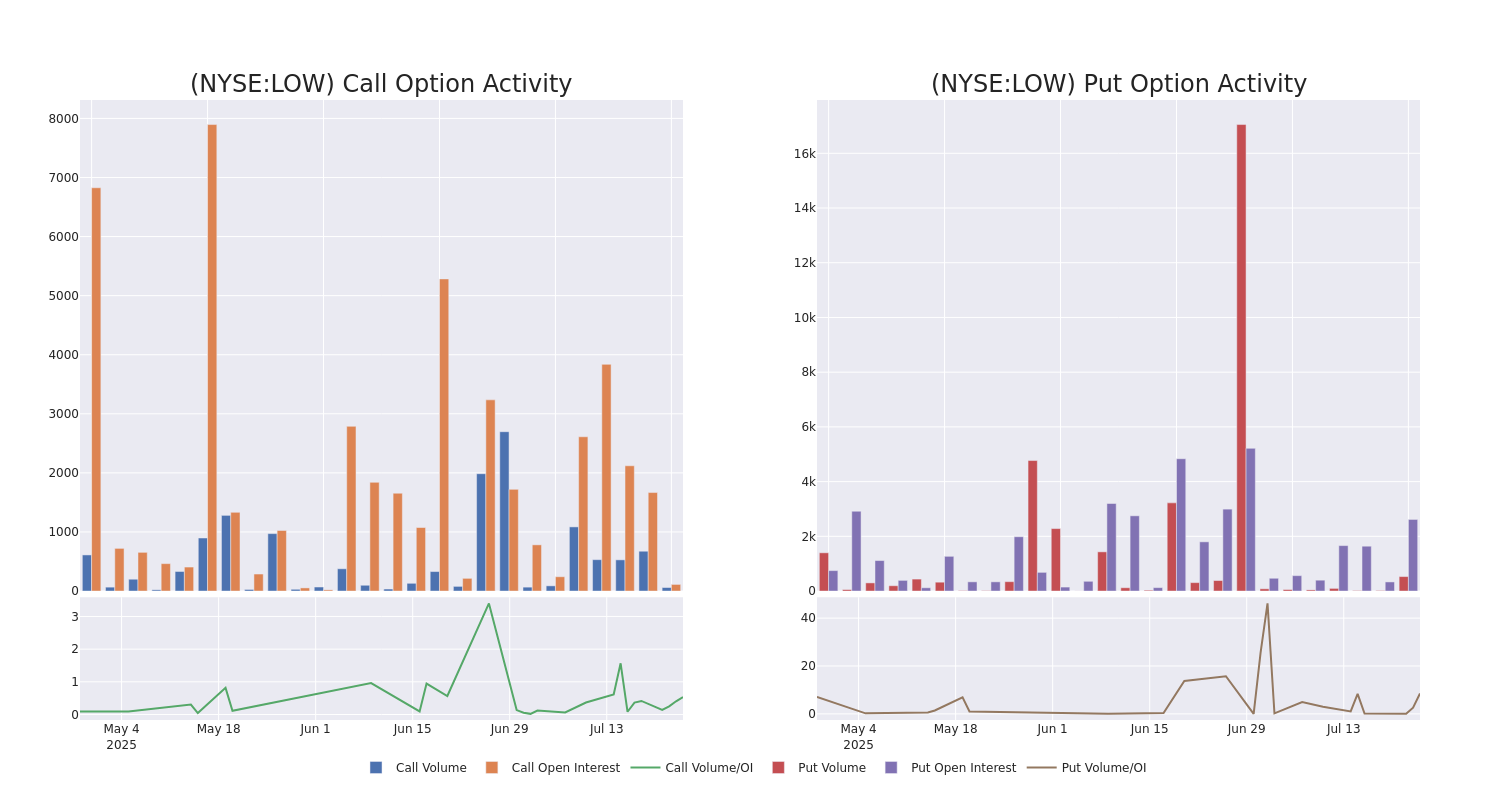

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Lowe's Companies's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Lowe's Companies's significant trades, within a strike price range of $200.0 to $280.0, over the past month.

Lowe's Companies 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LOW | PUT | SWEEP | BULLISH | 08/22/25 | $1.48 | $1.34 | $1.38 | $205.00 | $357.6K | 84 | 2.5K |

| LOW | CALL | SWEEP | BEARISH | 03/20/26 | $14.6 | $14.3 | $14.37 | $240.00 | $97.7K | 93 | 70 |

| LOW | PUT | SWEEP | BEARISH | 09/18/26 | $23.55 | $23.45 | $23.56 | $230.00 | $70.7K | 25 | 44 |

| LOW | CALL | SWEEP | NEUTRAL | 01/16/26 | $27.6 | $27.1 | $27.48 | $210.00 | $54.9K | 445 | 20 |

| LOW | CALL | SWEEP | BULLISH | 09/19/25 | $4.55 | $4.4 | $4.55 | $240.00 | $35.4K | 1.5K | 221 |

About Lowe's Companies

Lowe's is the second-largest home improvement retailer in the world, operating 1,750 stores in the United States, after the 2023 divestiture of its Canadian locations (RONA, Lowe's Canada, Réno-Dépôt, and Dick's Lumber). The firm's stores offer products and services for home decorating, maintenance, repair, and remodeling, with maintenance and repair accounting for two thirds of products sold. Lowe's primarily targets retail do-it-yourself (around 70% of sales) and do-it-for-me customers, but has expanded its commercial and professional business clients to 30% from less than 20% in the past six years. We estimate Lowe's captures a high-single-digit share of the domestic home improvement market, based on US Census data and management's market size estimates.

After a thorough review of the options trading surrounding Lowe's Companies, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Lowe's Companies Standing Right Now?

- With a volume of 1,075,303, the price of LOW is up 0.46% at $226.6.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 25 days.

Professional Analyst Ratings for Lowe's Companies

In the last month, 1 experts released ratings on this stock with an average target price of $300.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from Guggenheim downgraded its rating to Buy, setting a price target of $300.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lowe's Companies with Benzinga Pro for real-time alerts.