This Is What Whales Are Betting On BigBear.ai Hldgs

High-rolling investors have positioned themselves bearish on BigBear.ai Hldgs (NYSE:BBAI), and it's important for retail traders to take note.

\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in BBAI often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 13 options trades for BigBear.ai Hldgs. This is not a typical pattern.

The sentiment among these major traders is split, with 23% bullish and 38% bearish. Among all the options we identified, there was one put, amounting to $27,000, and 12 calls, totaling $717,549.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $0.5 to $10.0 for BigBear.ai Hldgs over the last 3 months.

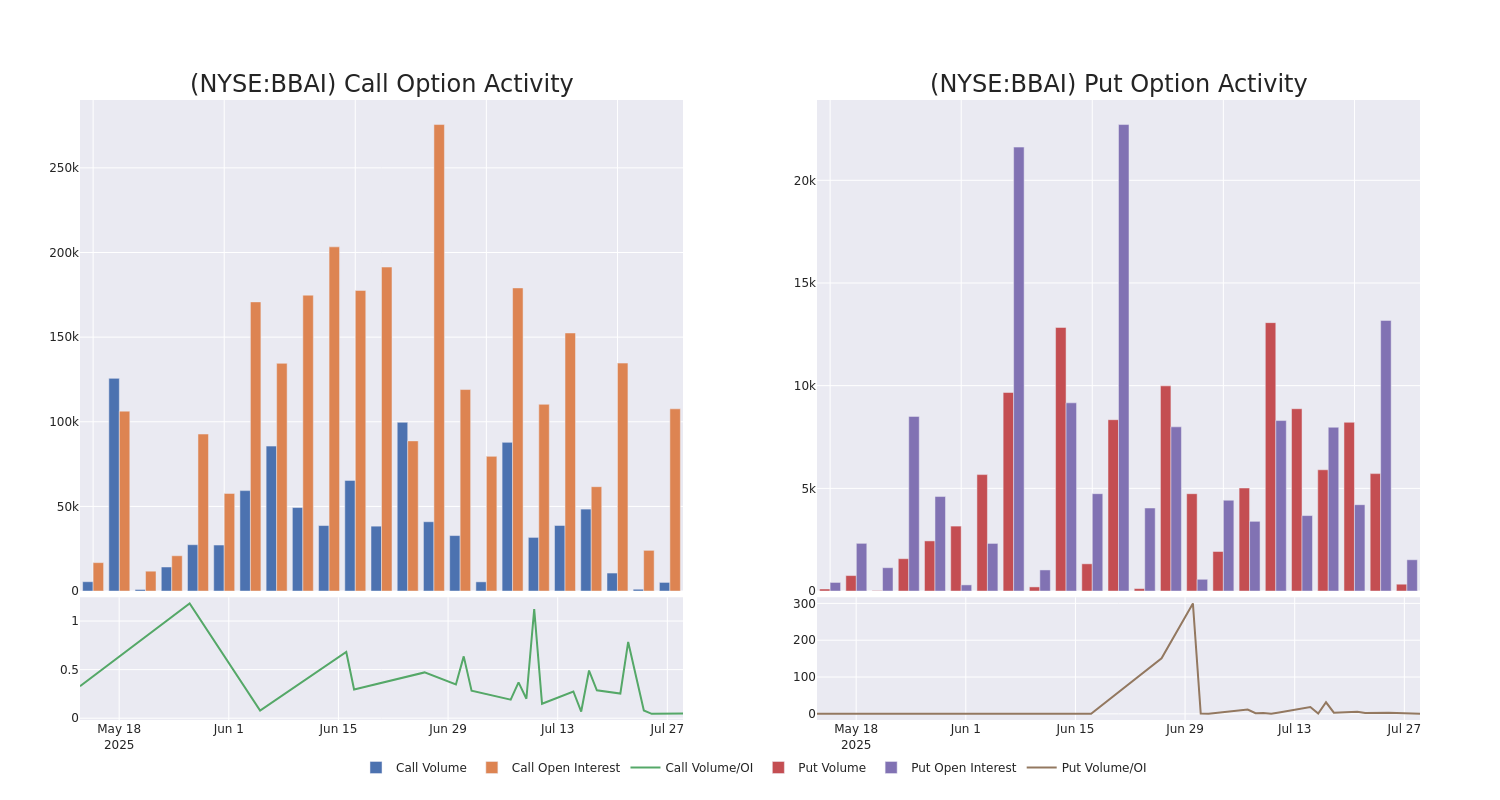

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for BigBear.ai Hldgs options trades today is 10917.0 with a total volume of 5,423.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for BigBear.ai Hldgs's big money trades within a strike price range of $0.5 to $10.0 over the last 30 days.

BigBear.ai Hldgs Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BBAI | CALL | SWEEP | BULLISH | 01/16/26 | $1.35 | $1.3 | $1.35 | $10.00 | $202.5K | 44.2K | 1.8K |

| BBAI | CALL | TRADE | NEUTRAL | 01/16/26 | $2.05 | $1.95 | $2.0 | $7.00 | $100.0K | 24.0K | 635 |

| BBAI | CALL | TRADE | NEUTRAL | 01/15/27 | $6.3 | $6.1 | $6.2 | $0.50 | $62.0K | 1.4K | 112 |

| BBAI | CALL | SWEEP | BEARISH | 01/15/27 | $5.3 | $5.2 | $5.21 | $2.00 | $54.6K | 9.0K | 450 |

| BBAI | CALL | SWEEP | BEARISH | 09/19/25 | $3.9 | $3.8 | $3.8 | $3.00 | $53.2K | 2.1K | 140 |

About BigBear.ai Hldgs

BigBear.ai Holdings Inc is a technology-led solutions organization, that provides both software and services to its customers. Its AI-powered decision intelligence solutions are leveraged in three markets; supply chains & logistics, autonomous systems, and cybersecurity. It operates in two segments; Cyber & Engineering segment and Analytics segment. Company generate revenue by providing customers with Edge AI-powered decision intelligence solutions and services for data ingestion, data enrichment, data processing, artificial intelligence, machine learning, predictive analytics and predictive visualization. It generate revenue from providing both software and services to customers.

Having examined the options trading patterns of BigBear.ai Hldgs, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of BigBear.ai Hldgs

- Trading volume stands at 37,430,707, with BBAI's price down by -6.72%, positioned at $6.67.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 13 days.

Professional Analyst Ratings for BigBear.ai Hldgs

1 market experts have recently issued ratings for this stock, with a consensus target price of $9.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from HC Wainwright & Co. keeps a Buy rating on BigBear.ai Hldgs with a target price of $9.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for BigBear.ai Hldgs, Benzinga Pro gives you real-time options trades alerts.