Palantir Touches New All-Time High Before Fading After Hours: What's Going On?

Shares of Palantir Technologies Inc. (NASDAQ:PLTR) surged to a fresh all-time high, despite there being no company-specific news to lead the session.

Check out the current price of PLTR stock here.

What Happened: The stock rose 3.72% on Wednesday, closing at $154.62, after reaching an all-time high of $155.68. It has since declined 0.39% after hours at the time of writing this. This brings the company’s year-to-date gains to 105.64%, 436% over the past year, and 1,580% over the past five years.

While there were no immediate catalysts that sparked the stock’s rally this week, the company has had a string of good news over the past month that has helped buoy the stock.

This includes a recent contract with NATO, alongside its growing role in government-backed AI initiatives, such as in President Donald Trump’s Project Stargate.

Wedbush Securities analyst Dan Ives believes that Palantir is on the trajectory to become a major enterprise software player, comparing its potential to that of Oracle Corp. (NYSE:ORCL). He said this while raising his target for the stock, from $140 to $160, representing an upside of 3.47% from current levels.

However, analyst consensus for the stock is currently well below the market price at $76.72 per share, with a broad “Sell” rating based on calls by 23 analysts over the past month.

Why It Matters: Investor Martin Shkreli, popularly referred to as “Pharma Bro,” says there is no reason Palantir “can't be a $10 trillion company,” since its total addressable market spans the inefficiencies of all Fortune 500 companies.

He does, however, warn about execution risks, saying that one bad quarter can bring the stock down 50%. Shkreli believes the stock requires “execution to perfection” from management

Recently, BigBear.ai Holdings Inc. (NYSE:BBAI) has been touted as the next Palantir, being an artificial intelligence and analytics play that is focused on defense and government contracts.

The stock is up 92.94% year-to-date and 583% from its 52-week low, which is believed to be only the beginning. Analysts from H.C. Wainwright recently raised their target for the stock, from $6 to $9, representing an upside of 13.49% from current levels.

Price Action: Palantir shares were up 3.72% on Wednesday, trading at $154.62, and are down 0.39% after hours.

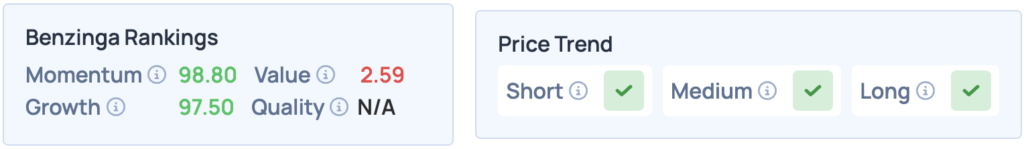

According to Benzinga’s Edge Stock Rankings, Palantir scores high on Momentum and Growth, while having a favorable price trend in the short, medium and long terms. How does it compare with BigBear.ai? Click here to find, along with more facts and insights.

Photo: slyellow / Shutterstock.com

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Why is it movingLarge Cap News After-Hours Center Markets Analyst Ratings Tech