Spotlight on Spotify Technology: Analyzing the Surge in Options Activity

Financial giants have made a conspicuous bearish move on Spotify Technology. Our analysis of options history for Spotify Technology (NYSE:SPOT) revealed 83 unusual trades.

Delving into the details, we found 28% of traders were bullish, while 51% showed bearish tendencies. Out of all the trades we spotted, 41 were puts, with a value of $2,491,840, and 42 were calls, valued at $5,397,469.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $300.0 and $1060.0 for Spotify Technology, spanning the last three months.

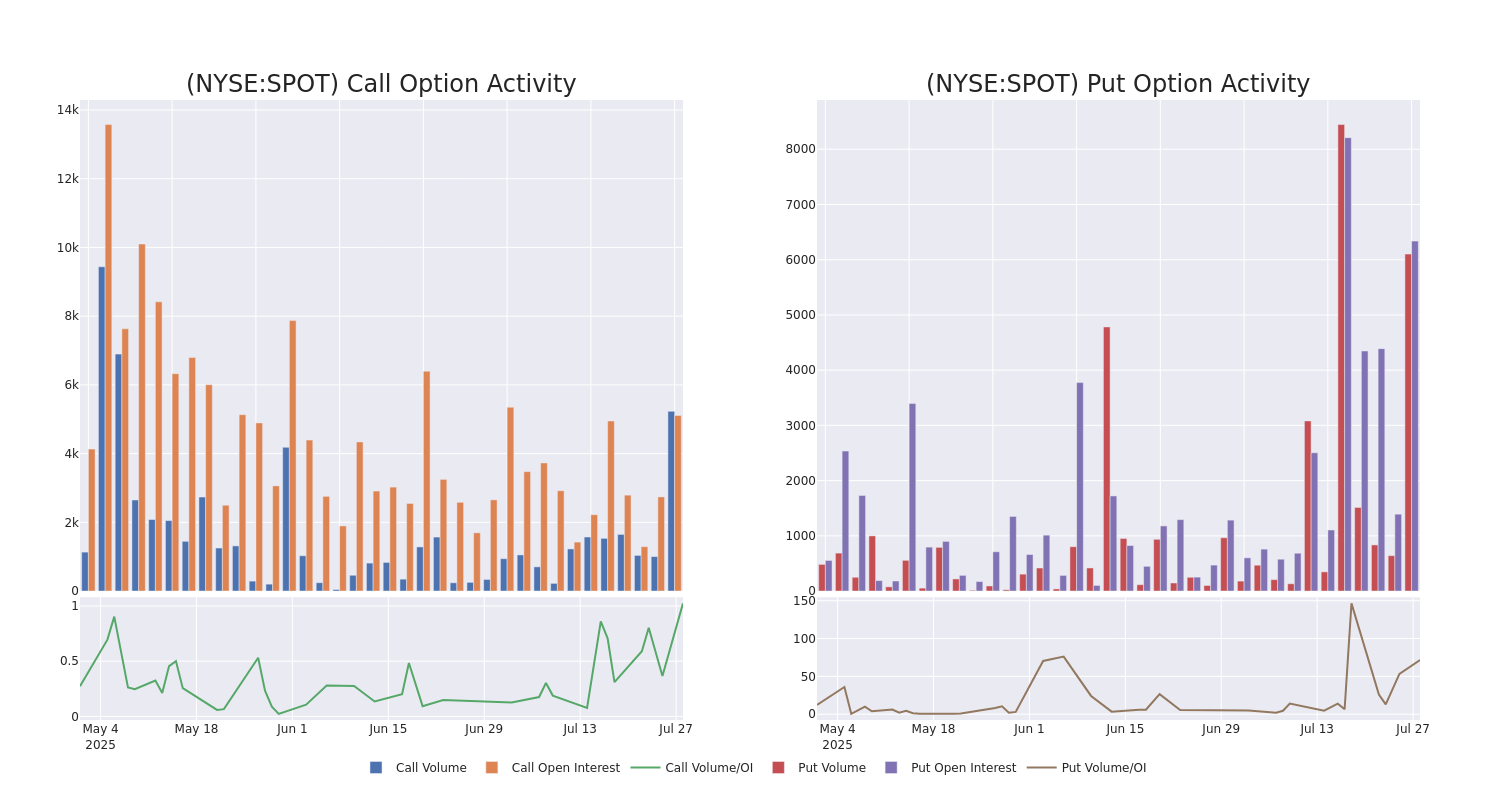

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Spotify Technology's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Spotify Technology's substantial trades, within a strike price spectrum from $300.0 to $1060.0 over the preceding 30 days.

Spotify Technology Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SPOT | CALL | SWEEP | BEARISH | 12/19/25 | $55.55 | $55.5 | $55.5 | $660.00 | $1.1M | 18 | 321 |

| SPOT | CALL | TRADE | BEARISH | 01/16/26 | $77.3 | $72.85 | $72.85 | $640.00 | $699.3K | 86 | 123 |

| SPOT | CALL | SWEEP | BEARISH | 03/20/26 | $74.15 | $72.2 | $72.2 | $680.00 | $555.9K | 105 | 77 |

| SPOT | CALL | SWEEP | BULLISH | 08/15/25 | $14.55 | $13.85 | $14.55 | $650.00 | $419.0K | 104 | 387 |

| SPOT | CALL | SWEEP | BEARISH | 12/19/25 | $57.45 | $55.5 | $55.5 | $660.00 | $288.6K | 18 | 55 |

About Spotify Technology

Spotify is the leading global music streaming service provider, with nearly 700 million monthly active users and over 250 million paying subscribers, with the latter constituting the firm's premium segment. Most of the firm's revenue and nearly all its gross profit come from the subscribers, who pay a monthly fee to access a music library that consists of most of the most popular songs ever recorded, including all from the major record labels. The firm also sells separate audiobook subscriptions and integrates podcasts within its standard music app. Podcast content is not exclusive and is typically free to access on other platforms. Ad-supported users can access a similar music catalog but cannot customize a similar on-demand experience.

Having examined the options trading patterns of Spotify Technology, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Spotify Technology's Current Market Status

- With a volume of 7,364,641, the price of SPOT is down -11.32% at $621.64.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 0 days.

Expert Opinions on Spotify Technology

In the last month, 5 experts released ratings on this stock with an average target price of $836.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Spotify Technology, targeting a price of $850.

* Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for Spotify Technology, targeting a price of $840.

* An analyst from Canaccord Genuity persists with their Buy rating on Spotify Technology, maintaining a target price of $850.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Spotify Technology with a target price of $800.

* An analyst from Bernstein persists with their Outperform rating on Spotify Technology, maintaining a target price of $840.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Spotify Technology options trades with real-time alerts from Benzinga Pro.