Behind the Scenes of C3.ai's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bullish stance on C3.ai.

Looking at options history for C3.ai (NYSE:AI) we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 53% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $87,653 and 11, calls, for a total amount of $587,920.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $50.0 for C3.ai during the past quarter.

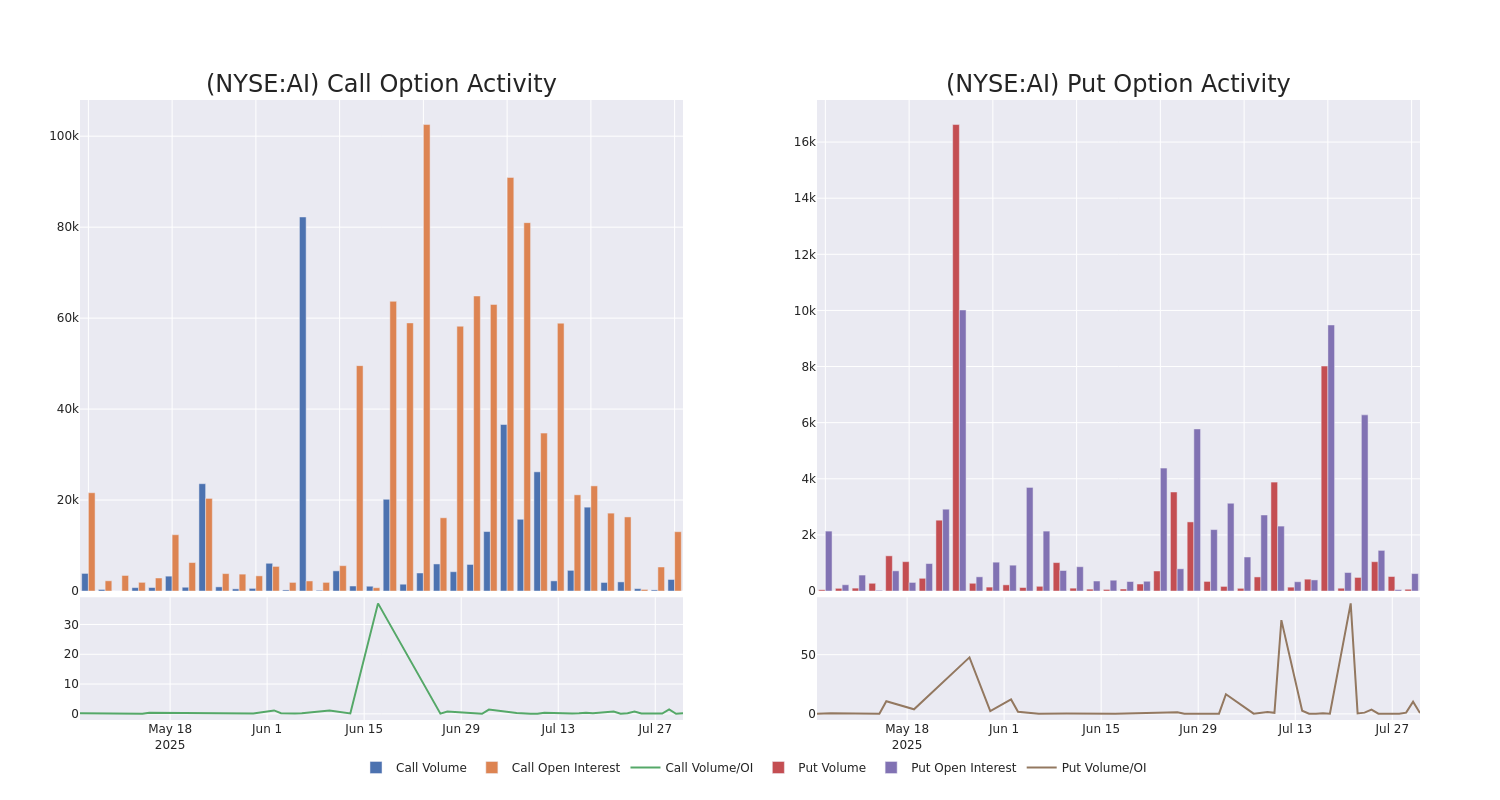

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for C3.ai's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across C3.ai's significant trades, within a strike price range of $20.0 to $50.0, over the past month.

C3.ai Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AI | CALL | TRADE | BULLISH | 01/16/26 | $6.4 | $6.3 | $6.36 | $20.00 | $245.4K | 1.9K | 450 |

| AI | PUT | SWEEP | BULLISH | 08/01/25 | $3.05 | $2.96 | $2.96 | $27.50 | $55.6K | 545 | 14 |

| AI | CALL | SWEEP | BULLISH | 12/17/27 | $9.35 | $9.15 | $9.26 | $25.00 | $46.6K | 225 | 100 |

| AI | CALL | SWEEP | BULLISH | 01/16/26 | $6.4 | $6.3 | $6.38 | $20.00 | $40.2K | 1.9K | 63 |

| AI | CALL | SWEEP | BEARISH | 12/17/27 | $7.9 | $7.7 | $7.7 | $30.00 | $38.5K | 570 | 50 |

About C3.ai

C3.ai Inc is an enterprise artificial intelligence company. The company provides software-as-a-service applications that enable customers to rapidly develop, deploy, and operate large-scale Enterprise AI applications across any infrastructure. It provides solutions under three divisions namely, The C3 AI Platform, which is an end-to-end application development and runtime environment for designing, developing, and deploying AI applications: C3 AI Applications, which is a portfolio of pre-built, extensible, industry-specific, and application-specific Enterprise AI applications: and C3 Generative AI, which combines the utility of large language models. Geographically the company derives revenue from North America, Europe, the Middle East and Africa, Asia Pacific, and the Rest of the World.

Having examined the options trading patterns of C3.ai, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is C3.ai Standing Right Now?

- With a trading volume of 4,349,163, the price of AI is up by 0.7%, reaching $24.39.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 34 days from now.

What Analysts Are Saying About C3.ai

2 market experts have recently issued ratings for this stock, with a consensus target price of $45.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from JMP Securities downgraded its rating to Market Outperform, setting a price target of $50.

* In a cautious move, an analyst from WestPark Capital downgraded its rating to Buy, setting a price target of $40.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for C3.ai, Benzinga Pro gives you real-time options trades alerts.