Behind the Scenes of Rocket Companies's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bearish stance on Rocket Companies.

Looking at options history for Rocket Companies (NYSE:RKT) we detected 15 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $187,007 and 13, calls, for a total amount of $4,101,177.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $12.2 to $21.2 for Rocket Companies over the last 3 months.

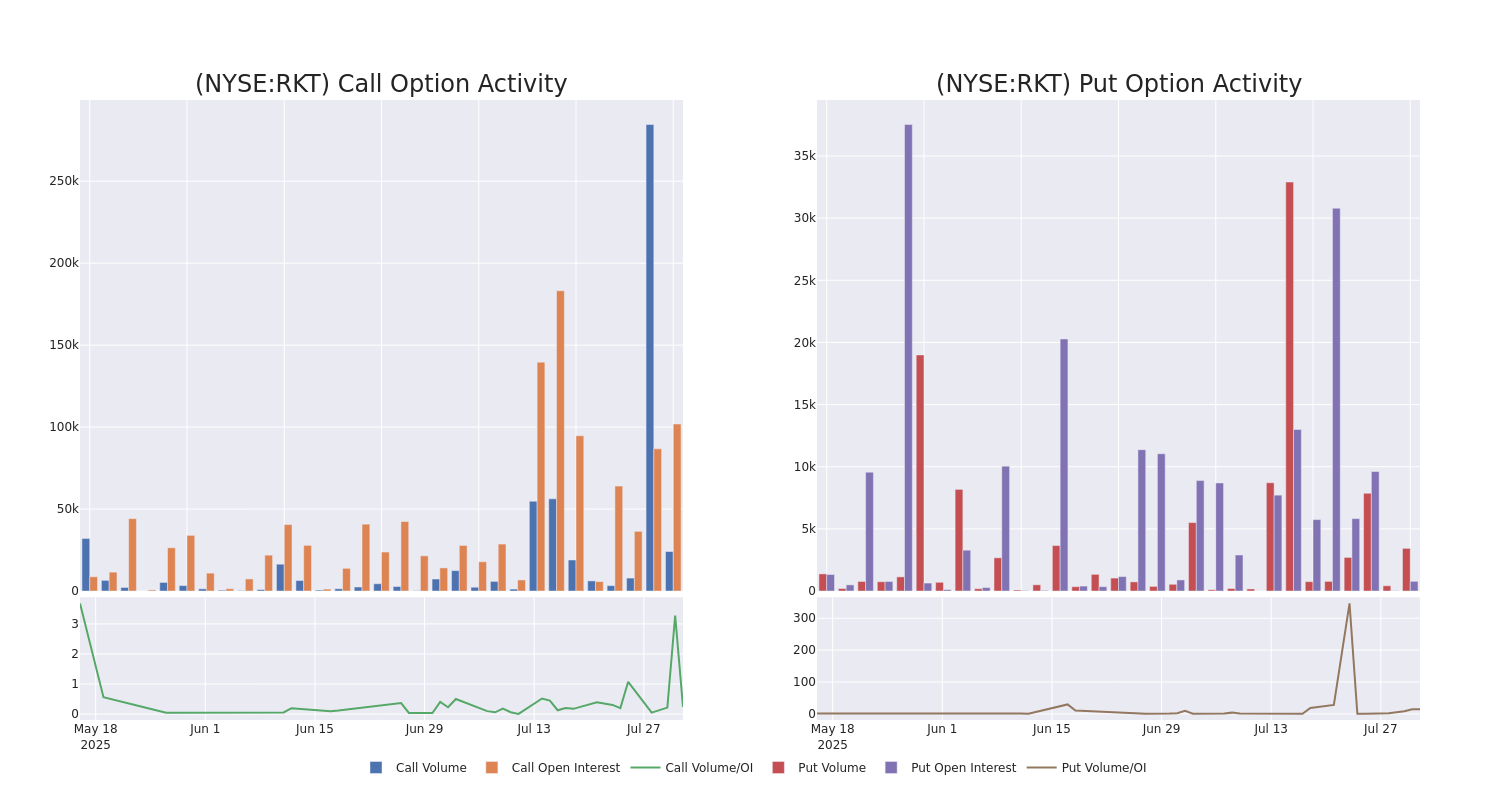

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Rocket Companies's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Rocket Companies's whale trades within a strike price range from $12.2 to $21.2 in the last 30 days.

Rocket Companies Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RKT | CALL | TRADE | BULLISH | 08/01/25 | $1.12 | $0.98 | $1.11 | $15.50 | $3.3M | 37.8K | 5.7K |

| RKT | CALL | SWEEP | BEARISH | 03/20/26 | $3.95 | $3.8 | $3.8 | $15.00 | $288.4K | 21.1K | 6.7K |

| RKT | PUT | TRADE | NEUTRAL | 01/16/26 | $6.05 | $5.75 | $5.88 | $21.20 | $117.6K | 542 | 5 |

| RKT | CALL | SWEEP | BEARISH | 03/20/26 | $3.95 | $3.8 | $3.8 | $15.00 | $114.7K | 21.1K | 3.0K |

| RKT | CALL | SWEEP | BULLISH | 01/15/27 | $5.4 | $5.05 | $5.4 | $14.20 | $75.6K | 5.4K | 23 |

About Rocket Companies

Rocket Companies is a financial services company that was originally founded as Rock Financial in 1985 and is currently based in Detroit. Rocket Companies offers a wide array of services and products but is best known for its Rocket Mortgage business. The company's mortgage lending operations are split between its direct-to-consumer lending, which sees borrowers accessing the company's lending arm directly through either its mobile app or website, and its partner network where mortgage brokers and other firms use Rocket's origination process to offer loans to their customers. The company has rapidly gained market share in recent years and will also be the largest mortgage servicer in the US following its acquisition of the Mr. Cooper Group.

Where Is Rocket Companies Standing Right Now?

- Currently trading with a volume of 39,617,126, the RKT's price is up by 13.85%, now at $16.82.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 102 days.

Expert Opinions on Rocket Companies

3 market experts have recently issued ratings for this stock, with a consensus target price of $14.67.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Keefe, Bruyette & Woods keeps a Market Perform rating on Rocket Companies with a target price of $14.

* An analyst from Barclays persists with their Equal-Weight rating on Rocket Companies, maintaining a target price of $16.

* Maintaining their stance, an analyst from Jefferies continues to hold a Hold rating for Rocket Companies, targeting a price of $14.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Rocket Companies, Benzinga Pro gives you real-time options trades alerts.