Andrew Left Doubles Down On Rocket Companies: 'This Isn't A Meme,' It's A 'Housing Juggernaut' In The Making (CORRECTED)

Editor's Note: This article has been updated to correct the individual’s name in the headline.

Citron Research founder Andrew Left is pushing back hard against the narrative that Rocket Companies Inc. (NYSE:RKT) is another meme stock.

Citron's defense comes just as Rocket launched a $1.25 billion tender offer to repurchase senior notes tied to its pending merger with Mr. Cooper, a move designed to streamline debt and clear regulatory hurdles. The offer includes a $50 early tender premium and underscores the company’s serious positioning as a long-term fintech powerhouse, rather than a short-term trading play.

Check out the current price of RKT stock here.

What Happened: On Monday, in a post on X, Citron Research said there is no way Rocket Companies is a “meme stock,” adding that “Rocket is building the $AMZN of mortgages, a $13 Trillion sector, 70% of all consumer debt.”

The post highlights Rocket's pending merger with Mr. Cooper Group Inc. (NASDAQ:COOP), which Citron described as a transformative move. With these two companies coming together, the post says, the obvious result is “a housing juggernaut.”

See Also: Top 2 Financial Stocks That May Collapse This Month

Citron’s post also cites hedge fund manager Dan Loeb, who came out in support of the deal, calling it “a transformative, synergy-rich merger between two technology leaders in a parochial, cost-inflationary industry.”

The post also points to a recent remark by Rocket’s CEO Varun Krishna during its latest earnings call, when he said the business can 10x using AI, without adding headcount or costs. “That's what a true compounder looks like,” it says.

It also addresses certain macroeconomic concerns, highlighting the fact that Rocket stands to gain irrespective of what the interest rate environment looks like. “Rates fall? It rockets. Rates stay high? It services 1 in 6 U.S. mortgages,” referring to its mortgage servicing rights business, which increases in value during periods of high interest rates.

The post concludes with another rejection of the meme label, saying, “This isn't a meme. This is what a better mousetrap looks like.”

Why It Matters: Citron had referred to Rocket Companies as its “call of the year” all the way back in May, and since then, the stock has rallied 33.86%.

The in-house AI was cited as a key advantage, with Citron calling it, “Salesforce meets Zillow meets TurboTax, but for mortgages.”

RKT Price Action: Rocket Companies shares were up 2.43% at $17.29 at the time of publication on Tuesday, according to Benzinga Pro.

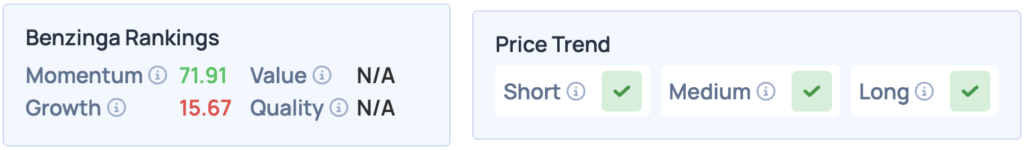

According to Benzinga’s Edge Stock Rankings, Rocket Companies scores high on Momentum, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Equities