Check Out What Whales Are Doing With NCLH

Benzinga's options scanner just detected over 9 options trades for Norwegian Cruise Line (NYSE:NCLH) summing a total amount of $583,322.

At the same time, our algo caught 5 for a total amount of 497,671.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $20.0 to $29.0 for Norwegian Cruise Line over the recent three months.

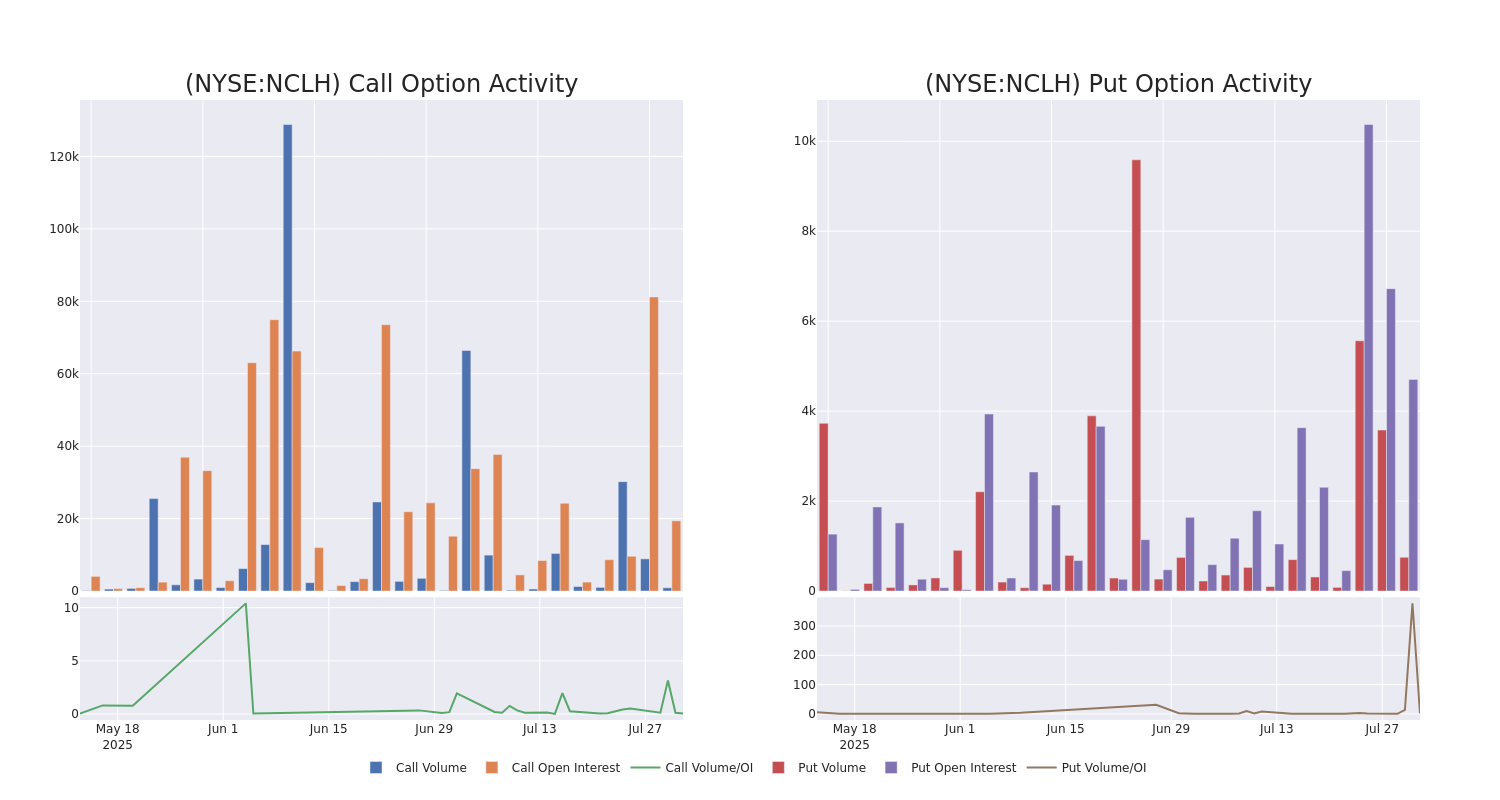

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Norwegian Cruise Line's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Norwegian Cruise Line's significant trades, within a strike price range of $20.0 to $29.0, over the past month.

Norwegian Cruise Line Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NCLH | PUT | SWEEP | BULLISH | 06/18/26 | $3.95 | $3.85 | $3.85 | $25.00 | $288.8K | 1.8K | 560 |

| NCLH | PUT | SWEEP | BEARISH | 03/20/26 | $1.39 | $1.36 | $1.39 | $20.00 | $104.1K | 1.1K | 1 |

| NCLH | CALL | TRADE | BULLISH | 03/20/26 | $3.35 | $3.3 | $3.35 | $25.00 | $71.3K | 700 | 22 |

| NCLH | CALL | SWEEP | BULLISH | 09/19/25 | $0.68 | $0.65 | $0.68 | $26.00 | $54.4K | 14.1K | 304 |

| NCLH | PUT | SWEEP | BULLISH | 12/18/26 | $2.66 | $2.52 | $2.53 | $20.00 | $50.4K | 867 | 0 |

About Norwegian Cruise Line

Norwegian Cruise Line is the world's third-largest publicly traded cruise company by berths (around 70,000). It operates 33 ships across three brands—Norwegian, Oceania, and Regent Seven Seas—offering both freestyle and luxury cruising. The company redeployed its entire fleet as of May 2022. With 12 passenger vessels on order among its brands through 2036, representing 37,500 incremental berths, Norwegian is increasing capacity faster than its peers, expanding its brand globally. Norwegian sails to around 700 global destinations.

Having examined the options trading patterns of Norwegian Cruise Line, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Norwegian Cruise Line

- Currently trading with a volume of 16,586,658, the NCLH's price is down by -1.76%, now at $25.11.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 90 days.

Expert Opinions on Norwegian Cruise Line

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $29.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from TD Cowen has revised its rating downward to Buy, adjusting the price target to $31.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Norwegian Cruise Line with a target price of $31.

* An analyst from Mizuho has decided to maintain their Outperform rating on Norwegian Cruise Line, which currently sits at a price target of $29.

* An analyst from Susquehanna persists with their Neutral rating on Norwegian Cruise Line, maintaining a target price of $25.

* Maintaining their stance, an analyst from Jefferies continues to hold a Buy rating for Norwegian Cruise Line, targeting a price of $29.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Norwegian Cruise Line, Benzinga Pro gives you real-time options trades alerts.