Smart Money Is Betting Big In ORCL Options

Investors with a lot of money to spend have taken a bearish stance on Oracle (NYSE:ORCL).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ORCL, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 19 uncommon options trades for Oracle.

This isn't normal.

The overall sentiment of these big-money traders is split between 31% bullish and 47%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $608,850, and 15 are calls, for a total amount of $727,688.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $280.0 for Oracle over the recent three months.

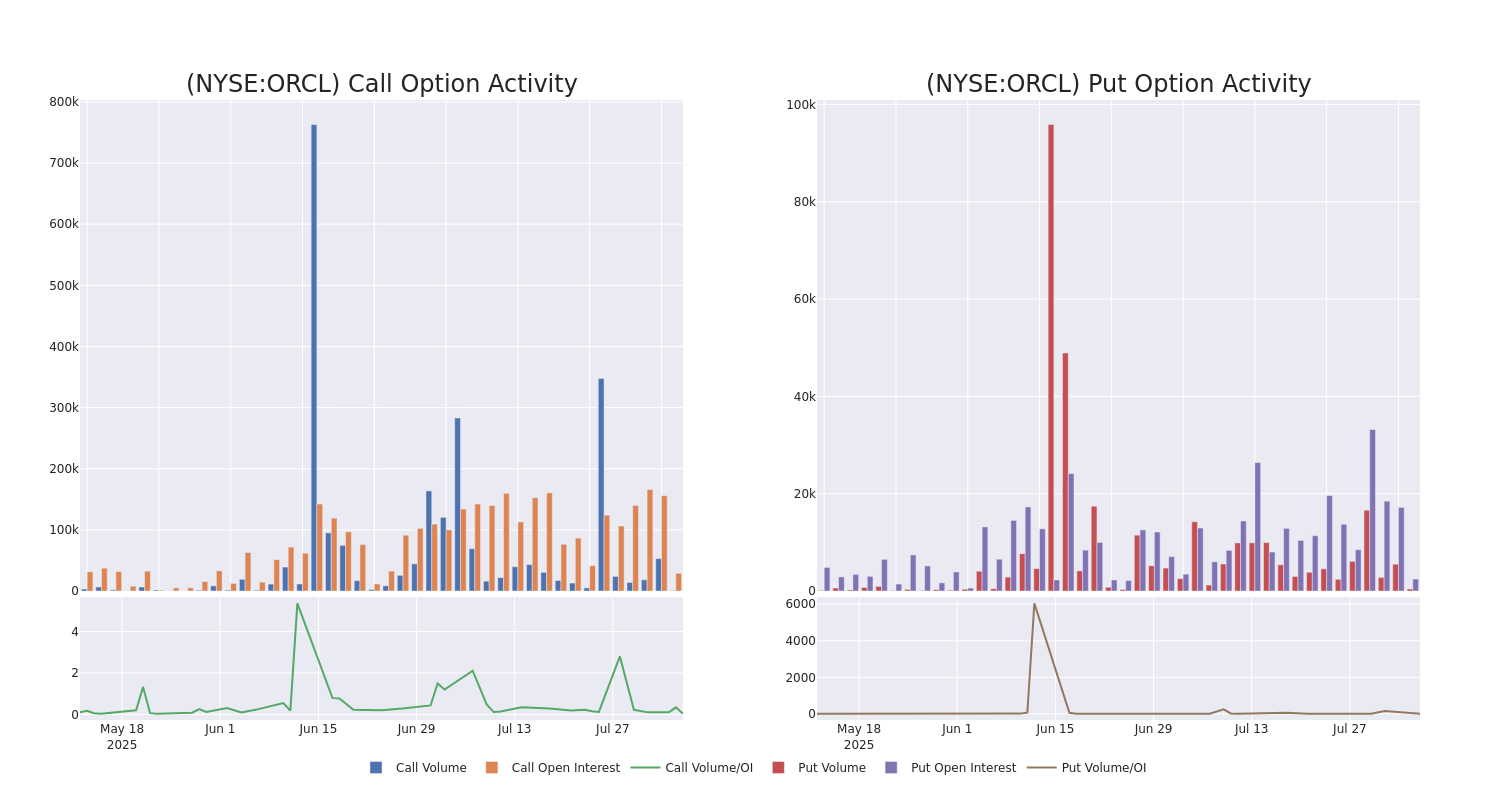

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Oracle's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Oracle's substantial trades, within a strike price spectrum from $150.0 to $280.0 over the preceding 30 days.

Oracle Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | PUT | TRADE | BULLISH | 01/15/27 | $10.5 | $7.5 | $7.8 | $150.00 | $312.0K | 744 | 400 |

| ORCL | PUT | SWEEP | BEARISH | 01/16/26 | $16.3 | $16.15 | $16.3 | $230.00 | $179.3K | 1.4K | 8 |

| ORCL | CALL | TRADE | BEARISH | 09/19/25 | $47.7 | $47.25 | $47.3 | $210.00 | $141.9K | 2.9K | 39 |

| ORCL | PUT | TRADE | BEARISH | 06/17/27 | $20.5 | $19.65 | $20.5 | $190.00 | $92.2K | 184 | 0 |

| ORCL | CALL | SWEEP | NEUTRAL | 08/08/25 | $7.8 | $7.5 | $7.66 | $247.50 | $76.6K | 734 | 101 |

About Oracle

Oracle provides enterprise applications and infrastructure offerings around the world through a variety of flexible IT deployment models, including on-premises, cloud-based, and hybrid. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system, which is commonly used for running online transaction processing and data warehousing workloads. Besides database systems, Oracle also sells enterprise resource planning, or ERP, customer relationship management, or CRM, and human capital management, or HCM, applications. Today, Oracle has more than 159,000 full-time employees in over 170 countries.

Having examined the options trading patterns of Oracle, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Oracle Standing Right Now?

- Currently trading with a volume of 2,498,448, the ORCL's price is up by 0.22%, now at $256.23.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 33 days.

What The Experts Say On Oracle

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $290.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from B of A Securities persists with their Neutral rating on Oracle, maintaining a target price of $295.

* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Oracle, targeting a price of $270.

* An analyst from JMP Securities has decided to maintain their Market Outperform rating on Oracle, which currently sits at a price target of $315.

* An analyst from Scotiabank downgraded its action to Sector Outperform with a price target of $300.

* An analyst from Piper Sandler upgraded its action to Overweight with a price target of $270.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Oracle, Benzinga Pro gives you real-time options trades alerts.