Behind the Scenes of Caterpillar's Latest Options Trends

Investors with a lot of money to spend have taken a bearish stance on Caterpillar (NYSE:CAT).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CAT, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 17 uncommon options trades for Caterpillar.

This isn't normal.

The overall sentiment of these big-money traders is split between 35% bullish and 58%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $502,802, and 8 are calls, for a total amount of $433,380.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $320.0 to $460.0 for Caterpillar over the last 3 months.

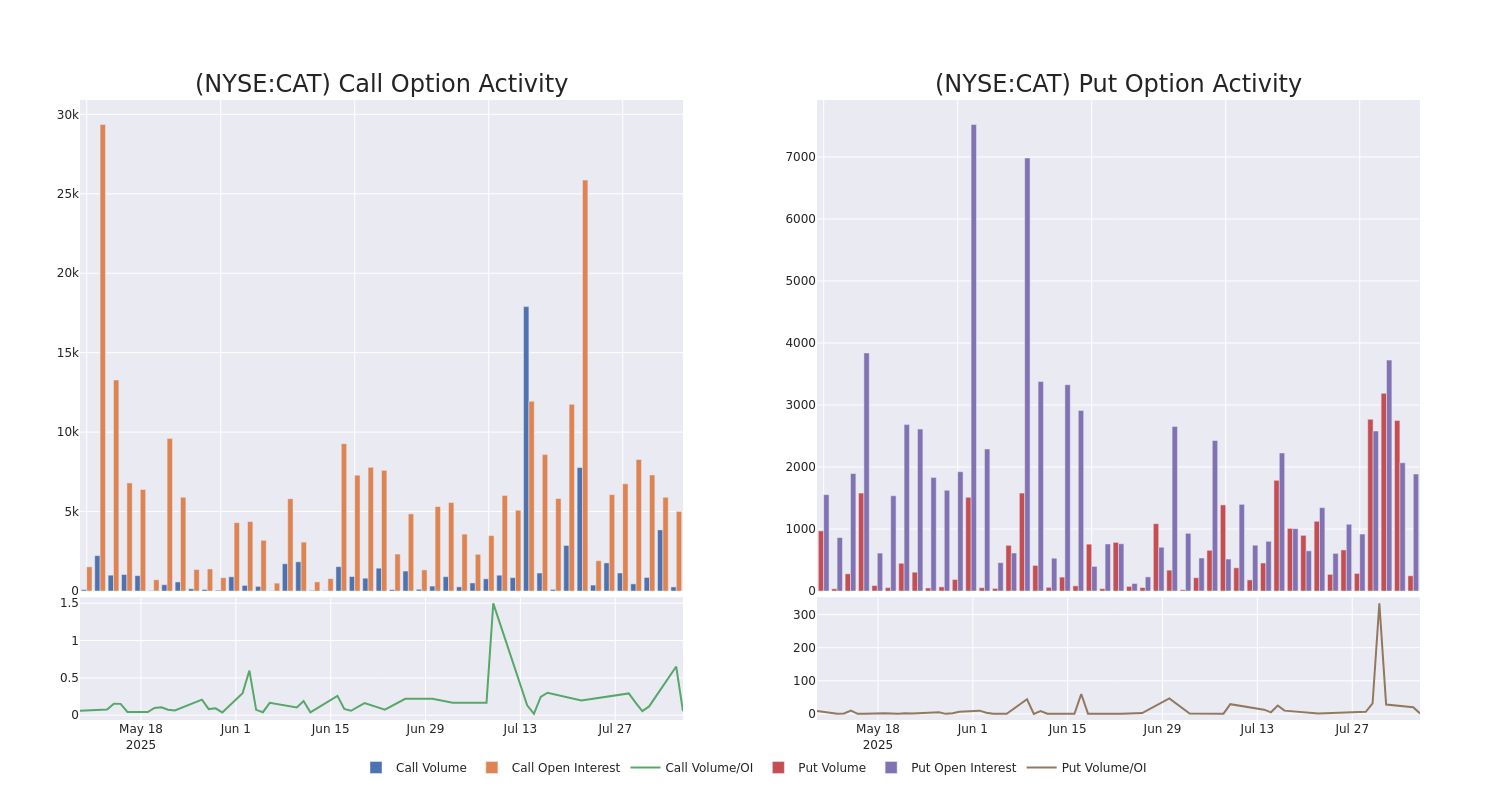

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Caterpillar options trades today is 492.64 with a total volume of 503.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Caterpillar's big money trades within a strike price range of $320.0 to $460.0 over the last 30 days.

Caterpillar Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | CALL | TRADE | BULLISH | 09/19/25 | $12.0 | $11.4 | $12.0 | $440.00 | $120.0K | 991 | 0 |

| CAT | PUT | SWEEP | BEARISH | 10/17/25 | $26.9 | $26.7 | $26.7 | $450.00 | $112.9K | 476 | 40 |

| CAT | PUT | SWEEP | BEARISH | 10/17/25 | $26.5 | $25.8 | $26.5 | $450.00 | $103.3K | 476 | 40 |

| CAT | CALL | TRADE | BULLISH | 01/16/26 | $32.35 | $31.4 | $32.1 | $430.00 | $73.8K | 844 | 41 |

| CAT | CALL | TRADE | BEARISH | 08/08/25 | $4.2 | $3.15 | $3.15 | $432.50 | $72.4K | 141 | 2 |

About Caterpillar

Caterpillar is the world's leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. Its reporting segments are: construction industries (40% sales/47% operating profit, or OP), resource industries (20% sales/19% OP), and energy & transportation (40% sales/34% OP). Market share approaches 20% across many products. Caterpillar operates a captive finance subsidiary to facilitate sales. The firm has global reach (46% US sales/54% ex-US). Construction skews more domestic, while the other divisions are more geographically diversified. An independent network of 156 dealers operates approximately 2,800 facilities, giving Caterpillar reach into about 190 countries for sales and support services.

Present Market Standing of Caterpillar

- With a volume of 1,272,150, the price of CAT is down -0.47% at $432.17.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 84 days.

What The Experts Say On Caterpillar

5 market experts have recently issued ratings for this stock, with a consensus target price of $437.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Oppenheimer persists with their Outperform rating on Caterpillar, maintaining a target price of $483.

* Maintaining their stance, an analyst from DA Davidson continues to hold a Neutral rating for Caterpillar, targeting a price of $388.

* An analyst from Barclays persists with their Equal-Weight rating on Caterpillar, maintaining a target price of $425.

* An analyst from Barclays persists with their Equal-Weight rating on Caterpillar, maintaining a target price of $383.

* An analyst from Truist Securities has decided to maintain their Buy rating on Caterpillar, which currently sits at a price target of $507.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Caterpillar, Benzinga Pro gives you real-time options trades alerts.