What's Going On With Intel Stock On Friday?

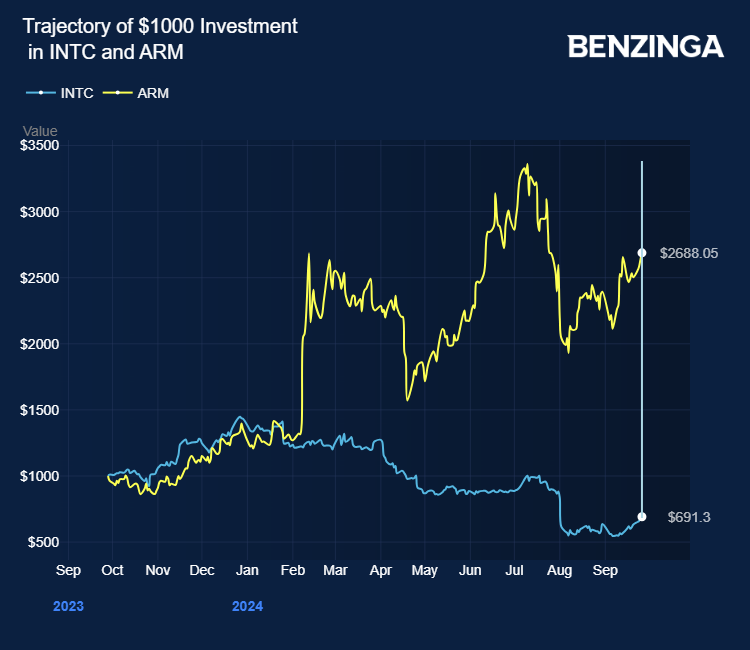

Struggling chipmaker Intel Corp (NASDAQ:INTC) continues to receive takeover proposals from chip companies, the latest being Arm Holdings Plc (NASDAQ:ARM) following Qualcomm Inc‘s (NASDAQ:QCOM) proposal earlier.

Arm Holdings recently proposed to acquire Intel’s product unit. However, Bloomberg reports that Intel is not looking to sell the business division.

Intel stock plunged 31% as it failed to capitalize on the artificial intelligence shift, which is something that contract chipmaker Taiwan Semiconductor Manufacturing Co (NYSE:TSM) excelled at.

Also Read: Super Micro Unveils Next-Gen Servers Powered by Intel’s Latest Xeon Chips

Meanwhile, some reports indicated Intel’s plans to convert its foundry business into an independent unit, including exploring a spinoff into a publicly traded company. The chipmaker also explored divesting stake in the programmable chip unit Altera.

However, Intel’s recent big wins included a U.S. chipmaking deal from Amazon.Com Inc’s (NASDAQ:AMZN) Amazon Web services and the U.S. Chip grant.

The chipmaker also clarified that it would not divest a majority stake in the struggling Israeli autonomous driving company Mobileye Global Inc (NASDAQ:MBLY), whose stock is down 66% in the last 12 months.

Intel’s exploration of stake sales to companies like Qualcomm and Arm could hinder its U.S. subsidy over antitrust grounds, the Financial Times reports.

Multiple deals including Nvidia’s proposal to snap Arm Holdings from Softbank Group Corp (OTC:SFTBF) (OTC:SFTBY) and Intel’s Tower Semiconductor (NASDAQ:TSEM) deal have succumbed to global regulatory opposition.

The semiconductor sector had a good week, buoyed by the key rate cuts in the U.S. and China, an upbeat quarterly print from Micron Technology, Inc (NASDAQ:MU), and continued AI investments from Big Tech companies.

Semiconductor ETFs, Invesco Semiconductors ETF (NYSE:PSI) and SPDR S&P Semiconductor ETF (NYSE:XSD), gained 5%- 7% in the last five days.

Price Action: INTC stock is down 0.04% at $23.91 at the last check on Friday.

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Briefs BZ Data Project Stock BattlesM&A News Top Stories Tech Media