Profit Potential For A News Trade Setup In Both Directions

The Institute for Supply Management will release results from the latest survey of purchasing managers. Traders watch the Purchasing Manager’s Index (PMI) for indications of economic health. These managers have to react quickly and stay on top of current business conditions to keep their companies relevant in the competitive marketplace. The PMI will be released Monday April 3, at 10:00 AM ET, offering a trade opportunity using a high probability strategy.

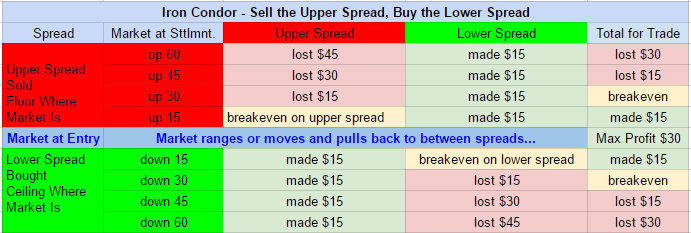

Based on previous releases and market reaction, an Iron Condor, ready to profit on a pull back to the market’s initial reaction move, makes for just such a strategy. The setup includes two Nadex EUR/USD spreads both of which should have a profit potential of $15 or more for a combined profit potential of $30.

To profit on a pull back, one spread could be bought below the market with the ceiling where the market is trading at the time and one spread could be sold above the market with the floor where the market is trading at the time. Each spread then has the potential to profit should the market make a pull back and return from an initial move in reaction to the news released.

What if the market doesn’t pull back though and it just makes a move to a new level and remains there? Then stops are in place to ensure risk is kept in check. For this trade with a profit potential of $30, stops should be placed where the market would reach 60 pips above and below from where it was at entry. At 60 pips, one side will have profited the full $15 but the other side will have lost $45 for a loss of $30, which would keep risk reward to a 1:1 ratio.

For a more in depth look at the profit and loss potential for this trade, see the chart below.

Entry for this news trade can be as early as 9:00 AM ET for spreads expiring at 11:00 AM ET. As time expires on this trade and when the market pulls back, the closer it gets to where it was at entry, right between the two spreads, the greater the profit made. Max profit is achieved when the market returns to center.

A complete calendar of trade events and free day trading education, along with free access to the spread scanner can be found on www.apexinvesting.com.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Binary Options Education Eurozone Futures Commodities Options Forex Markets