Natural Gas Market Outlook: Stable Surface, Structural Strain

Natural gas prices are largely aligned with historical norms, with the Q contract nearing its 15-year median as expiration approaches and summer-autumn 2025 contracts trading slightly above median levels but within the interquartile range. In contrast, winter 2026–27 contracts remain firmly above the upper quartile, pointing to persistent long-term risk pricing. Despite some normalization in 3-year forward pricing, the curve continues to show significant distortions at both short- and long-term horizons. On the fundamentals side, storage is projected to grow by +33 BCF in mid-July, with levels tracking well above the 5-year median. Weather-driven demand has begun to ease nationally, though regional deviations remain (especially in the Central and Mountain areas), highlighting the importance of localized heat trends in shaping market sentiment.

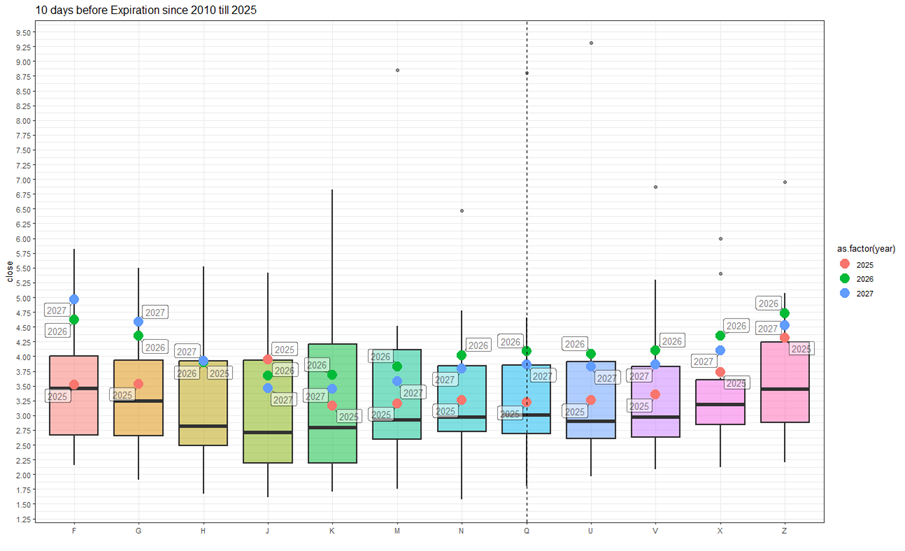

Current gas prices compared to price dispersion 10 days before expiration by month since 2010

The expiration of contract Q is approaching. Its price is close to the median value for 15 years on the expiration date. We expect high volatility in the near and next contract U. The prices of the next contracts have not changed significantly. The 2025 fall contracts are trading slightly above the median values on the expiration date, while remaining within the interquartile range. The 2026 and 2027 winter contracts continue to be above the upper quartile.

Forward curve compared to 2020-2024

Despite the fact that prices for 2025 contracts with delivery in three years have approached the levels of similar contracts for 2023 and 2024, there remains a pronounced skew in the forward curve in segments with the nearest (1–2 years) and most distant (5–6 years) deliveries.

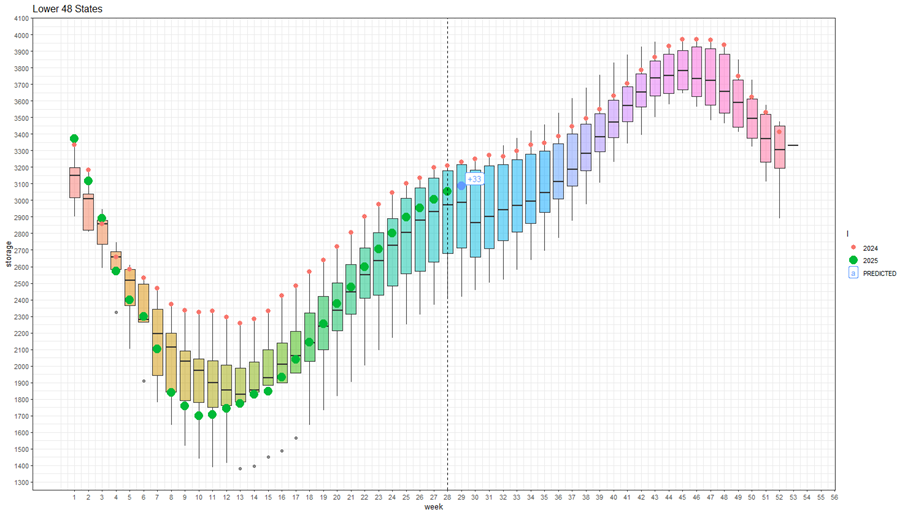

Current stocks and forecast for next week compared to 2019-2024

For week 29 (July 14-20), we expect an increase in storage of 33 BCF. The fill rate remains firmly above the median for the previous five years. Injection rates are maintaining positive momentum. If the current supply and demand conditions remain unchanged, peak levels similar to those seen in 2024 are possible. Weather and seasonal phenomena in the second half of summer and early fall remain a limiting factor.

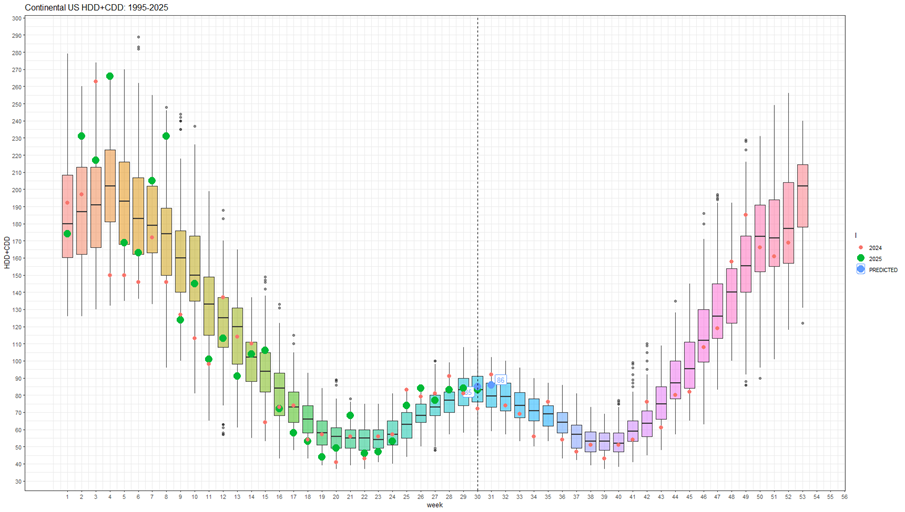

Weekly HDD+CDD total based on current NOAA data and forecast for the next two weeks compared to 1994-2024

In the current 30th week, despite expectations of HDD+CDD growth, the weather stabilized and reached the 30-year median. The following week (31) is forecast to be slightly above the median. The seasonal peak in weather has practically passed, and a decrease in HDD+CDD values is expected going forward.

Explanation of the graph: the candles represent quantiles for 30 years from 1994 to 2024. Red dots represent 2024, green dots represent 2025, and blue dots represent the 2025 forecast.

Weekly HDD+CDD totals based on current NOAA data and forecasts for the next two weeks compared to 1994-2024 by region

Looking at the regional breakdown, we see a sharp decline in HDD+CDD in week 30 in the MOUNTAIN and PACIFIC regions and a slight excess of the upper quantile in the Central regions. The remaining regions are within the interquartile range in weeks 30-31.

Weekly total difference between supply and demand compared to 2014-2024

In the current 30th week, the difference between supply and demand fell below the median. This was mainly due to a decline in exports to Mexico and continued production growth. Liquefied natural gas exports remained stable.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributors Expert IdeasCommodities Opinion Trading Ideas