Larry Ellison Says 'Most Of The World's Valuable Data' Is In Oracle As AI Demand Skyrockets

Enterprise cloud giant, Oracle Corp. (NYSE:ORCL), highlighted its strategic edge in the intensifying global AI race, something that allows it to successfully compete against the giants of this space.

What Happened: During its fourth quarter earnings results on Wednesday, Oracle’s Chairman, Larry Ellison, emphasized the company’s competitive strength in its deep integration inside enterprise data architecture.

“Most of the world's valuable data is stored in an Oracle database,” Ellison said, pointing out that these systems are now being transitioned to public cloud platforms. “All of those databases are moving to the cloud, Oracle's cloud, Microsoft's Azure cloud, Amazon's cloud, or Google's cloud.”

The comment reinforces Oracle's positioning, not just as a cloud vendor, but as a foundational data layer for enterprise AI, regardless of where customers choose to host their infrastructure.

At the core of Oracle's AI strategy is its new flagship product, Oracle Database 23AI, which Ellison described as “an AI-centric piece of technology.” The platform is built to integrate enterprise data directly with leading large language models (LLMs), such as ChatGPT and Grok.

Ellison explained that Oracle's database and applications are designed to consolidate enterprise data and make it accessible to today's leading AI models. “Our database takes all of your data,” he said, adding that customers can use models like ChatGPT or Grok “in the Oracle Cloud” to work with their own data securely and at scale.

Underscoring the level of demand it is now seeing for its cloud infrastructure solutions, the company’s CEO, Safra Catz’s said that they are now turning customers away, or scheduling them into the future when they have “enough supply to meet demand.”

Ellison reiterated the same, saying that “the demand continues to outstrip supply," and that “he’s never seen anything remotely like this.”

Why It Matters: The company released its fourth quarter results on Wednesday, reporting $15.9 billion in revenue, compared to $14.29 billion a year ago, and ahead of consensus estimates at $15.58 billion.

Oracle posted a profit of $1.70 per share, beating estimates at $1.64, driven by strong performance in its Oracle Cloud Infrastructure (OCI) business, with $3 billion in revenue, an increase of 52% year-over-year.

“We expect OCI consumption revenue to grow even faster in FY26. OCI revenue growth rates are skyrocketing, so is demand,” Ellison said.

Price Action: Shares of Oracle were down 0.62% on Wednesday, trading at $176.38, but they popped 7.58% after hours following the company’s fourth quarter results.

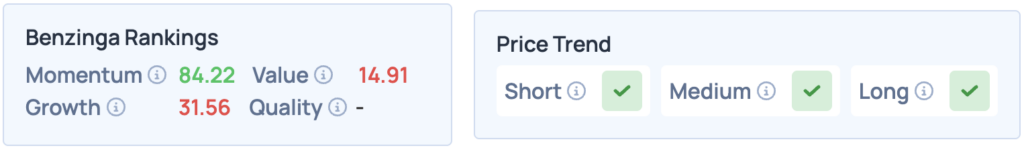

According to Benzinga’s Edge Stock Rankings, Oracle shares score high on Momentum, but lag on other metrics. They have a favorable price trend in the short, medium, and long term. Let’s see how it compares with its peers and competitors in cloud computing and AI.

Read More:

Photo courtesy: drserg / Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Larry Ellison Oracle Database 23AI Safra CatzEquities News Markets