Northrop Grumman Eyes 'Multi-Billion Dollar Opportunities' In Middle East Air Defense, Europe Amid Regional Instability

Northrop Grumman Corp. (NYSE:NOC), a key player in the aerospace and defense sector, is strategically positioned to capitalize on burgeoning international demand, particularly in the Middle East and Europe, fueled by escalating regional instability.

Check out the current price of NOC stock here.

What Happened: This was a key takeaway from the company’s robust second-quarter 2025 earnings call, which saw the defense giant surpass revenue and earnings forecasts.

The company reported a significant 18% year-over-year growth in international sales, reflecting a global environment of increased defense spending. CEO Kathy Warden highlighted the breadth and depth of the company's portfolio and its ability to “respond with speed to our customers' needs.”

She emphasized, “The U.S. and our allies are making significant investments in defense capabilities, and we continue to see growing demand and opportunity for our broad range of product offerings.”

Warden specifically pointed to the Middle East as a region ripe with potential. “In The Middle East, where I joined the President [Donald Trump] in May, there are several multi-billion dollar opportunities in integrated air and missile defense, munitions, E-2D, ARGEM ER, and ground based radars,” she stated.

Europe, too, is experiencing a “generational shift in defense spending,” with NATO countries committed to increasing their defense expenditures, providing a basis for “strong awards and sales growth” for Northrop Grumman across weapon systems and integrated air and missile defense solutions.

The company’s strategic investments in production capacity, such as doubling solid rocket motor output by 2029, underpin its ability to meet this rising global demand. Warden reiterated, “Speed of bringing technology to market is important in this environment, and capacity is an important enabler to rapidly fielding capability.”

Why It Matters: Northrop Grumman reported second-quarter revenue of $10.35 billion, beating analyst estimates of $10.11 billion and adjusted earnings of $7.11 per share, beating estimates of $6.76 per share.

It revised the 2025 revenue guidance from a range of $42 billion to $42.5 billion to a new range of $42.05 billion to $42.25 billion. Analysts forecast full-year revenue of $42.11 billion.

The company also raised its 2025 adjusted earnings guidance from a range of $24.95 to $25.35 per share to a new range of $25 to $25.40 per share. Analysts forecast earnings of $25.21 per share.

Price Action: Shares of NOC rose 9.41% on Tuesday. The stock was up 20.47% year-to-date and 27.47% over the past year.

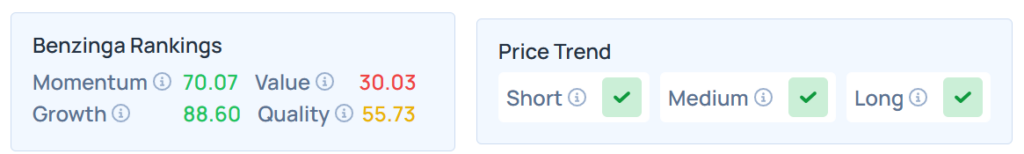

Benzinga Edge Stock Rankings shows that NOC had a stronger price trend over the short, medium, and long term. Its momentum ranking was good, and its value ranking was poor at the 30.03th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended on a mixed note on Tuesday. The SPY was up 0.014% at $628.86, while the QQQ declined 0.52% to $561.25, according to Benzinga Pro data.

On Wednesday, the futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were trading higher.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Ian Dewar Photography / Shutterstock.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: News