IBM's 'Client Zero' AI Strategy To Deliver $4.5 Billion In Annual Savings — CEO Says 'Reimagining And Reinventing How We Run Our Company'

Tech giant IBM (NYSE:IBM) is aggressively deploying its own AI and automation tools across its operations, unlocking billions in savings and productivity gains, while reshaping how the company functions internally.

What Happened: During its second quarter results on Wednesday, IBM’s CFO, James Kavanaugh, said that the company now expects to achieve approximately $4.5 billion in annual run-rate productivity savings by the end of 2025, up from $3.5 billion at the end of 2024.

IBM credits this to its internal adoption of AI and automation, as part of its “Client Zero” model, which involves implementing its tech stack across business units to test scale, functionality and impact before rolling it out to customers.

Kavanaugh said these initiatives have become a “flywheel” that is already driving financial results. “Our productivity initiatives create a flywheel that allows us to invest back in our business, both organically and inorganically, increase our financial flexibility, and deliver margin expansion.”

“We are transforming our enterprise operations using technology and embedding AI across more than 70 workflows,” the company’s CEO, Arvind Krishna, said during the call.

He further adds that, “we are seeing extreme penetration around that [AI workflows], and that's given us guidance and confidence… about reimagining and reinventing how we run our company.”

Why It Matters: Last month, senior analyst Dan Ives referred to both Oracle Corp. (NYSE:ORCL) and IBM as the new Microsoft Corp. (NASDAQ:MSFT), referring to them as “catch-up trades.”

“I kind of view IBM and Oracle similar to how I viewed Microsoft in mid-2023,” Ives said, adding that the broader AI tailwind is far from priced in.

IBM released its second-quarter results on Wednesday, reporting $16.97 billion in revenue, beating consensus estimates of $16.57 billion. Earnings during the quarter stood at $2.80 per share, ahead of estimates at $2.64.

Price Action: Shares of IBM were up 0.01% on Wednesday, trading at $282, and are down 5.16% after hours, following the company’s earnings announcement.

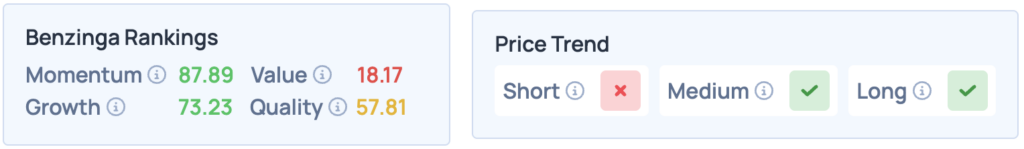

Shares of IBM show strong Growth and Momentum according to Benzinga’s Edge Stock Rankings, with a favorable price trend in the medium and long terms. Click here for deeper insights into the stock and to see how it compares with peers and competitors.

Read More:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Earnings