Rigetti Computing, Netflix, Johnson & Johnson, United Airlines And ASML: Why These 5 Stocks Are On Investors' Radars Today

U.S. stocks moved higher today, with the Dow Jones gaining more than 200 points, or 0.5%, to close at 44,254.78. The Nasdaq added 0.25% to finish at 20,730.49, while the S&P 500 advanced 0.3% to 6,263.70.

These are the top stocks that gained the attention of retail traders and investors throughout the day.

Rigetti Computing, Inc. (NASDAQ:RGTI)

Rigetti Computing’s stock surged 30.12% to close at $16.55, with an intraday high of $16.84 and a low of $13.78. The stock’s 52-week range is $21.42 to $0.66. The quantum computing firm announced a significant breakthrough, achieving a 99.5% median fidelity rate for two-qubit gates on its 36-qubit modular system, marking a substantial improvement over its previous chip.

Netflix Inc. (NASDAQ:NFLX)

Netflix’s stock fell by 0.79% to $1250.31, with a high of $1271 and a low of $1249.82. The stock’s 52-week high and low are $1341.15 and $588.43, respectively. The streaming giant is gearing up for its second-quarter earnings report on Thursday, focusing on upcoming content and future growth prospects.

Johnson & Johnson (NYSE:JNJ)

Johnson & Johnson’s stock rose 6.19% to $164.78, reaching an intraday high of $166.12 and a low of $154.8. The 52-week range is $169.99 to $140.68. The company reported strong quarterly earnings, with adjusted earnings per share of $2.77, surpassing analyst expectations and boosting its annual forecast. The 2025 adjusted EPS forecast was raised to $10.80-$10.90 range.

United Airlines Holdings Inc. (NASDAQ:UAL)

United Airlines’ stock increased by 2.42% to $88.47, with a high of $88.67 and a low of $85.81. The stock’s 52-week high and low are $116 and $37.02, respectively. Despite missing revenue estimates in the second quarter, the airline exceeded earnings expectations, reporting positive demand shifts in early July. Revenue for the period came in at $15.27 billion, missing the consensus estimate of $15.35 billion.

ASML Holding NV (NASDAQ:ASML)

ASML’s stock dropped 8.33% to $754.45, with an intraday high of $760.90 and a low of $730.60. The 52-week range is $979.99 to $578.51. The semiconductor firm expressed concerns over its 2026 growth, citing geopolitical and macroeconomic challenges, including potential tariffs impacting margins.

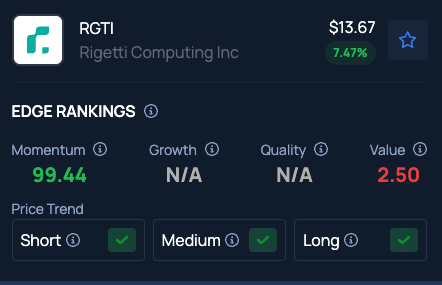

Benzinga's Edge Stock Rankings indicate Rigetti Computing has positive Short, Medium And Long Price Trends. Here is how the stock is performing on other indicators.

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Photo Courtesy: vectorfusionart on Shutterstock.com

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.