Ripple, Circle Push For Fed Access As $5.7 Trillion Stablecoin Surge Fuels Ambitions To Replace SWIFT, Says Industry Observer

Major digital asset firms and issuers of stablecoins, Circle Internet Group Inc. (NYSE:CRCL) and Ripple (CRYPTO: XRP) are aiming to become integral players in the banking system to show how crypto can now be used in banking, as highlighted by Anthony Agoshkov, co-founder of Marvel Capital.

What Happened: These firms have formally applied to the Office of the Comptroller of the Currency (OCC) for national trust bank charters, signaling a profound shift in the financial landscape.

This move indicates a clear ambition to transition beyond merely facilitating transactions, explains Agoshkov.

He argues that the sheer volume of stablecoin activity underscores their foundational role. “To me, the numbers say it all. Stablecoins moved over $5.7 trillion last year, and we're already at $4.6 trillion halfway through 2025. That’s the core financial infrastructure,” he told Benzinga.

This staggering activity underpins Ripple and Circle’s “rational next move” towards deeper financial integration. The applications reveal a clear intent: stablecoin issuers, collectively holding billions in reserves, are no longer content with being mere intermediaries.

He views this as a “structural leap,” embedding crypto “inside the system, with full credibility,” effectively redefining what it means for “crypto to become the bank.”

“It's obvious that stablecoin issuers aren't content being passengers anymore,” Agoshkov remarked. Their pursuit of national bank charters aims for “a direct line into the Fed's payment plumbing,” mirroring the access traditionally enjoyed by banks.

Why It Matters: A stablecoin is a type of cryptocurrency where the value of the digital asset is supposed to be pegged to and collateralized by a reference asset, which is either fiat money or another cryptocurrency.

This pivotal development of Ripple and Circle applying for banking licenses promises to fundamentally reshape how banking operates.

Agoshkov envisions a future where established financial layers are bypassed: “Once these firms get Fed access and national licensing, we will be talking about skipping the whole middle layer — no SWIFT, no correspondent chains, just native, regulated settlement.”

Ripple issues the stablecoin, RLUSD, whereas Circle issues USDC. Thus, having a banking license will help these firms mobilize capital on blockchain.

Price Action: As of the publication of this article, XRP was trading at $3.44 per coin. Its all-time high was $3.84 with a market capitalization of $203.74 billion.

On the other hand, CRCL rose 1.46% in premarket on Wednesday. The stock was up 138.27% since its listing.

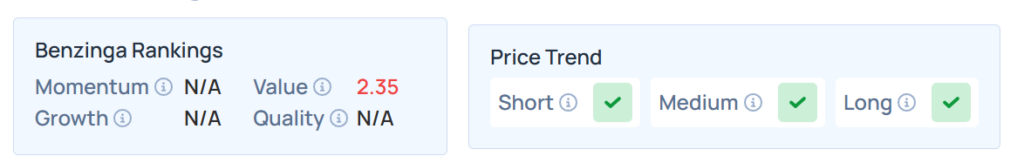

Benzinga Edge Stock Rankings shows that CRCL had a stronger price trend over the short, medium, and long term. Its value ranking was poor at the 2.35th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Wednesday. The SPY was up 0.39% at $631.30, while the QQQ advanced 0.19% to $562.30, according to Benzinga Pro data.

Read Next:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Cryptocurrency