Manpower Stock: Why It May Be Best To Wait Until Next July

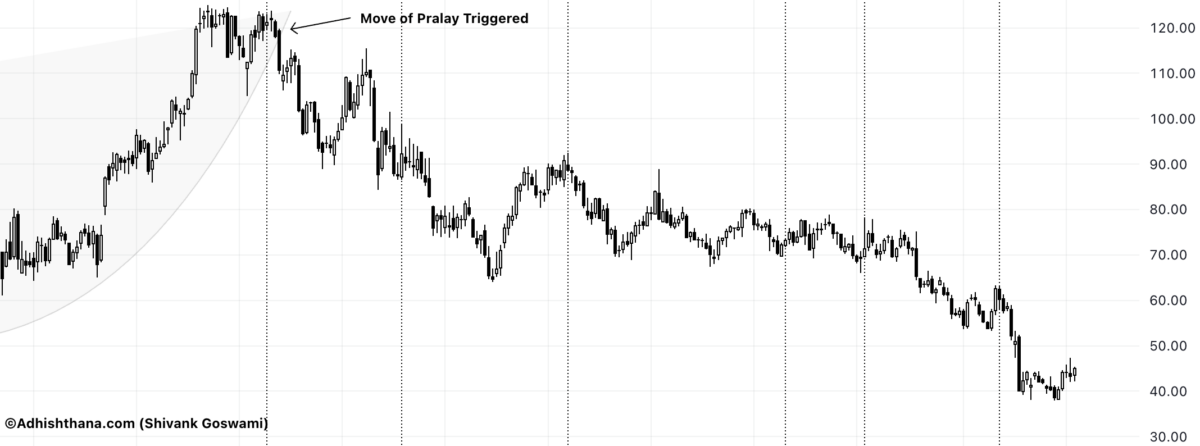

Manpower Group (NYSE:MAN) has been falling for what feels like forever—the stock has been in a steady downtrend for over 1400 days. Now entering the Guna Triads in its Adhishthana Cycle, the real question is: what went wrong, and is there any recovery in sight?

What Went Wrong for Manpower?

According to Adhishthana Principles, stocks move through a formation called the Adhishthana Cakra between Phases 4 and 8. This is typically a channel or arc pattern, from which a breakout is triggered in Phase 9. The breakout signals the beginning of a strong bullish move and the start of the Himalayan formation. But Manpower never got there.

Instead of breaking out, it broke down. That breakdown marked the beginning of what is called the Move of Pralay—a highly aggressive selloff.

"When the underlying breaks the Cākra on the flip side, it typically draws consolidation up to the Guna triads. The movement after the break is typically highly significant, and the selling momentum is extremely strong." — Adhishthana: The Principles That Govern Wealth, Time & Tragedy

Since then, the stock has lost over 68 percent, sliding from the $120 zone to around $45. And the structural damage hasn't healed yet.

Where It Stands Now: The Guna Triads Begin

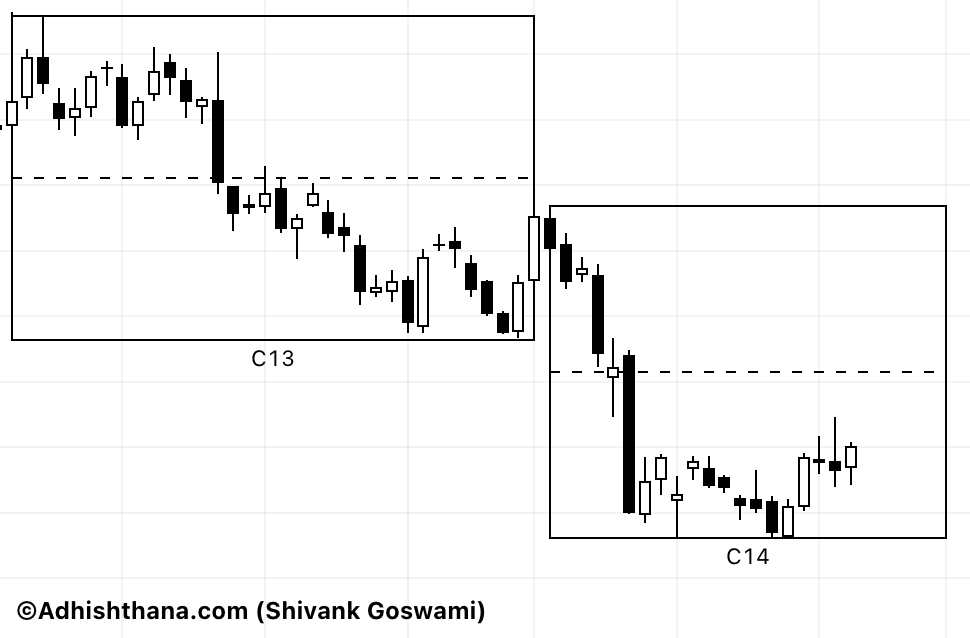

MAN is currently in Phase 14 of its 18-phase Adhishthana cycle on the weekly charts. Phases 14 to 16 are collectively known as the Guna Triads. These three phases decide whether a stock has enough momentum to reach Nirvana in Phase 18.

But the early signs are not encouraging. Phase 14, which ends on September 14, 2025, has so far been bearish. According to the principles, when Tamoguna dominates Phase 14, it typically rules out the possibility of Nirvana in Phase 18.

Investor Outlook

MAN's steep decline was structurally driven by the Move of Pralay. And now, with Phase 14 unfolding under the influence of Tamoguna, the outlook continues to lean bearish.

The Guna Triads will be completed by July 19, 2026. Until then, investors should avoid the stock. The current setup doesn't suggest the slump is over. To put it simply, Just when Manpower thought it was out, the bears pulled it back in.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributors Expert IdeasEquities Technicals Opinion Signals Trading Ideas