Nextcure Stock Skyrockets Nearly 45% In After-Hours Trading After Sharing Preclinical Data For Brittle Bone Disease

NextCure Inc. (NASDAQ:NXTC) stock surged by 44.87% to $7.62 in after-hours trading on Thursday.

Check out how the NTXC stock is trading here.

What Happened: The surge in NextCure’s stock value came after the company presented new preclinical data for NC605, a potential treatment for brittle bone disease.

Earlier in the day, the company’s shares were already trading higher after the presentation of the new preclinical data for NC605. The data demonstrated that treatment with NC605 improved bone microarchitecture and reduced fracture incidence compared to anti-sclerostin treatment in a well-established model of osteogenesis imperfecta.

Priyanka Kothari, NextCure's Director, stated, "NC605 has the potential to provide significant therapeutic benefit for patients."

The Maryland-based biopharmaceutical company closed on Thursday at $5.26 and has traded between $2.80 – $20.76 over the past year. NextCure stock carries a market capitalization of $14.08 million, according to data from Benzinga Pro.

Why It Matters: NextCure has been making significant strides in its research and development efforts. The company recently announced a strategic partnership with Simcere Zaiming to develop SIM0505, a CDH6-targeting antibody-drug conjugate for solid tumors. This partnership is expected to advance NextCure’s oncology pipeline.

However, the company’s stock has been on a rollercoaster ride. Earlier in July, NextCure enacted a 1-for-12 reverse stock split, and its shares began trading on an adjusted basis. Despite this, the company’s stock has continued to show resilience and potential for growth.

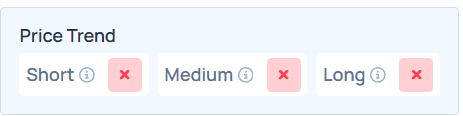

Benzinga Edge Stock Rankings indicate that NXTC stock has a negative price trend across all time frames. Know how the stock fares on other parameters here.

Read Next:

Photo Courtesy: Mizkit on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: why it's movingEquities Markets