Why BP Stock Should Be On Your List Now?

BP (NYSE:BP) stock has been recovering recently from its April lows, along with other major oil and gas companies. This recovery is related to the improvement in oil prices lately. But why should you consider BP stock now?

While the stock has not outperformed its peers over the past five years, the company has become a potential takeover target for larger firms. Even if a takeover doesn’t happen, the activist investor Elliott has been building a stake in the company this year, which is something very interesting to watch.

Why Is It Important to Have an Activist Investor in Your Company?

Because of voting rights. Activist investors aim to influence the strategic direction of the company. This is crucial for BP, which has been struggling with recent board decisions and shifting targets. BP has also altered its strategy as we saw in February, when the company dropped its climate targets and announced a renewed focus on oil and gas. In July, most BP-related news has centered on the company planning to halt or exit its green energy projects.

Let the Numbers Speak for Themselves

The company is set to announce its quarterly earnings on August 5th, which are expected to provide more clarity about BP's future even if they are below the expectations, especially after it experienced revenue declines in the past two quarters. However, the real challenge lies in its profitability as the profit margin is in negative territory.

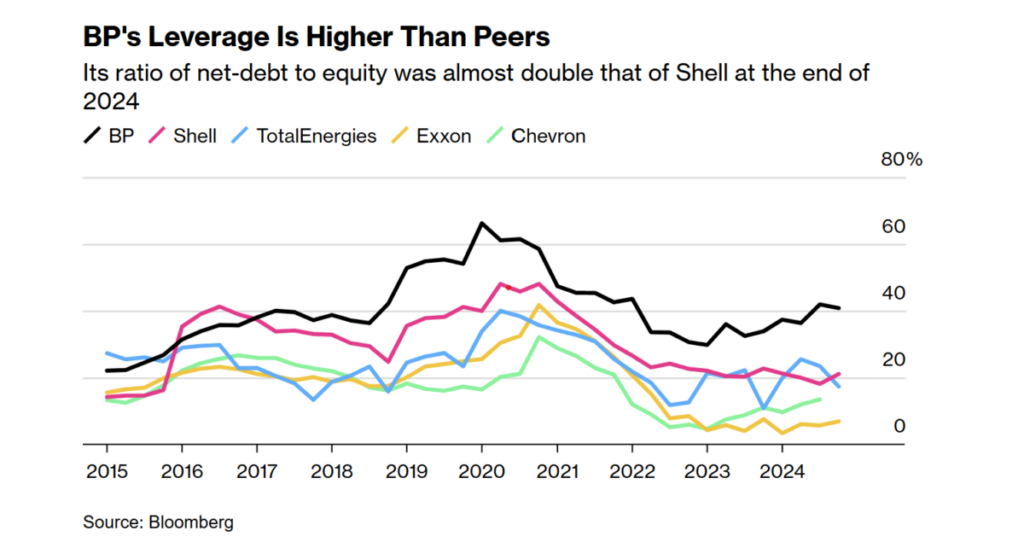

BP also has a high debt-to-equity ratio of 92%, which highlights the urgent need for change to lower its debt and improve profitability. The company has committed to cutting costs by $4–$5 billion through 2027. It also plans to divest $20 billion in assets by 2027 while increasing investments in oil and gas and reducing net debt from $23 billion to a target range of $14–$18 billion. There’s also growing pressure for the company to sell off its renewable energy projects.

BP's forward P/E ratio stands at 13.39 compared to the sector average of 13.75, keeping it competitive. The company is gradually narrowing the gap with its peers in terms of its debt-to-equity ratio.

Analyst Recommendations

The consensus price target is $35.98, based on ratings from 13 analysts. The highest target is $53, issued by Bernstein on February 8, 2023. The lowest is $29, issued by Jefferies on May 19, 2025. The three most recent analyst ratings came from Piper Sandler, Scotiabank, and Wells Fargo—released on July 15, July 11, and June 26, 2025, respectively. With an average price target of $33.67 from those three firms, there’s an implied 5.18% upside.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributorsEquities Commodities Opinion Trading Ideas