Why Climb Global Solutions Stock Keeps Climbing?

Climb Global Solutions (NASDAQ:CLMB) has been in a steep rally since mid-2023. Here’s how the stock is positioned within the Adhishthana Cycle, and what that says about where it’s headed next.

The Phase 9 Breakout: Climb's Himalayan Ascent Begins

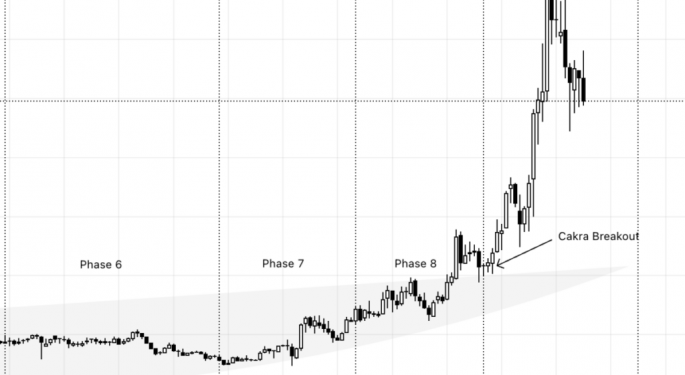

Under the Adhishthana Principles, stocks form a structure known as the Adhishthana Cakra between Phases 4 and 8. This is typically a channel or arc pattern. A breakout from this formation in Phase 9 signals the start of a strong bullish move, what the framework calls the Himalayan formation. Climb followed the textbook setup.

Starting 2 Jan 2009, the stock entered Phase 4 and began forming its Cakra. This continued through Phase 8, which concluded on 31 Aug 2023. Then, right on cue, Climb broke out of the Cakra to kick off Phase 9, and the rally began.

Since then, the stock has soared by ~247%, delivering exactly what Phase 9 is known for: a decisive, powerful move.

This phase on the monthly chart will continue until 30 June 2026. After that, Climb will enter Phase 10, often the peak of the Himalayan formation. So far, the structure remains clean and bullish.

What About the Weekly Chart?

On the weekly chart, Climb is currently in Phase 4, which is considered a no-action zone. According to the Adhishthana framework, this phase typically offers little signal and is best observed, not traded. This weekly Phase 4 will continue until 19 April 2026.

Investor Outlook

Climb’s strong Phase 9 breakout on the monthly chart suggests the bullish structure is well intact. Existing investors should continue to hold, looking ahead to the potential Himalayan peak in Phase 10. New investors, however, may want to wait for more clarity, especially until the stock exits the weekly Phase 4. If the principles say no action, it’s usually for good reason.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributors Expert IdeasEquities Technicals Opinion Signals Trading Ideas