Microsoft, Meta Stocks Add $440 Billion In A Day—Nearly Matching Netflix's Entire $503 Billion Market Cap

Microsoft Corp. (NASDAQ:MSFT) and Meta Platforms Inc. (NASDAQ:META) added over $400 billion in market capitalization after reporting robust earnings results on Wednesday, powered by artificial intelligence progress and roadmap, which is more than several big companies listed on the stock exchanges.

Check out MSFT and META stock prices here.

What Happened: Satya Nadella-led Microsoft soared after reporting its results during after-hours on Wednesday, adding nearly $265 billion, whereas Mark Zuckerberg‘s Meta Platforms also rallied after its results, adding nearly $175 billion in investor wealth.

These Magnificent 7 companies together gained about $440 billion in market capitalization, which compares to the total market cap of $503.19 billion of another Big Tech firm, Netflix Inc. (NASDAQ:NFLX).

This single-day after-hours addition of $440 billion surpassed the market cap of big U.S. firms like Costco Wholesale Corp. (NASDAQ:COST) at $411.32 billion, Johnson & Johnson (NYSE:JNJ) at $402.81 billion, Palantir Technologies Inc. (NASDAQ:PLTR) at $374.30 billion and Home Depot Inc. (NYSE:HD) at $370.19 billion.

In fact, only 20 firms worldwide had a market cap of over $440 billion according to the data by companiesmarketcap.com.

Why It Matters: These hyperscalers, operating massive and highly scalable data centers to deliver cloud computing and other digital services worldwide, while leveraging AI, have led to a positive outlook by investors and experts alike.

Meta reported second-quarter revenue of $47.52 billion, beating estimates of $44.58 billion, with earnings of $7.14 per share versus expectations of $5.79.

Microsoft reported fourth-quarter revenue of $76.44 billion, exceeding the $73.80 billion estimate, with EPS of $3.65 compared to $3.37 expected.

Wedbush Securities’ Daniel Ives also hailed the earnings by these technology giants and said that their results validated his “AI Revolution bull thesis into next few years.”

CNBC’s ‘Mad Money’ host Jim Cramer, who began his career at Goldman Sachs more than four decades ago, compared his early impression of Wall Street talent to Zuckerberg, Nadella, and their tech executives.

“When I went to work at Goldman Sachs 43 years ago, I thought everyone was so darned smart. They were. But not at the level of a Zuckerberg or a Nadella,” he said.

“My head is spinning as I try to take in what they teach. They are extraordinary,” he added.

Price Action: Shares of Microsoft jumped by 8.64% in premarket on Thursday, while Meta soared by 12.12%.

MSFT had gained 22.61% on a year-to-date basis, while it was up 22.68% over the past year. Meta, on the other hand, was up 16.02% YTD and 46.41% over a year.

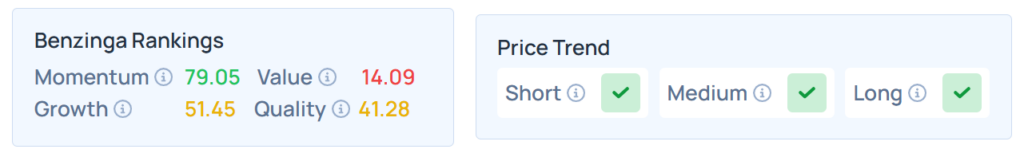

Benzinga's Edge Stock Rankings indicate that MSFT maintains a strong momentum across the short, medium, and long term. However, the stock scores poorly on value rankings. Additional performance details are available here.

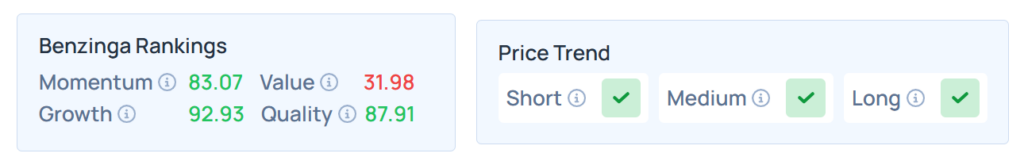

Benzinga's Edge Stock Rankings indicate that META also maintains a strong price trend across the short, medium, and long term. However, the stock scores badly on value rankings as well. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Thursday. The SPY was up 0.93% at $640.35, while the QQQ advanced 1.36% to $575.76, according to Benzinga Pro data.

Read Next:

Image Credit: Imagn Images

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: News