Yes, There Are Historical Comparisons For The Swiss Franc's Insane Move Last Week (Sort Of)

“Switzerland is a place where they don’t like to fight, so they get people to fight for them while they ski and eat chocolate” – Larry David (Seinfeld Co-Creator)

Before last Thursday, the Swiss Franc, like the Euro, had been in a steady decline. In fact, from May 7 of last year until the close last week on the 14th (8 months), the Franc was down a little over 15 percent. And then came Thursday. The Swiss National Bank announced the unpegging of the fixed exchange rate with the Euro causing a mini panic. The Franc jumped up almost 20 percent in two days sending the Swiss stock market into a free fall and leaving many investors with steep losses.

It seems that the Swiss National Bank (SNB) had had enough. From the SNB, “The minimum exchange rate was introduced during a period of exceptional overvaluation of the Swiss franc and an extremely high level of uncertainty on the financial markets. This exceptional and temporary measure protected the Swiss economy from serious harm. The economy was able to take advantage of this phase to adjust to the new situation”. They also pushed their key interest rate from -0.25 percent to -0.75 percent.

The SNB introduced the exchange rate peg in 2011 to fend off “safe haven” inflows that were pushing up the values of the Franc and hurting exports. They were printing Francs and buying Euros, and the reserves were becoming a problem. With the ECB moving to provide stimulus, the SNB was concerned about further devaluation and didn’t feel it was necessary. Ironically, they seem to be shooting themselves in the foot in the short term at least. Growth and export projections have come way down considerably and immediately.

There really isn’t any precedence for this scenario, but we took a look at the current conditions in the Swiss Franc (Futures price) to see if there were any times in its history where the currency had jumped so precipitously and to then see how the market reacted over the next week. We only found two instances.

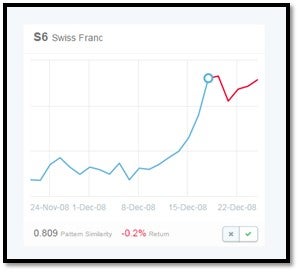

You can see that in both instances, in 1995 and 2008, the Franc was down in the next week but both pull backs were less than -1 percent. Also worth noting is that in both instances, the price pulled back immediately and then rebounded a bit.

Last Week’s Move – Up 19 Percent In 2 Days

September 1995 – Up 8.5 Percent In 5 Days

December 2008 – Up 12 Percent In 6 Days

We shall see how the dust settles from here. Have a great week.

Image credit: Dodo Von Den Bergen, Wikimedia

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Swiss FrancForex Markets Trading Ideas Best of Benzinga