Options Corner: Diplomatic Progress Clears The Path For This Call Spread On Applied Materials

While the wider business community awaited news regarding trade negotiations between the U.S. and China, one of the more anxious names may have been Applied Materials Inc (NASDAQ:AMAT). As a semiconductor equipment specialist, Applied Materials represents a vital cog for multiple tech sectors, including computers, smartphones and solar products. However, tensions between the world's top two economies threatened the company's access to critical rare earth minerals.

To be sure, the immediate response to the new trade deal framework — announced on Tuesday following two days of high-level discussions between U.S. and Chinese officials — was muted. While analysts in principle are encouraged by the agreement, which involves both sides rolling back contentious actions, it is still pending approval from President Donald Trump and Chinese counterpart Xi Jinping.

Derek Scissors, a senior fellow at the American Enterprise Institute, remarked that the deal is merely another "band aid." He further warned that China could easily reinstate the blockade on rare earths. Marc Busch, a professor of international business diplomacy at Georgetown University, added to the concerns, noting that China's rhetoric hasn't shifted, raising doubts regarding the sustainability of negotiations.

Despite the headwinds, the broader point is that the Trump administration, for all its tough talk, likely understands the consequences of unmitigated aggression. The president has previously issued stern warnings and later walked back the magnitude of his policies. China being the world's second-largest economy, the White House can't afford to act imprudently.

On the other end, the Chinese economy isn't all rainbows and gummy bears either. When tensions first erupted, China was already dealing with serious issues, such as deflation and a prolonged property crisis. Both sides have reason to play ball and that ultimately may be good news for Applied Materials.

Statistical Backdrop Smiles Favorably On AMAT Stock

While narratives provide the context and color surrounding a particular asset or enterprise, they're not great at forecasting market behaviors. Storylines focus on the "why" of an investment. But when it comes to trading, participants of this discipline tend to focus on the "how" — how much, how fast and most importantly, how likely.

With options trading in particular, it's not enough to have confidence that AMAT stock will move in a certain direction. Depending on the specific strategy, the magnitude of movement is critical. At the same time, all options expire. Therefore, the speculated move must occur within the defined window. This makes probability the centerpiece of options market analysis.

Tackling the topic of probabilities isn't easy using traditional methodologies of fundamental and technical analysis. That's because both approaches suffer from the non-stationarity dilemma: the metric of comparison (such as share price or earnings) fluctuates temporally and contextually. Also, pattern-based technical analysis — while offering a visual representation of price behaviors — is not falsifiable.

To remedy this problem, traders can impose stationarity by converting pricing data into market breadth sequences; that is, sequences of accumulative and distributive sessions. Doing so creates a binary ecosystem, where demand profiles are assessed by a simple observation — it's either happening or it's not.

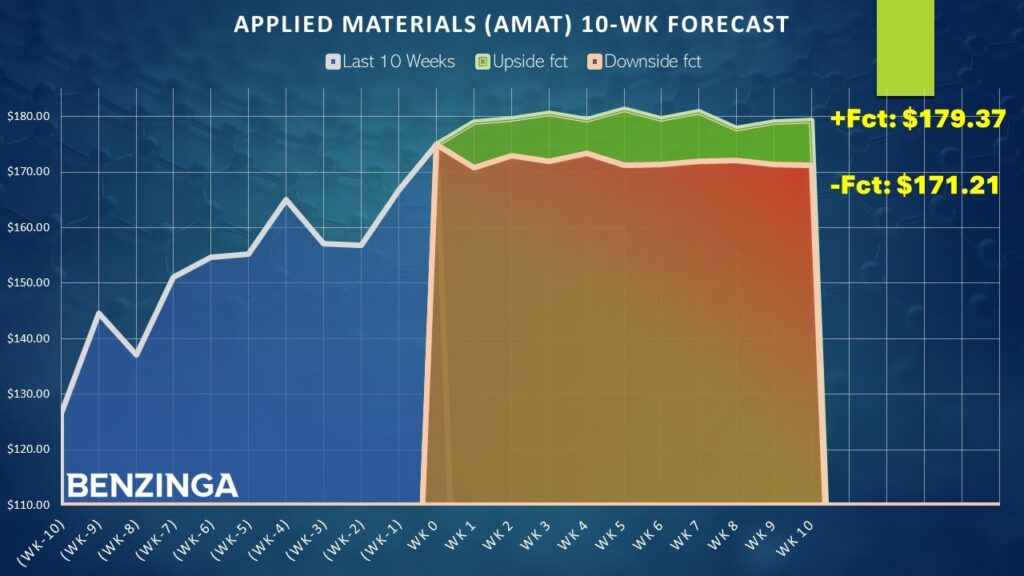

Currently, AMAT stock is on course to print a "6-4-U" sequence: six up weeks, four down weeks, with a net positive trajectory across the 10-week period. In 56.67% of cases, the following week's price action results in upside, with a median return of 2.26%. Assuming that AMAT closes this Friday at $175, it could potentially rise to just under $179 in short order, perhaps a week or two.

Should the bulls maintain control of the market, historical trends suggest that AMAT stock could push toward the $181 level in the next three to four weeks.

An Optimistic But Sensible Trade For Applied Materials

Based on the market intelligence above, the multi-leg options strategy that arguably stands out the most is the 177.50/180 bull call spread expiring July 11. This transaction involves buying the $177.50 call and simultaneously selling the $180 call, for a net debit paid of $125. Should AMAT stock rise through the short strike price ($180) at expiration, the maximum reward is also $125, a payout of 100%.

Primarily, this trade is attractive because of the statistical response to the 6-4-U sequence. With the fundamentals also aligning positively, AMAT stock in theory should have enough fuel to trigger the short strike price at expiration.

Further, the 6-4-U represents a positive uptick in terms of sentiment regime. As a baseline, the chance that a long position will be profitable over any given week is 54%. With the aforementioned sequence, the bullish trader receives almost 3 percentage points of favorable odds.

Granted, it's not the biggest advantage. However, the advantage is still on the bulls' side, incentivizing a long-side debit strategy. As well, the political backdrop adds credibility to the argument.

The opinions and views expressed in this content are those of the individual author and do not necessarily reflect the views of Benzinga. Benzinga is not responsible for the accuracy or reliability of any information provided herein. This content is for informational purposes only and should not be misconstrued as investment advice or a recommendation to buy or sell any security. Readers are asked not to rely on the opinions or information herein, and encouraged to do their own due diligence before making investing decisions.

Read Next:

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert Ideas Options Trade of the Day Stories That MatterEquities Long Ideas Options