A Perfect Storm Of Risks For Precious Metals, And Yet Gold And Silver Still Lag. Why?

Nick Kwan/Pexels

A Perfect Storm For Gold And Silver

In theory, the past week should have been a perfect storm for gold and silver bulls, as the news fed investors a buffet of systemic risks. In one steam tray was China's "Lehman Moment" with the impending default of the China Evergrande Group (OTC: EGRNF).

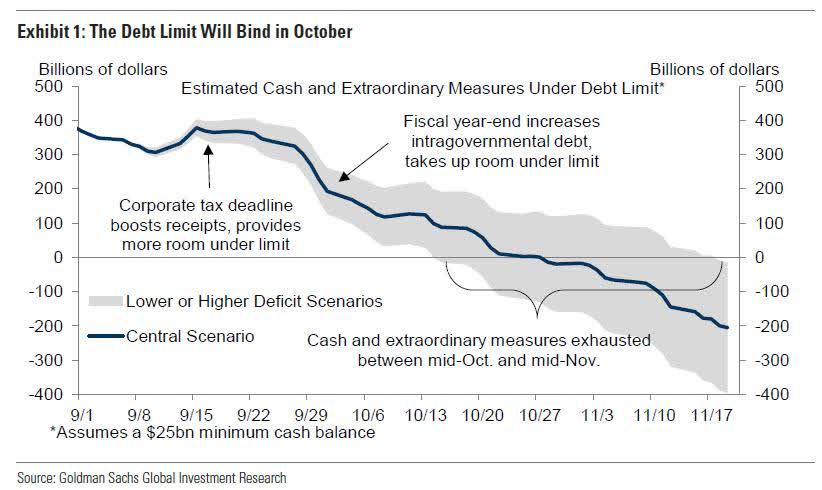

In another steam tray was the "game of chicken" over America's impending debt limit.

Nearby, investors could find steaming dish of reported hyperinflation fears by UBS clients. And right next to the croissants, were rumors of shortages of industrial parts.

Meanwhile, the rotting apple in the fruit bowl was the seemingly never-ending COVID pandemic.

And Yet...

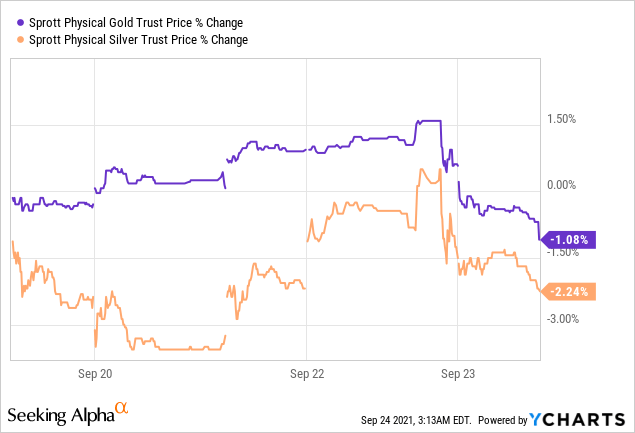

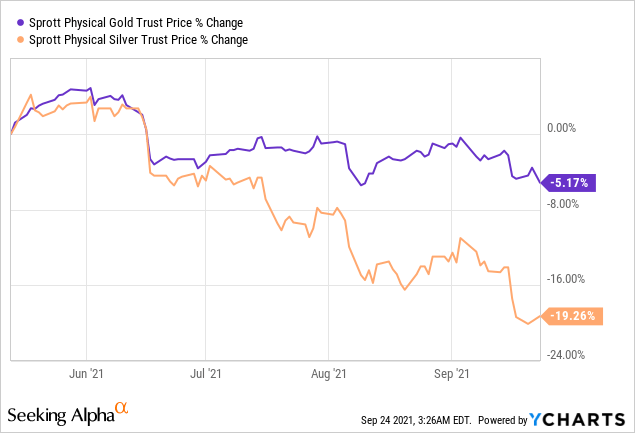

Despite all that, here's how the Sprott Physical Gold Trust (NYSE: PHYS) and the Sprott Physical Silver Trust (NYSE: PSLV) ETFs had done over the last five days, as of Thursday's close.

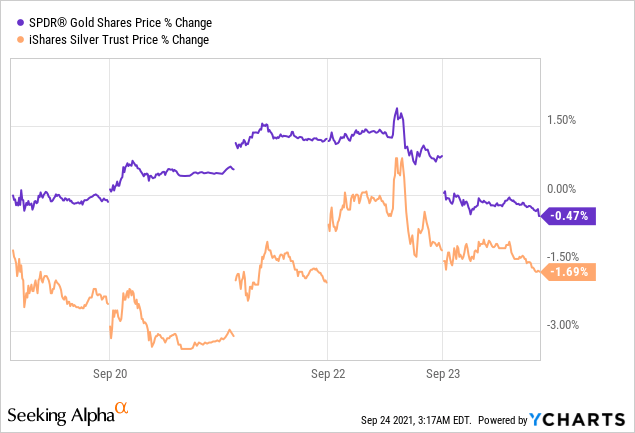

Similar picture with the more widely traded gold and silver ETFs, the SPDR Gold Trust (NYSE: GLD) and the iShares Silver Trust (NYSE: SLV).

Industrial Commodities Versus Precious Metals

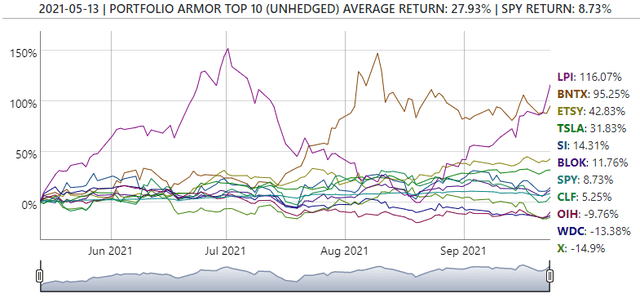

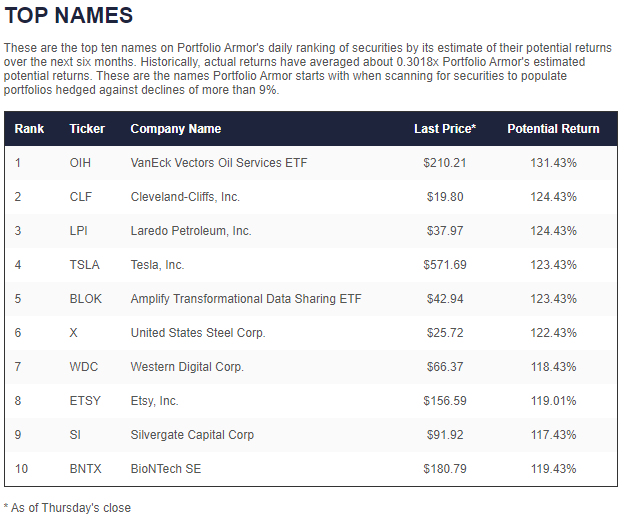

A point we made in a recent post (Supply-Side Inflation Hits Home), is that inflation driven by shortages in the real economy would inflate the prices of industrial commodities, but not necessarily precious metals. We made a similar point in June as well (Black Gold Beats Silver) where we noted that our recent top names had included industrial commodity companies such as Laredo Petroleum, Inc. (NYSE: LPI).

Screen capture via Portfolio Armor on 5/13/2021.

Since then, LPI has more than doubled...

While gold and silver have sucked wind,

Supply-Side Inflation Versus Systemic Risk

Supply-side inflation may explain the performance of industrial commodities versus precious metals over the last few months, but it doesn't explain the weak performance of precious metals in the face of putative system risks. There seem to be two possible answers here:

- Investors don't really see Evergrande, the debt limit, the shortages, and the bubbling inflation as systemic risks, or,

- Investors see these as systemic risks, but they don't see gold and silver as havens from them.

Regarding the first possible answer, one could argue that foreign lenders' exposure to Evergrande, at about $20 billion, is fairly small, and we've been through the debt limit dance before without crashing through it. It's harder to reconcile the UBS survey results showing their clients' fears of hyperinflation with the recent performance of precious metals though.

Which do you think is the correct answer, 1. or 2.? Or do you have a different answer altogether? Please share your thoughts in the comments.

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

Posted-In: contributors Gold metalsPenny Stocks Commodities Small Cap Markets ETFs