Here's How The S&P 500 Collapse Looked

The S&P 500 shaved more more than eight points in roughly 10 minutes on Monday. There doesn't appear to be any difinitive news item that caused the price to drop.

Using iSentium's Twitter sentiment platform, a shift can be seen in sentiment to the negative before the futures sold off:

(click to enlarge)

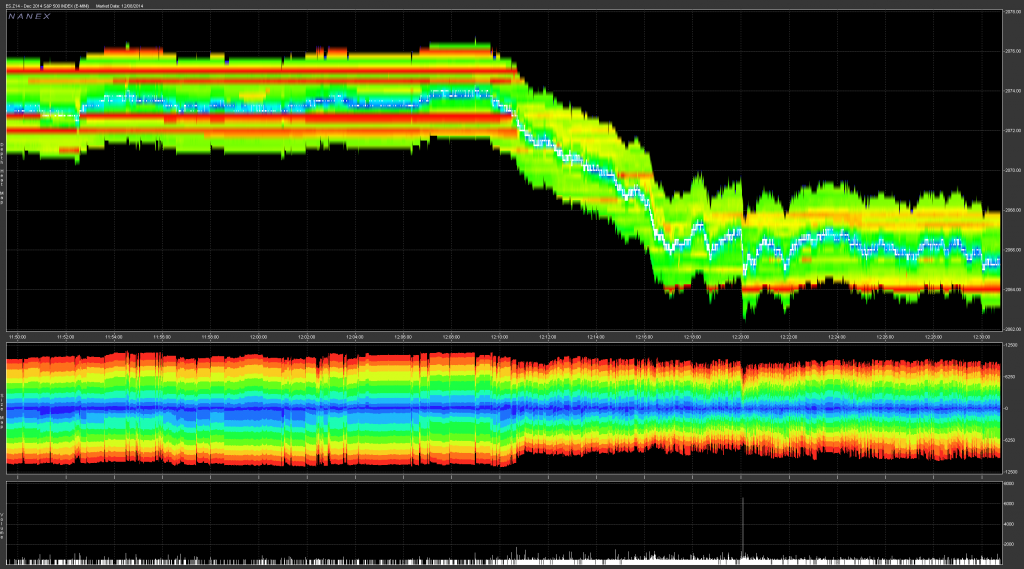

Subsequently, as sentiment changed, data from Nanex shows that the order book for the S&P 500 e-mini futures went red before order books dried up and the price dropped:

(click to enlarge)

According to a source inside Nanex that doesn't want to be named, message rates spiked around 12:16 p.m. EDT and surpassed the raw network traffic observed just minutes later at 12:20 p.m. EDT. This traffic volume may have been information blasts related to the repricing of stocks, options and ETFs.

When sharp moves happen in the market, the message rates swell and sometimes burn out the Securities Information Processor (also known as The SIP) causing problems similar to the NASDARK outage. Failures in SIP can cause batch uploads of stale quote data to mix with new data and cause serious disruptions for automated and carbon-based trading life forms.

As of 1:40 p.m. EST, S&P 500 E-mini Futures traded down 0.86 percent at $2,058.25.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: iSentium NanexIntraday Update Best of Benzinga