Nike Down Before Earnings On Heavy Options Volume

Nike Inc (NYSE: NKE) is down more than 3% on the day heading into its earnings release, after the market closes today. As the COVID-19 omicron variant concerns continue to pop up in multiple countries, options traders are looking bearish on Nike, potentially over fears travel and holiday shopping will be tempered, thus retail apparel companies.

SEE ALSO: Why Nike Shares Are Trading Lower Today

What Happened: With the omicron variant being detected in 45 U.S. states and ICU hospital beds filling up across the country, the broader market has been red on the day, and Nike has shown no appetite to recover from the 3% losses on the day thus far.

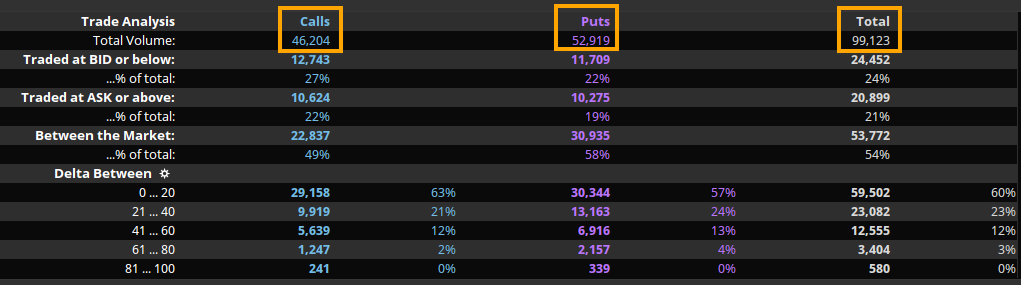

Options traders have been notably bearish on Nike with more than 52,000 puts traded compared to approximately 46,000 calls on the day (image below).

Looking at the options data above, the lion's share of options trades has been bearish. And with the total option trades being just under 100,000 thus far, this represents approximately 22% of the total options in the stock (~429,000 options).

Why It Matters: Trading more than 20% of the total option flows in one day, especially before earnings demonstrates heavy options activity on the stock. Considering about 40% of these are short-dated (expiring Dec. 23), it means over half of the option trades on the day are for views beyond the earnings release after market today.

What's Next: While the short-dated flows are more bearish, the majority of options volume for Jan. 21, 2022, expiry is mixed with one bullish strike standing out above the rest. That is the $180 strike for the Jan. 21 expiry which represents over 7% of the total option flows today (image below).

Of the next five expiries, this is the largest strike by volume, which suggests medium-term, a potentially larger option trader is taking a bullish view after the earnings release and is expecting a 15% gain over the next month.

If Nike comes out with a really strong earnings report, there is scope for the stock to move up to that $180 strike by the Jan. 21 expiry.

If the earnings report is weak, the stock could head lower towards the major support level between $147 and $150 which has strong open interest around those lower prices.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: atheleticNews Options Sports Markets Movers Trading Ideas General Best of Benzinga