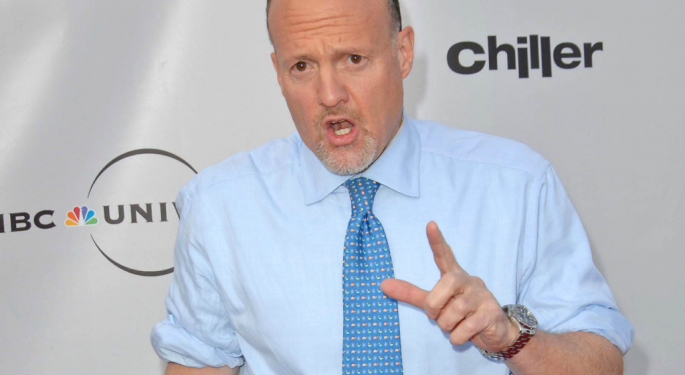

Jim Cramer Weighs In On Cathie Wood's And Larry Fink's Portfolio: 'Don't Want Your Nest Egg To Be Concentrated'

In a recent discussion, CNBC‘s Jim Cramer emphasized the importance of portfolio diversification, drawing comparisons between the investment strategies of ARK’s Cathie Wood and BlackRock’s Larry Fink, CNBC reports.

"What we don't want is your nest egg to be concentrated in just a few stocks that might be very wrong for the moment, causing you to give up on the entire asset class," Cramer mentioned.

Wood’s High-Risk Strategy: Wood’s investment approach is characterized by concentrating on a few high-potential stocks. While this strategy has led to significant gains in the past, such as her early investment in Tesla Inc., it has also resulted in substantial losses in recent years.

“That’s the danger of running an undiversified portfolio: You have to be right every time, or else your investors, they get obliterated,” Cramer said.

See Also: Apple Challenges Google Maps’ Reign As Users Warm Up To The Once-Hated Product

Fink’s Diversified Approach: On the other hand, Fink, whose firm BlackRock is the world’s largest asset manager with $9.4 trillion in holdings, prioritizes diversification. His strategy involves a holistic approach to the market, investing across different sectors and considering a range of factors influencing inflation.

“Fink knows how to manage this risky environment…That’s called a strategy to keep you in the best assets over time, not a tactic to either hit it out of the park or strike out,” Cramer added.

Read Next: Elon Musk Threatens To Unfollow A Subscriber If They Keep Posting About It

Image via Shutterstock

Engineered by Benzinga Neuro, Edited by

Pooja Rajkumari

The GPT-4 Benzinga Neuro content generation system exploits the extensive Benzinga Ecosystem, including native data, APIs, and more to create comprehensive and timely stories for you.

Learn more.

Latest Ratings for TSLA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Daiwa Capital | Upgrades | Neutral | Outperform |

| Feb 2022 | Piper Sandler | Maintains | Overweight | |

| Jan 2022 | Credit Suisse | Upgrades | Neutral | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Blackrock Cathie WoodNews Markets Analyst Ratings Media Trading Ideas General