SoftBank Moves To Raise $4.9 Billion With Overnight T-Mobile Block Sale— Stock Drops 4% After Hours As Investors Digest Discount

Japan’s SoftBank Group Corp. (OTC:SFTBY) is reportedly looking to raise $4.9 billion via a sizable overnight stake sale.

What Happened: On Tuesday, it was revealed that the Japanese investment holding company would be raising these funds via an unregistered overnight block sale of its stake in T Mobile US Inc. (NASDAQ:TMUS), according to a report by Bloomberg News, which saw the terms of the deal.

SoftBank is offering 21.5 million shares in the telecom giant at a price range of $224 to $228 per share, representing a 3% discount to T-Mobile’s closing price on Monday, at $230.99.

The deal, when completed, is set to be the largest U.S. equity block sale since Toronto-Dominion Bank's (NYSE:TD) $13.1 billion divestiture of its stake in Charles Schwab Corp. (NYSE:SCHW) in February. It also adds to the growing wave of equity offerings by new and existing shares, reaching $91.4 billion so far in 2025, up from $75.9 billion last year.

See Also: Dimon Called Crypto A ‘Ponzi Scheme’—Now JPMorgan Is Building JPMD To Trade It

As of March 31, 2025, SoftBank held 85.4 million T-Mobile shares, equivalent to a 7.52% stake, which was originally acquired as part of Sprint Corp.’s $26.5 billion merger with T-Mobile in 2020. SoftBank had acquired a majority stake in T-Mobile back in 2013.

Following the proposed transaction, SoftBank’s stake will shrink by 1.9 percentage points, leaving it with a roughly 5.6% stake in the company.

The transaction is being managed by Bank of America Corp. (NYSE:BAC), and neither SoftBank nor T-Mobile has immediately responded to Benzinga’s request for a comment.

Why It Matters: This move might prompt T-Mobile’s majority stakeholder, Deutsche Telekom AG (OTC:DTEGY), to vie for greater control of the company, something that it’s been pursuing for the past several years.

SoftBank continues to pursue investment opportunities in the U.S., having led a $40 billion investment round in OpenAI early this year.

The company’s CEO, Masayoshi Son, had earlier committed to investing $100 billion in the United States during a meeting with the then President-Elect Donald Trump at Mar-a-Lago late last year.

Price Action: T-Mobile shares were up 1.31% on Monday, ending the day at $230.99, but are down 3.89% after hours following news of the stake sale.

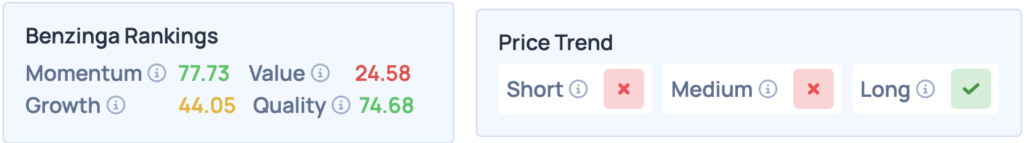

The company’s shares show strong Momentum, and rank well on Quality according to Benzinga’s Edge Stock Rankings, but only have a favorable price trend in the long term. See here for deeper insights into the stock, the company, its peers, and competitors.

Photo Courtesy: Koshiro K on Shutterstock.com

Read More:

Posted-In: Donald Trump Masayoshi Son Sprint Corp Toronto-Dominion BankEquities News Markets