Cathie Wood's Ethereum Double-Down: Ark Bets $7.9 Million On ETH-Staking ETF Buy While Selling Coinbase At Highs

On Wednesday, Cathie Wood-led Ark Invest executed significant trades, including substantial purchases in Tempus AI Inc. (NASDAQ:TEM), NVIDIA Corp. (NASDAQ:NVDA), 3iQ Ether Staking ETF (ETHQ.U) and Coinbase Global Inc. (NASDAQ:COIN).

The Tempus AI Trade saw ARK Genomic Revolution ETF (BATS:ARKG) and ARK Innovation ETF (BATS:ARKK) funds acquiring a total of 158,051 shares of the health technology company. This move comes on the heels of Tempus AI’s announcement of receiving 510(k) clearance from the Food and Drug Administration for its ECG-Low EF software, which utilizes AI to detect potential left ventricular ejection fraction issues.

This regulatory milestone has propelled Tempus AI’s stock. The shares ended the day 7.3% higher at $59.97. The total value of the TEM shares bought by Ark on this day amounts to $9.5 million.

The Nvidia Trade involved the ARK Space Exploration & Innovation ETF (BATS:ARKX) fund purchasing 11,021 shares of the Jensen Huang-led company. This acquisition aligns with recent developments where NVIDIA’s stock surged following news of potential U.S. government licenses allowing the sale of high-powered AI chips to China. This move could restore billions in revenue for NVIDIA, as the company looks to capitalize on renewed opportunities in the Chinese market. Notably, on Tuesday, Wood acquired 2,999 Nvidia shares for $511,929.

On Wednesday, Nvidia stock closed nearly 0.4% higher at $171.37. Ark’s total purchase amounted to $1.9 million.

The 3iQ Ether Staking ETF Trade saw both Ark Fintech Innovation ETF (BATS:ARKF) and ARK Next Generation Internet ETF (BATS:ARKW) funds purchasing a combined 600,000 shares of ETHQ.U shares, an ETF incorporated in Canada that invests long-term in the second-largest cryptocurrency, Ethereum (CRYPTO: ETH). This move aligns with Cathie Wood‘s ongoing support for Ethereum’s potential in transforming the financial services industry.

ETHQ.U shares closed at $13.24 on Wednesday, putting the value of Ark’s trades at $7.9 million.

The Coinbase Trade: Ark Invest’s decision to sell 9,555 shares of the cryptocurrency-trading platform from its ARKW ETF comes as the stock hit a new 52-week high. This surge was fueled by a pivotal announcement from President Donald Trump, who said he had secured the necessary votes to advance the GENIUS Act. Additionally, Bitcoin (CRYPTO: BTC) reached a new all-time high, further boosting investor sentiment. The closing price for Coinbase on Wednesday was $398.20, valuing the Ark transaction at $3.8 million.

Other Key Trades:

- Roku Inc (ROKU): Sold 248,18 shares by ARKF and 166,354 shares by ARKK.

- Guardant Health Inc (GH): Sold 21,712 shares by ARKG.

- Rocket Lab USA Inc (RKLB): Sold 57,567 shares by ARKX.

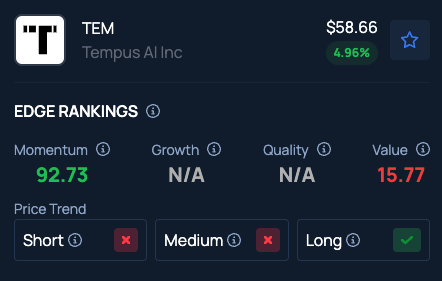

Benzinga’s Edge Stock Rankings show Tempus AI has Momentum in the 92nd percentile but Value in the 15th percentile. Here is how the stock ranks on other metrics.

Photo Courtesy: Ira Lichi On Shutterstock.com

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal