California's $21B Wildfire Fund Faces Existential Test As Edison Liability Looms: 'Claims May Be Substantial Enough To Fully Exhaust The Fund'

California's $21 billion wildfire insurance fund, created to protect ratepayers and keep investor-owned utilities solvent, could be on the verge of depletion if Southern California Edison, which is owned by Edison International (NYSE:EIX), is found liable for the devastating Eaton Fire in early 2025.

Check out the current price of EIX stock here.

What Happened: According to a draft report presented to the state's Catastrophe Response Council on Thursday, “the resulting claims may be substantial enough to fully exhaust the fund” if Edison is found responsible, according to a report by Digital Insurance.

See Also: Wall Street’s Most Accurate Analysts Give Their Take On 3 Utilities Delivering High-Dividend Yields

The fund, established in 2019 after the 2018 Camp Fire bankrupted PG&E Corp. (NYSE:PCG), was designed as a financial backstop for utility-sparked wildfires.

According to Tom Welsh, CEO of the California Earthquake Authority, which administers the fund, “The purpose was fundamentally to protect ratepayers from the volatility that can come through pass-through costs of catastrophic wildfires that are ignited by utilities.”

The fund was initially seeded with $10.5 billion from utilities and an equal amount in state-issued bonds. It currently holds $12 billion in assets, but has a claims capacity of up to $22 billion.

So far, it has paid out $925 million of the $1.92 billion PG&E owed for the 2021 Dixie Fire, and is expected to cover $275 million of the $1.275 billion PG&E faces for the Kincaid Fire.

The fund’s existential threat now stems from the Eaton Fire early this year, which burned over 58 square miles, destroying 16,000 structures and leading to the loss of 29 lives. SoCal Edison, which serves the county’s east side, which was impacted by the fire, disclosed in February that an inactive power line near the ignition point is being investigated.

Consultants from Milliman and Moody's estimated insured property losses from the Eaton Fire could range from $8 billion to $13 billion.

That figure could rise another 20% to 25% once infrastructure and uninsured homes are included, said Dr. Patzi Uriz, a Moody's director. “There is a lot of uncertainty [on the estimates] because we don’t have updated information from CalFire since February.”

Why It Matters: Despite its legal issues, Edison International’s short interest at 2.47% is relatively low compared to its peer group at 3.27%, according to Benzinga Pro.

Price Action: Shares of Edison International were down 1.45% on Wednesday, trading at $51.69, and are since up 1.08% after hours.

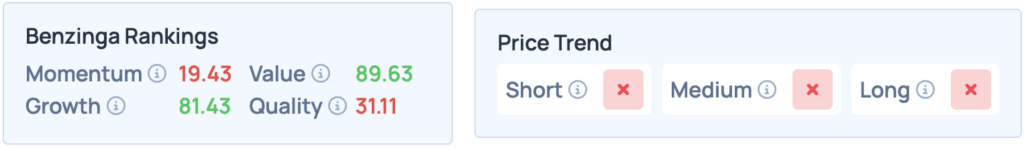

According to Benzinga’s Edge Stock Rankings, Edison International scores high on Value and Growth, but has an unfavorable price trend in the short, medium and long term. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Ken Wolter / Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Politics